PNB Housing Finance is a branch of Punjab National Bank. It offers housing loan to individuals and corporate bodies for buying, constructing, repairing and upgrading houses. It also provides loan against property, loan for commercial space and for purchase of residential plots. PNB housing offers tailor-made home loan solutions with best-in class services and simplified loan procedures.

PNB offers home loan at lower interest rate starting from 7.35% p.a. You can avail home loan up to 90% of the property value with the maximum tenure of up to 30 years.

What are the features and benefits of PNB Housing Loan?

PNB home loan comes with the following features and benefits.

- Extensive home loan products like Home Purchase Loans, Home Construction Loans, Home Extension Loans, Home Improvement Loans and Plot Loans.

- Door step services for easy and fast loan approval and disbursal

- In the case of cost escalation, loan enhancement facility is available

- Flexible repayment tenure up to 30 years

- Quick and hassle-free application process

- Multiple repayment options

- Home loan funding up to 90% of the property value

- Pan India network presence

- Well-experienced employees and best-in class network to deliver satisfactory customer services.

| Interest Rate | 7.35% p.a onwards |

| Loan Amount | Maximum up to 90% of the property cost |

| Loan Tenure | 30 years |

| Processing Fee | 0.25% - 0.50% of the loan amount + applicable taxes |

| Penal Interest Rate | 2% per month on dues |

| Prepayment/Foreclosure Charges |

Nil for floating rate packages. 2% - 3% for fixed rate and non-individuals |

| Rate Packages | Floating Rate |

What is the interest rate for PNB Housing Loan?

The interest rate for home loans offered by PNB Housing Finance starts from 7.35% per annum. The interest rates may vary for each home loan product as given below.

| PNB Housing Loan Products | Interest Rate (p.a) |

| PNB Home Purchase Loan | 7.35% - 9.10% |

| PNB Home Improvement Loan | 7.35% - 9.10% |

| PNB Plot Loan | 8.35% - 10.10% |

| PNB Home Loan for NRIs | 7.35% - 9.10% |

| PNB Unnati Home Loan | 10.75% - 12% |

What are the home loan products available in PNB Housing?

PNB Housing offers wide range of home loan products with which you can choose according to your requirements.

PNB Home Purchase Loan

Home Purchase Loans are ideal for purchasing residential house in India.

PNB Home Construction Loan

Home Construction Loans are ideal for self-construction of a residential house property. If you have already possessed own land and need to build a residential house on the land, you can avail this loan.

PNB Home Extension Loan

Home Extension Loans are ideal for adding more space to your existing home. With this loan, you can extend your existing residential house property as per your needs.

PNB Home Improvement Loan

Home Improvement Loans are ideal for improving your existing home such as complete renovation, upgradation, repairing, water-proofing, roofing, tiling, flooring, plumbing, electrical work, false ceiling and woodwork.

PNB Residential Plot Loan

Residential Plot Loans are ideal for purchasing residential plot in an urban area to construct home.

PNB Home Loan for NRIs

PNB Housing offers wide range of home loan products for NRIs and PIOs to purchase, construct, repair and renovate residential property in India.

PNB Unnati Home Loans

Unnati Home Loan is a unique home loan solution that comes with simplified loan procedures and customer friendly services. For home loan up to Rs.35 lakhs, you will get 90% of the property value. The interest rate for Unnati home loan starts from 10.75% p.a.

PNB Pradhan Mantri Awas Yojana

PNB Housing offers Credit Linked Subsidy Scheme (CLSS) for EWS, MIG and LIG categories under Pradhan Mantri Awas Yojana. Under this scheme, you can avail interest subsidy for purchase/construction/enhancement of home.

What is the eligibility required to avail PNB Housing Loan?

In order to avail home loan in PNB Housing, your age should not be more than 70 years at the time of maturity of loan.

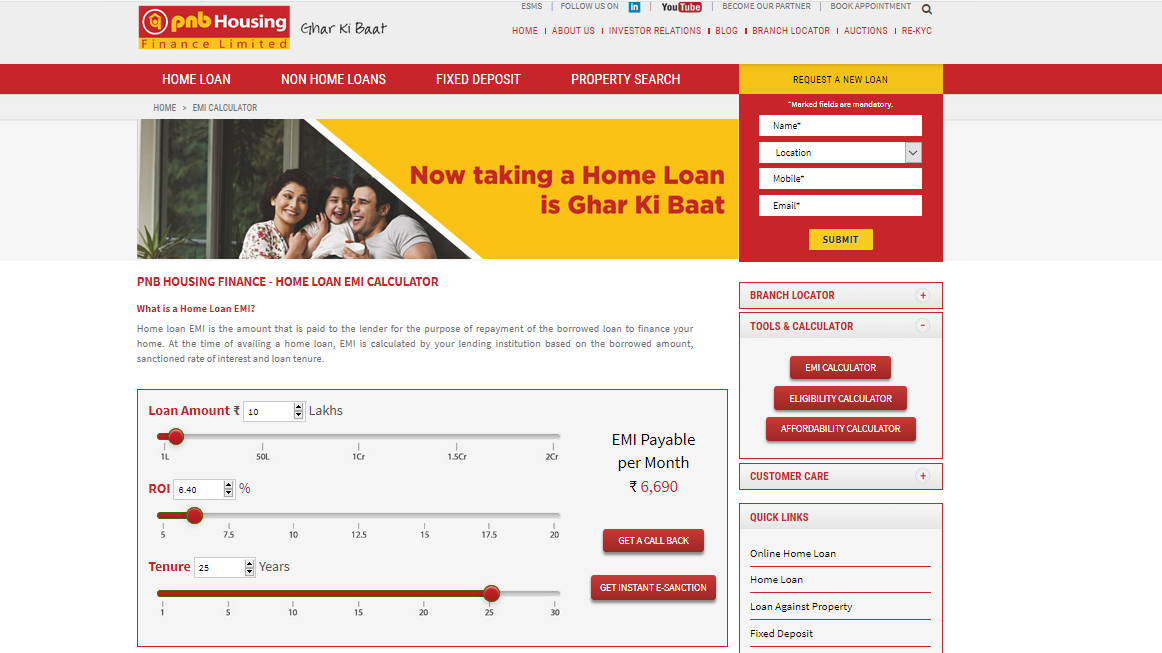

How to calculate EMI for PNB Housing Loan?

PNB Housing Finance - Home Loan EMI Calculatoris a simple and user-friendly tool designed to calculate the approximate value of the monthly EMI on home loan. It is calculated on the basis of principal, interest and tenure. To calculate EMI for PNB housing loan, just follow the simple steps given below.

Step 1: Click this link PNB Housing Finance - Home Loan EMI Calculator

Step 2: Enter the principal home loan amount, loan tenure and interest rate in the respective fields.

Step 3: Once you have provided all these details, the EMI payable per month will appear on the screen.

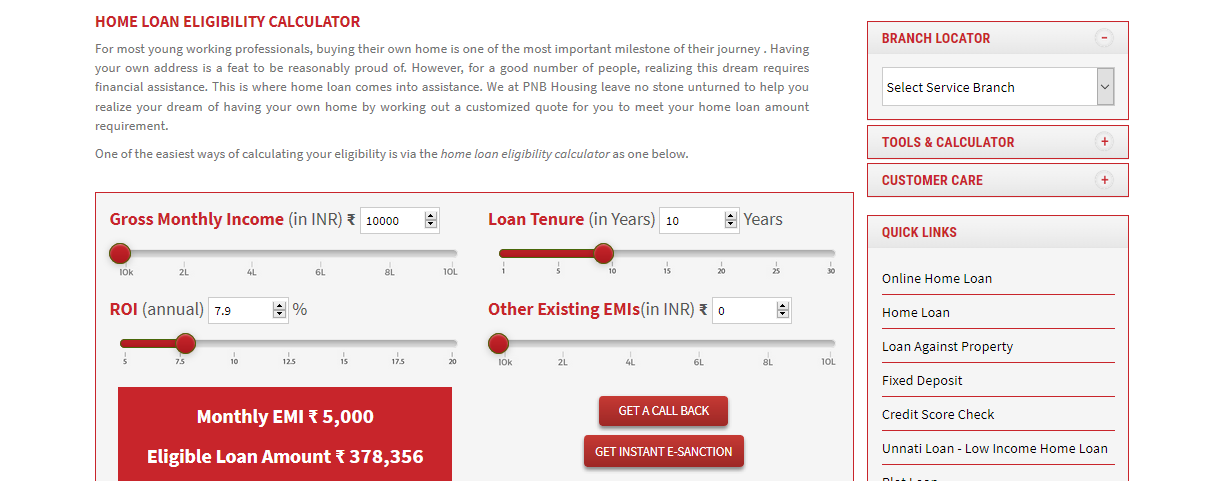

How to calculate PNB Housing Loan Eligibility?

PNB Housing Finance - Home Loan Eligibility Calculator tool helps to calculate how much loan amount you can avail from the bank. Your loan eligibility is determined based on the factors such as your age, nature and size of your income, prior loan commitments, credit report and regulatory guidelines. In addition to these factors, your income, tenure and interest rate also determines the loan value.

Step 1: Click this link PNB Housing Finance - Home Loan Eligibility Calculator

Step 2: Select your gross monthly income, loan tenure, rate of interest and other existing EMIs if any.

Step 3: Once you have provided all these details, your eligible loan amount will appear on the screen.

What are the documents required to apply for PNB Housing Loan?

To apply for home loan in PNB Housing, you need to submit the following list of documents.

- Duly filled application form with photograph

- Age Proof - Passport/PAN card/Any other Certificate from Statutory Authority

- Address Proof - Passport/Driving license/Voter ID/Ration card/Telephone bill/Any other Certificate from Statutory Authority

- Educational Qualifications - Latest Degree

- Processing Fee Cheque drawn in favour of 'PNB Housing Finance Ltd.'

- Copy of Title Documents of the Property, Approved Plan, etc.

Salaried Employees

- Last 3 months Salary Slips

- Form 16 for last 2 years

- Last 6 months Bank Statements

Self-Employed/Professionals

- Certificate of Proof of Business Existence with Business Profile

- Last 3 years Income Tax returns, Profit and Loss Account and Balance Sheets duly certified by a Chartered Accountant

- Last 12 months Bank Statements

PNB Housing Loan Customer Care

For any queries related to home loan in PNB Housing, you can contact the customer care service using the below-mentioned contact details.

| PNB Housing Finance Toll-Free Number | 1800 120 8800 |

| customercare@pnbhousing.com, nricare@pnbhousing.com | |

| Register in online | click here |

| Write to Corporate Office Address | PNB Housing Finance Ltd. Address: 9th Floor, Antriksh Bhavan, 22 Kasturba Gandhi Marg, Near Connaught Place, New Delhi 110001 |

PNB Housing Loan - Important Links

To apply for PNB housing loan, click here

To track your PNB housing loan application status, click here

To locate your nearest PNB housing loan branch, click here