LIC Housing Finance Limited (LIC HFL) offers home loan from Rs.1 lakh to Rs.15 crores at lower interest rates from 6.90% p.a onwards. LIC home loan comes with the flexible loan tenure of up to 30 years. LIC offers wide range of customizable home loan products according to the customer's home loan eligibility. LIC home loan fits all types of customer base such as salaried, self-employed, professional, NRIs, etc.

With LIC home loan, customers who are eligible under PMAY - CLSS can get interest subsidy up to Rs. 2.67 lakhs.

What are the features and benefits of LIC Home Loan?

Some of the features and benefits of LIC home loan are given below.

- PAN India presence and overseas offices at Dubai and Kuwait.

- Skilled professionals for providing door step service.

- Simple documentation

- Quicker loan sanction

- Lower EMI

- Online facility for home loan sanction

- Competitive interest rates

- Maximum tenure of 30 years or attainment of 60 years, whichever is earlier

- No prepayment penalty

- No hidden cost

- Balance transfer or takeover of existing home loans

- Construction of house/purchase of flat from housing boards or private developer and repair/renovation of existing house.

| Interest rate | 6.90% p.a onwards |

|---|---|

| Loan Amount | Rs.1 Lakh to Rs.15 crores |

| Maximum Loan Tenure | Up to 30 years |

| Processing Fees | 0% - 0.50% |

| Current LHPLR | 14.70% |

What are the eligibility criteria required to avail LIC Home Loan?

The borrower's eligibility to avail home loan in LIC is based on their income and loan repayment capacity. In addition to this, other factors such as the applicant's age, credit score, credit history, etc. also determines one's eligibility. Some of the basic eligibility criteria required to avail home loan in LIC are given below.

| Maximum Age | Salaried - 50 years, Self-Employed - 75 years |

|---|---|

| Income | Rs.30,000 per month |

| Work Experience | 2 years |

| Credit Score | Minimum 600 |

| Nationality | Resident and Non-Resident Indian |

What are the home loan schemes available in LIC?

LIC offers a wide range of home loan schemes for salaried and self-employed borrowers. Some of the home loan schemes offered by LIC are given below.

LIC HFL Home Loan:

- This scheme is ideal for purchasing ready home, moving to new home or homes that are under construction.

- With this scheme, one can avail loan up to Rs.3 crore

- After retirement, the maximum loan tenure can be extended up to 10 years.

LIC HFL Griha Varishtha:

- This scheme is ideal for purchasing a flat or house where Occupancy Certificate is obtained.

- With this scheme, one can avail 6 EMI waiver.

- The co-applicants can be children.

LIC HFL Pradhan Mantri Awas Yojana:

- This scheme is ideal for purchasing or constructing first pucca house.

- Interest subsidy up to Rs. 2.67 lakh is available.

LIC HFL Griha Suvidha:

- This scheme is ideal for owning home.

- In this scheme, age and income does not matter.

- This loan scheme is eligible for subsidy under PMAY-CLSS.

LIC HFL Home Loan for NRIs:

- This scheme is ideal for NRIs who wish to own a house in India.

- The loan amount is available at lower interest rate.

- There is no prepayment penalty.

LIC HFL Plot Loan:

- This scheme is ideal for purchase of residential plots to construct home within 3 years.

- The maximum loan amount is 75% of the property value

- The maximum loan tenure is 15 years.

LIC HFL Home Construction Loan:

- This scheme is ideal for construction of home.

- In this scheme, you can get loan up to Rs.75 lakh.

- The maximum repayment tenure is 30 years for salaried and 20 years for self-employed.

LIC HFL Home Extension Loan:

- This scheme is ideal for extension of home

- The maximum loan amount is up to Rs.15 crore

- This scheme comes with online loan sanction facility.

LIC HIF Home Renovation Loan:

- This scheme is ideal for renovation or improvement of home.

- The maximum loan amount is up to Rs.15 crore

- The maximum repayment tenure is 30 years for salaried and 20 years for self-employed.

LIC HFL Home Loan Top Up:

- This scheme is available for both existing and new customers.

- New customers can avail top up when switching their existing home loan to LIC.

- The loans are floating linked to LHPLR.

LIC HFL Pay When You Stay:

- This scheme is ideal for purchasing a house or flat under construction.

- The maximum loan tenure is up to 30 years

- The loan amount starts from Rs.20 lakhs to Rs.200 lakhs.

LIC HFL 6 EMI Waiver:

- This scheme is ideal for purchase of readily built house or flat where Occupancy Certificate is obtained.

- Up to 6 EMI waiver available with 2 each at the end of third, sixth and tenth year.

- The interest type is floating and linked to LHPLR.

LIC HFL Advantage Plus:

With this scheme, you will get the following benefits.

- Lower interest rates

- Affordable EMIs

- Top up loan

- 2 EMI waiver

What are the interest rates for LIC Home Loan Schemes?

The interest rate for LIC home loan starts from 6.90% onwards. Depending on the scheme and type of employment, the interest rates may vary. The schemes and its interest rates for salaried and self-employed individuals are given below.

| Schemes | Interest Rates p.a | |

| Salaried | Self-Employed | |

| LIC HFL Home Loan | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Griha Varishtha | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Griha Suvidha | 7.15% - 7.95% | 7.25% - 8.05% |

| LIC HFL Home Loan for NRI | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Home Construction Loan | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Home Extension Loan | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HIF Home Renovation Loan | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Home Loan Top Up | 8.50% - 9.00% | 8.50% - 9.00% |

| LIC HFL "Pay when you Stay" | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL 6 EMI Waiver | 6.90% - 7.80% | 7.00% - 7.90% |

| LIC HFL Advantage Plus | 6.90% - 7.80% | 7.00% - 7.90% |

Note: Pay when you Stay, 6 EMI Waiver, Advantage Plus are part of special offers of LIC HFL.

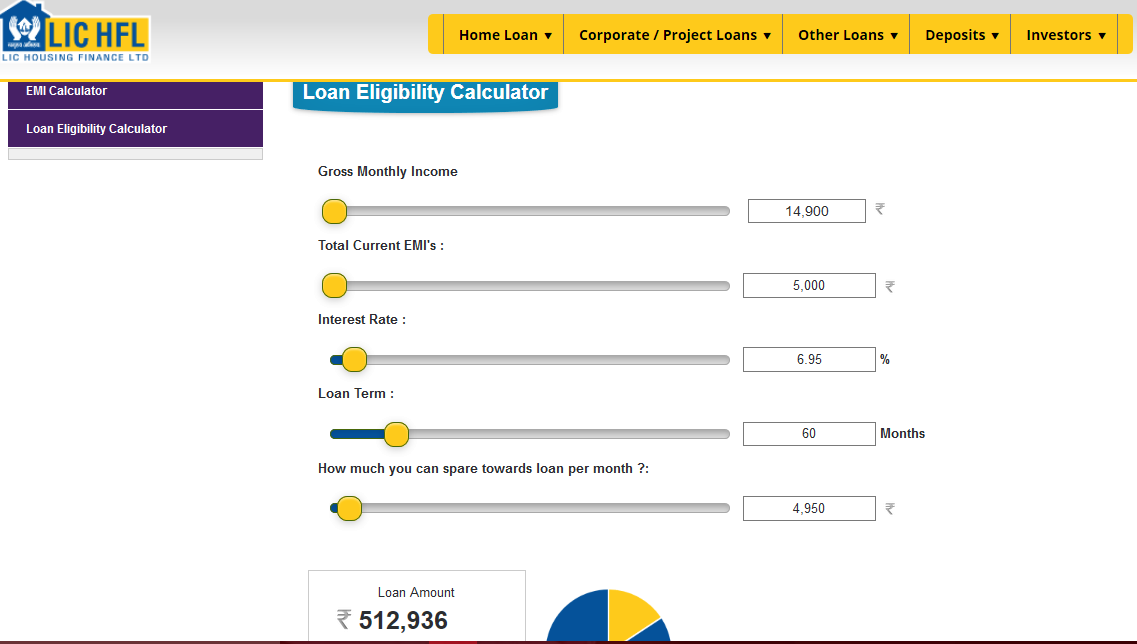

How to calculate LIC Home Loan Eligibility?

To avail home loan in LIC, you need to possess some eligibility criteria. The eligibility for home loan is calculated on the basis of your income, credit score, repayment capacity, etc. You can calculate home loan eligibility using LIC Home Loan Eligibility Calculator.

Step 1: Click here to calculate the home loan amount you are eligible for.

Step 2: Select your gross monthly income, total current EMIs, interest rate, loan term and your monthly EMI.

Step 3: Once you have provided all these details, the loan amount you are eligible for will appear on the screen.

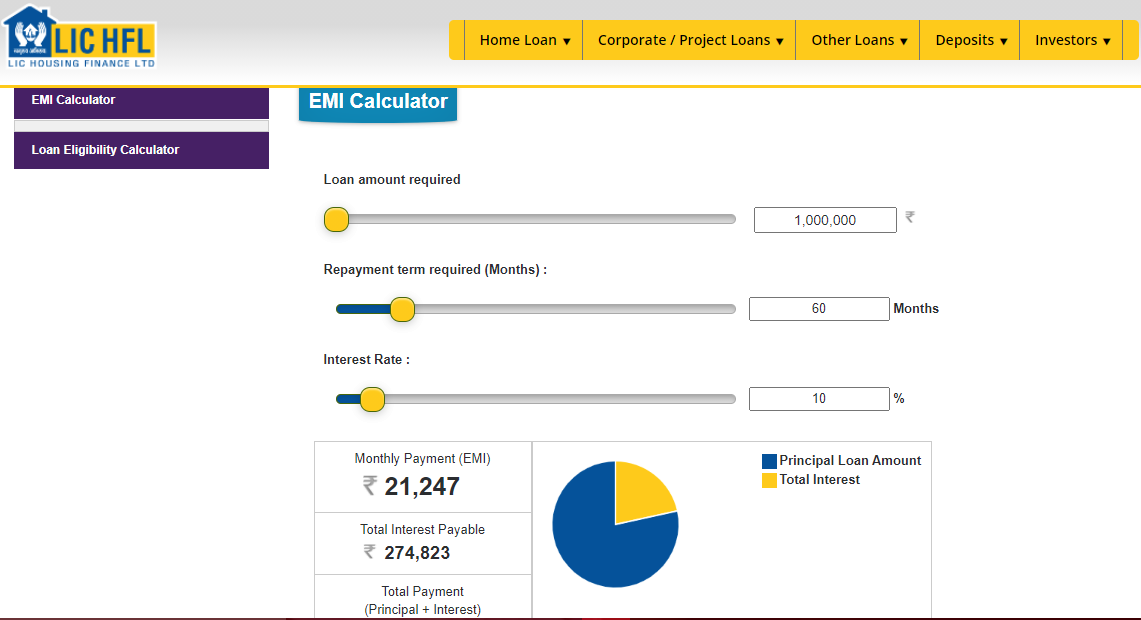

How to calculate LIC Home Loan EMI?

- You can calculate LIC home loan EMI using LIC Home Loan EMI Calculator

- With LIC home loan EMI calculator, you can calculate monthly payment, total interest payable and total payment of principal and interest on the basis of loan amount, tenure and interest rate.

- To calculate EMI, just click here and select the loan amount, repayment term and interest rate.

What are the documents required to apply for LIC Home Loan?

In order to apply for home loan in LIC, you need to submit the following list of documents.

KYC documents

- Aadhaar card

- PAN card

- Passport, for NRIs

- Address proof

Income documents

- Salary slip and Form no.16 for salaried

- Last three years ITR and financials for self-employed/professionals

- Last 6 to 12 months bank statements

Property documents

- Property ownership proof

- Allotment letter of builder/society for flats

- Tax paid receipt up to date

LIC Home Loan - Important Links:

- To apply for LIC Home Loan, click here

- To track your LIC Home Loan status, click here

- To locate your nearest LIC office, click here

LIC Home Loan Customer Care:

For any help regarding LIC home loan, you can contact LIC home loan customer care. The customer care details are given below.

| Call LIC Contact Number | 912222178600 |

| Email to | customersupport@lichousing.com |

| Register in Online | Click here |

| Write to LIC Corporate Office Address | LIC Housing Finance Limited Corporate Office 131, Maker Tower-F Premises, 13th Floor, Cuffe Parade, Mumbai-400 005 Maharashtra. |