The Silicon Valley of India, Bangalore serves as a major centre of attraction for people across India. As large number of people started to migrate to Bangalore for work, they end up in buying their own homes there. The Bangalore Municipality body, Bruhat Bengaluru Mahanagara Palike (BBMP) imposes property tax to those own properties in Bangalore every year. The municipality uses this tax to offer public facilities in Bangalore.

Property tax is a tax collected by the State Government through a local body. The owners of the property have to pay property tax on real estate every year even for vacant land. The property tax is utilized by the government to maintain roads, drainages, public parks and other civic amenities in the state. BBMP uses Unit Area Volume (UAV) to calculate property tax which should be paid in year on year basis. The UAV is determined by the location, nature of usage and expected returns from the property.

What is BBMP Property Tax Payment?

- The BBMP property tax should be paid every year.

- The tax period begins in the month of April and ends in March of the upcoming year. The property tax for the financial year 2019-2020 should be paid within April 30, 2020.

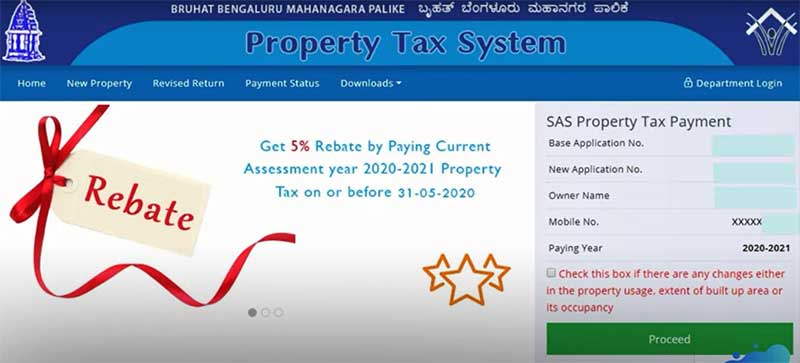

- If the tax payer pays the full amount in one installment, a 5% rebate on property tax will be paid by BBMP.

- Delayed payment of property tax attracts interest rate of 2% per month.

How to pay BBMP Property Tax in Online?

You can pay your BBMP property tax easily in online by following the step-by-step procedure given below.

Step 1: Visit BBMP Property Tax portal https://bbmptax.karnataka.gov.in/

Step 2: On the homepage, select 'Enter Application No' and then enter the 10-digit application number. Click 'Retrieve'

Step 3: Once you have submitted your application number, the owner name and ward number will appear on the screen. Select the details and then tap 'Confirm'

Step 4: On the next page, check your property details and if there are any changes in the property details, select the checkbox and click 'Proceed'. This will take you to Form 5. If there is no change needed in the details, just click 'Proceed'.

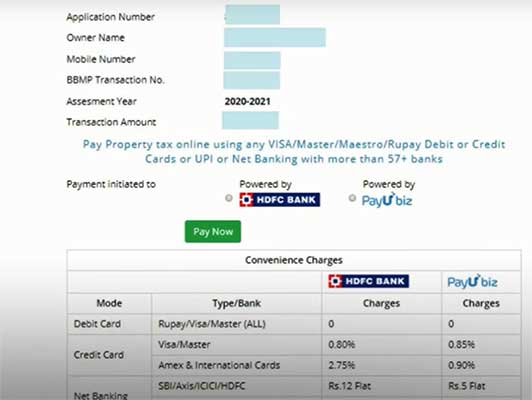

Step 5: Check whether the pre-filled details in form 4 are correct. Select the type of tax payment, click the checkbox and then click the mode of payment which you want to proceed with.

Step 6: A pop-up message will ask you whether the details provided are correct. Click 'OK'

Step 7: If you have preferred online payment, you will be taken to the payment page where you need to select the mode of online payment - Credit Card/ Debit Card/ Net Banking/ UPI Payment. Upon successful payment, a system generated receipt number will appear on the screen. Download and print it for future reference.

How to pay BBMP Property Tax in Offline?

To pay your property tax in offline, just follow the simple procedures given here.

Fill the required form and visit the nearest authorized centres such as,

- Bangalore 1 centre

- Assistant Revenue Offices.

Some of the authorized banks which collect tax are,

- Canara Bank

- Axis Bank

- HDFC Bank

- ICICI Bank

The BBMP has tied up with certain banks for property tax payment. You can pay your property tax in any one of the following banks.

- YES Bank

- IDBI

- Indian Overseas Bank

- Corporation Bank

- Kotak Mahindra Bank

- Indian Bank

- Maharashtra Bank

- Indusind Bank

- SBI

How to get BBMP Property Tax Receipt?

You can get BBMP property tax receipt by following the steps given below.

Step 1: Visit BBMP Property Tax portal https://bbmptax.karnataka.gov.in/

Step 2: On the home page, click the 'Download' tab and then select 'Receipt Print'

Step 3: On the receipt print page, select the assessment year, enter your application number and captcha code. Then click 'Submit'

Step 4: Once you have submitted the details, the property tax receipt will be downloaded in PDF format.

How is BBMP Property Tax calculated?

The property tax is calculated in three ways - Annual Rental Value System, Capital Value System and Unit Area Value System.

Annual Rental Value System:

The Annual Rental Value system is based on the expected rent from the property. This system is followed in cities like Chennai and Hyderabad.

Capital Value System:

The Capital Value System is based on the market value of the property. The market value of the properties in this system is fixed by the stamp duty department of the area.

Unit Area Value System:

The Unit Area System is based on the expected returns from the property which depends on the location and usage of the property. As the unit of calculation is based on per square feet per month (Unit), and for a particular location and street (Area), and multiplied by a rate (Value), this method of property calculation is called Unit Area Value System. This system is followed in cities like Bangalore and New Delhi.

What is the formula used to calculate BBMP Property Tax?

The formula which is used to calculate BBMP property tax is,

Property Tax (K)= (G-I)*20% + Cess (24% of Property Tax)

Here, G is the Gross unit area value arrived by X+Y+Z

I is depreciation amount, G*H/100

X is the Tenanted area of property x rate of per sq ft of property x 10 months

Y is the Self-occupied area x rate of per sq ft of property x 10 months

Z is the Vehicle parking area x rate of per sq ft of property x 10 months

H is the percentage of depreciation rate which depends upon the age of property.

The property tax is equal to 20% of the total area of property which includes tenanted, self-occupied and vehicle parking area multiplied by rate of per sq ft of property fixed by BBMP for usage of property for 10 months with reduction in depreciation permitted by BBMP and 24% of property tax.

How to calculate BBMP Property Tax in Online?

You can calculate the tax on your property easily in BBMP Property Tax website.

Step 1: Visit BBMP Property Tax portal https://bbmptax.karnataka.gov.in/

Step 2: On the home page, click 'Department Login' located on the right-side.

Step 3: Login to your account using your username and password.

Step 4: Once logged into your account, Click the 'Tax Calculator' menu.

Step 5: On the tax calculator page, select your group, assessment, category, sub category and enter the zone, year of construction, built up area and car park area. Then click 'Submit'

Step 6: Once you have clicked the submit button, your property tax for the current fiscal year will appear on the screen.

What is BBMP Property Tax Rate?

The BBMP property tax rate differs according to the category. The property tax on residential properties for the present zonal classification under Unit Area Value system is divided into six zones from A to F.

| Zones | Tenanted (per sq.ft) | Self-Occupied (per sq.ft) |

|---|---|---|

| A | Rs. 5.00 | Rs. 2.50 |

| B | Rs. 4.00 | Rs. 2.00 |

| C | Rs. 3.60 | Rs. 1.80 |

| D | Rs. 3.20 | Rs. 1.60 |

| E | Rs. 2.40 | Rs. 1.20 |

| F | Rs. 2.00 | Rs. 1.00 |

Forms related to BBMP Property Tax:

There are six types of forms related to BBMP Property Tax. They are,

Form I:

It is a white coloured form used when the property owner has the Property Identification Number (PID). PID is a unique ID allotted to every property owner which contains important information such as street, ward and the plot in which the property is situated.

Form II:

It is a pink coloured form used when the property owner has Khata number instead of Property Identification Number (PID). The Khata number is a number of the Khata Certificate which is issued to every property. The Khata Certificate contains all details regarding the property.

Form III:

It is a green coloured form used when the property owner has neither the Property Identification Number nor the Khata number.

Form IV:

It is a white coloured form used when there is no change in the property details such as the extent of built up area, usage and its occupancy.

Form V:

It is a blue coloured form used when there are changes in the property such as change of property from under-construction to constructed.

Form VI:

This form should be used when the property under calculation is exempted from property tax.

What is the due date and rebate for BBMP Property Tax?

If you pay your property tax before the due date issued by the BBMP in single installment, you will be eligible to receive 5% rebate and if you pay your property tax after the due date, you will be charged an interest rate of 2% per month. In case you want to avoid interest, you can also pay your property tax in two installments. But you cannot avail rebate for doing so. Make sure you have paid your property tax by April 30, 2020.

Which properties come under BBMP Property Tax?

The properties which attract property tax in Bangalore are,

- Residential houses occupied by owner or tenants

- Office buildings

- Factory buildings

- Flats

- Shops

- Godowns

Important Links related to BBMP Property Tax:

- To find zonal classification in Bangalore, click here

- To check depreciation rate, click here

- To check Unit Area Value and zonal divisions click here

- For contact details of Revenue Officers and Assistant Revenue Officers click here