Nowadays, Debit card plays a predominant role everywhere. Almost all cashless transactions are made through debit card. Debit card offers secure and fast payment. With debit card, you can easily pay without any need to carry cash and can easily withdraw cash from ATM all over the world.

State Bank of India (SBI) offers variety of debit cards according to the needs of the customer. Offers, rewards, daily cash withdrawal limit, transaction limit and features may vary for each debit card. Customers can choose the debit card which suits their purpose. Customers are rewarded every time for shopping with SBI debit card.

What are the types of SBI Debit Card?

SBI Classic Debit Card:

- With SBI classic debit card, you can book movie tickets, pay bills, travel and shop online with Master Secure Code or verified by Visa at over 5 lakh merchant companies in India.

- With this SBI classic debit card, you can withdraw cash from State bank ATMs or other bank ATMs across India.

- This debit card comes with the daily cash limit at ATM with a minimum of Rs. 100 and a maximum of Rs. 20,000.

- The maximum e-commerce limit for this debit card is Rs. 50,000.

- By using this debit card for the first three purchase transactions, you can also earn attractive reward points.

SBI Global International Debit Card:

- SBI Global International Debit Card can be used to shop at over 6 lakh merchant locations across India and 30 million markets around the world.

- With this debit card, you can withdraw cash from State bank ATMs or other bank ATMs across India and throughout the world.

- You can enjoy cashless shopping at your convenience and avail Freedom Rewardz points for your shopping.

- With this debit card, you can shop goods at merchant outlets, make online payment and withdraw cash all over the world.

- As this debit card comes with EMV chip, it offers additional protection.

- The minimum daily transaction limit at ATMs across India is Rs. 100 and the maximum limit is Rs. 40,000 while the international transaction limit varies according to the ATM and country.

SBI Gold International Debit Card:

- SBI Gold International Debit Card can be used to purchase goods, pay in online and to withdraw cash in India and across the world.

- By using SBI gold international debit card for minimum 3 purchase transactions in a quarter, your SBI rewardz points earned during the quarter will get doubled.

- The daily transaction limit for this card comes with a minimum of Rs.100 and a maximum of Rs. 50,000 across India. The international transaction limit varies according to the ATM and country.

- There is no minimum online transaction limit. However, the maximum online transaction limit in India is Rs. 2,00,000. The international PoS varies according to the country and the online transaction limit with foreign currency worth Rs. 50,000.

- This debit card offers complimentary insurance coverage to the card holder.

SBI Platinum International Debit Card:

- SBI Platinum International Debit Card offers 1 SBI rewards point for every purchase worth Rs. 200 which includes shopping, dining, fuel refilling, travelling and online shopping.

- By using SBI platinum international debit card for minimum 3 purchase transactions in a quarter, your SBI rewardz points earned during the quarter will get tripled.

- The daily transaction limit for this card comes with a minimum of Rs. 100 and a maximum of Rs. 1,00,000 across India. The international transaction limit varies according to the ATM and country.

- There is no minimum online transaction limit. But the maximum online transaction limit in India is Rs. 2,00,000. The international PoS varies according to the country and the online transaction limit with foreign currency worth Rs. 50,000.

- This debit card comes with Airport Lounge Access.

SbiINTOUCH Tap and Go Debit Card:

- SbiINTOUCH Tap and Go Debit Card comes with contactless technology through which you make safe payments by just showing the card near the PoS terminal.

- With this contactless debit card, you can purchase at over 10 lakh merchant establishments across India and 30 million outlets worldwide.

- Like other debit cards, this card too offers 1 Freedom rewardz point for every purchase worth Rs. 200 on shopping, dining, fuel refilling, travelling and online shopping.

- For the first three purchase transactions using this card, bonus points will be awarded.

- The daily transaction limit for this card comes with a minimum of Rs. 100 and a maximum of Rs. 50,000 across India. The international transaction limit varies according to the ATM and country.

- There is no minimum online transaction limit. However, the maximum online transaction limit in India is Rs. 75,000. The international PoS varies according to the country with the online transaction limit of foreign currency worth Rs. 50,000.

SBI Mumbai Metro Combo Card:

- With SBI Mumbai Metro Combo Card, you can travel in Mumbai metro trains conveniently. As this card acts as a payment-cum-access card at Mumbai metro stations, you need not wait in queues for long hours to get tickets.

- Using this debit card, you can purchase goods at over 10 lakh merchant points across India and 30 million outlets worldwide and provides reward points for your purchases.

- This card comes with the daily cash limit at ATM with a minimum of Rs. 100 and a maximum of Rs. 40,000 across India. The international transaction limit varies according to the ATM and country.

- There is no minimum online transaction limit. But the maximum transaction limit in India is Rs. 75,000. The international PoS varies according to the country with the online transaction limit of foreign currency worth Rs. 50,000.

- In card to card transfer within SBI, three transactions per day is allowed. You can transfer Rs. 15,000 per transaction.

SBI My Card International Debit Card:

- With SBI My Card International Debit Card, you can purchase at over 6 lakh merchant locations in India and 30 million across the world.

- The daily transaction limit for this card comes with a minimum of Rs. 100 and a maximum of Rs. 40,000 across India. The international transaction limit varies according to the ATM and country.

- There is no minimum online transaction limit. But the maximum online transaction limit in India is Rs. 75,000. The international PoS varies according to the country and the online transaction limit of foreign currency worth Rs. 50,000.

- As this debit card comes with EMV chip, it provides more protection. Also you can withdraw cash in India and worldwide.

SBI International Debit Card on International Websites:

- With this SBI International Debit Card, you can make purchase transactions in the international websites you like the most.

- This debit card is valid only on selected merchant websites.

- The bank will charge 3% for all international transactions with service tax.

- No OTP or PIN required for transaction in international merchant websites.

SBI Business Debit Card:

- SBI Business Debit Card is designed specially to meet the business requirements of the customers who belong to the bank's commercial segment.

- This card helps you to check your business expenses through which you can control your expenses to the maximum extent.

- Using this card, you can make online payments, pay utility bills and can purchase business items easily.

- As this debit card is accepted by millions of merchant outlets all over the world, you can make your payments conveniently.

- SBI business debit card offers wide range of offers for payments over travelling, dining and purchasing other business items.

SBI Premium Debit Card:

- SBI Premium Debit Card covers various complimentary insurance covers such as Personal Accident Insurance, Checked-in Baggage Loss Cover, Purchase Protection Cover and Lost Card Liability Cover.

- This card comes with complimentary airport lounge access.

- The maximum daily transaction limit at ATM in India is Rs. 2,00,000 whereas the international transaction limit varies according to the country.

- The maximum daily e-commerce limit in India is Rs. 5,00,000 and the international online transaction limit with the foreign currency worth Rs. 50,000.

- The maximum daily cash deposit limit at cash deposit machine in India is Rs. 49,900.

SBI Pride Debit Card:

- SBI Pride Debit Card covers various complimentary insurance covers such as Personal Accident Insurance, Checked-in Baggage Loss Cover, Purchase Protection Cover and Lost Card Liability Cover.

- SBI pride debit card comes with complimentary airport lounge access.

- In India, the maximum daily transaction limit at ATM is Rs. 1,00,000 whereas the international transaction limit varies according to the country.

- In India, the maximum daily e-commerce limit is Rs. 2,00,000 and the international online transaction limit with the foreign currency worth Rs. 50,000.

- In India, the maximum daily cash deposit limit at cash deposit machine is Rs. 49,900.

How to apply for a new SBI Debit Card?

You can apply for new SBI debit card through various modes such as internet banking, by writing to SBI customer care or by contacting 24x7 SBI helpline.

Internet Banking:

If you want to apply for a new SBI debit card, you can easily apply for it through internet banking. To apply for it, just follow the simple steps given below. The steps given here are applicable for SBI YONO app too.

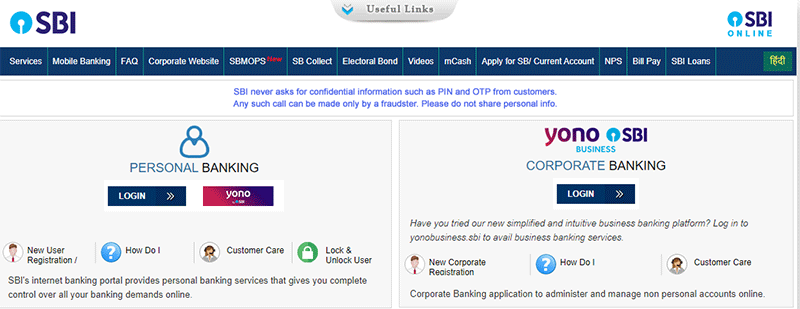

Step 1: Visit SBI's internet banking site www.onlinesbi.com

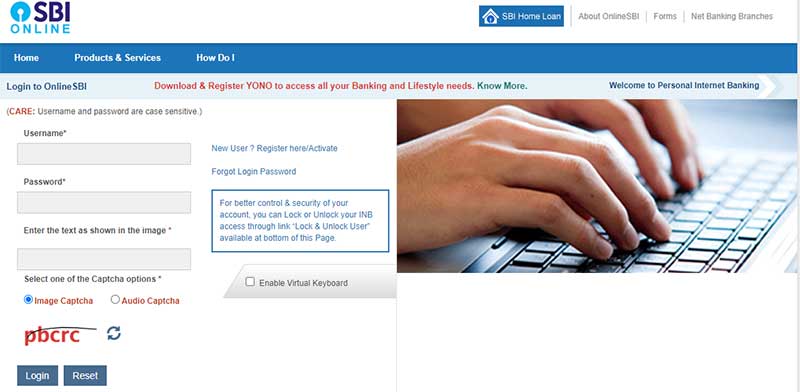

Step 2: Login to your account using your username and password.

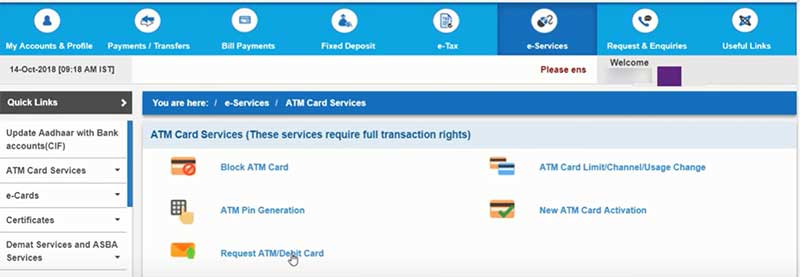

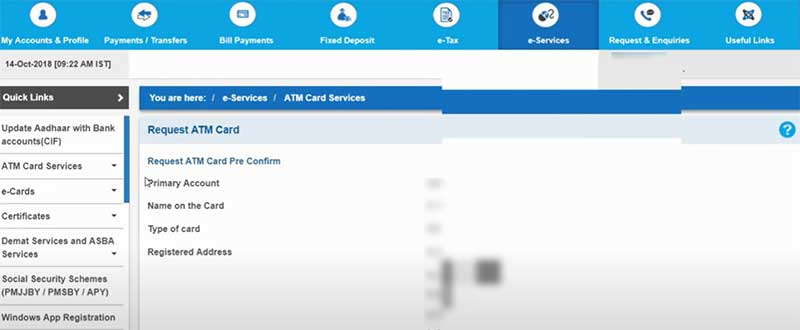

Step 3: After logging into your account, click 'e-services' option on the top menu and then click 'ATM Card Services'

Step 4: On the next page, click 'Request ATM/Debit Card' under ATM card services.

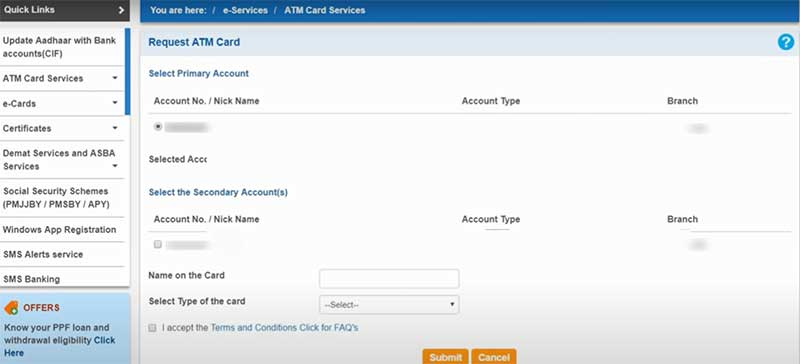

Step 5: On the next page, enter all the details required for new debit card by selecting your account, name and type of debit card. Then click 'Submit'.

Step 6: Confirm your debit card details on the next page and click 'Submit'.

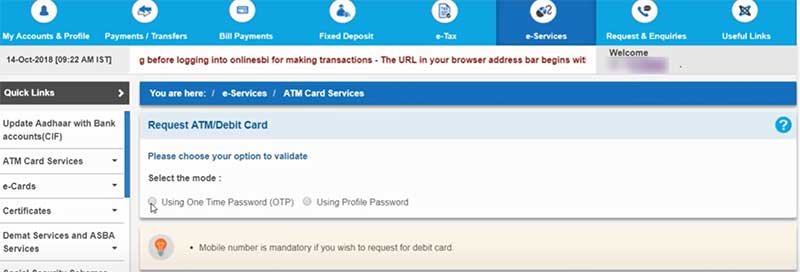

Step 7: Select either OTP or profile password for verification and enter the OTP or password. Then click 'Submit'

Step 8: Upon successful request, you will be notified the duration for the delivery of debit card.

Written Request:

You can request for a new debit card by writing to SBI customer care email id: contactcentre@sbi.co.in. You can also write to State Bank Contact Centre, P.O. Box No. 825, Bangalore 560 008.

SBI Helpline:

You can also apply for debit card by contacting SBI's 24x7 helpline through Toll-free numbers 1800 11 2211, 1800 425 3800 or 080 26599990.

How to activate new SBI debit card in Online?

You can activate your new debit card in online through internet banking. Just follow the steps given below to activate your new SBI debit card.

Step 1: Login to your SBI internet banking account.

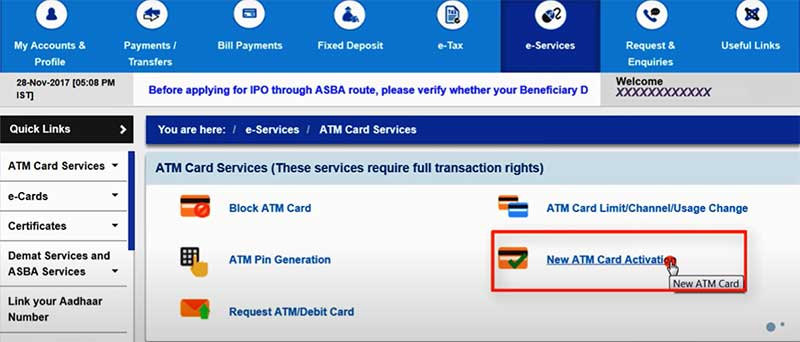

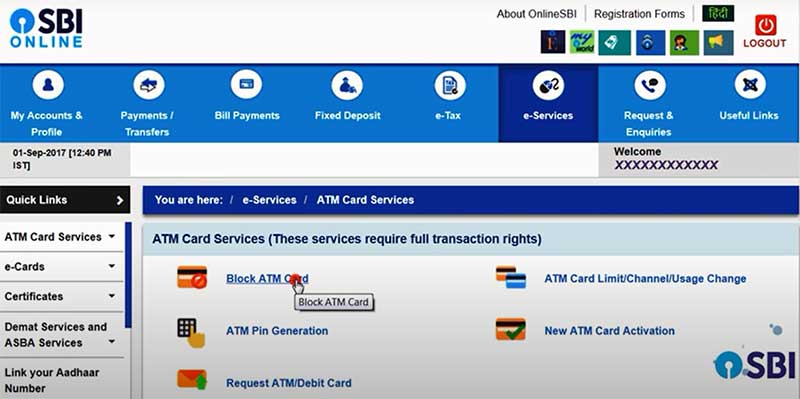

Step 2: Go to 'e-Services' option and click 'ATM Card Services'

Step 3: On the next page, click 'New ATM Card Activation' under ATM card services.

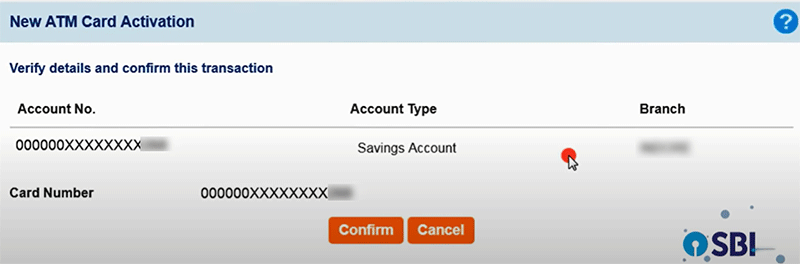

Step 4: On the next page, select your account number and enter your 16-digit ATM card number. Then click 'Activate'

Step 5: Verify your details and then click 'Confirm'. Then enter the high security password sent to your mobile number and then click 'Confirm'.

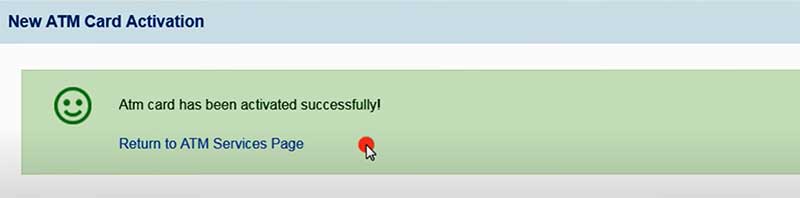

Step 6: On the next page, a message upon successful activation of ATM card will appear on the screen.

How to block SBI Debit Card?

If your debit card has been lost or stolen, you can block your debit card through internet banking, SMS or by contacting SBI toll-free number.

Internet Banking:

You can easily block your debit card by following the simple steps given below.

Step 1: Login to your SBI internet banking account.

Step 2: Go to 'e-Services' option and click 'ATM Card Services'

Step 3: Under ATM Card Services, click 'Block ATM Card'

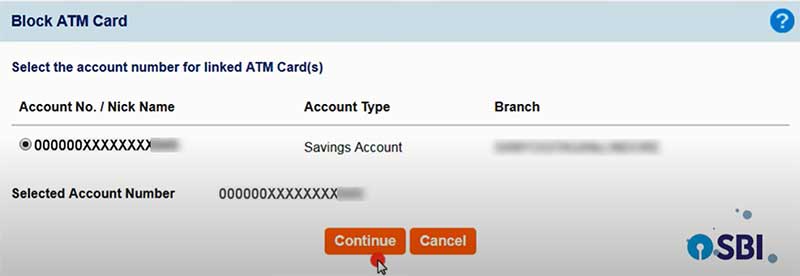

Step 4: On the next page, select your account and then click 'Continue'.

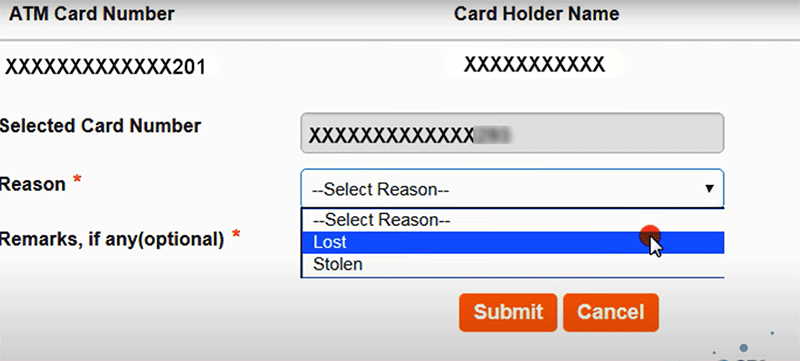

Step 5: Then select the card which you want to block and then select the reason why you want to block the card.

Step 6: Once you clicked the submit button, a pop up message will appear. Click OK.

Step 7: On the next page, check the card details which you want to block and then click 'confirm'

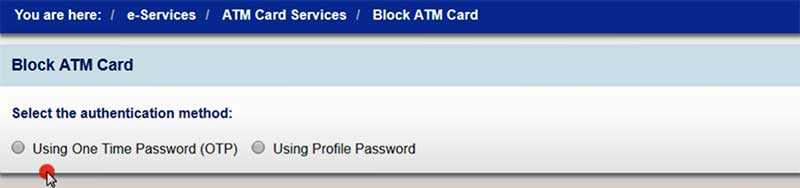

Step 8: Choose whether you want to proceed further using OTP or profile password and then enter the OTP or Password.

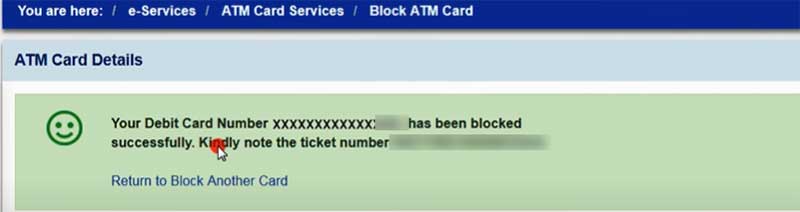

Step 9: On the next page, you will see a message upon successful blocking of your debit card. Note down the ticket number for future reference.

SMS:

If you don't have internet banking facility, you can easily block your SBI debit card through SMS. To block your SBI debit card, send an SMS in the format of Block (space) (last 4 digits of your debit card) to 567676.

SBI Helpline:

Another easy way through which you can block your SBI debit card is by contacting the SBI's 24x7 helpline numbers 1800 11 2211, 1800 425 3800 or 080 26599990.

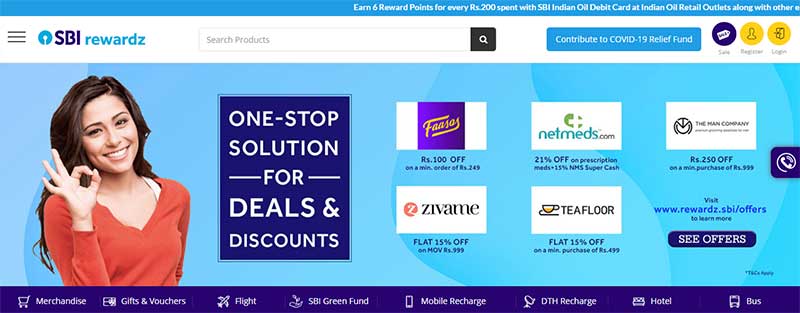

SBI Debit Card Rewardz:

SBI Rewardz, India's most rewarding loyalty program awards reward points to its customers whenever they use SBI products or services. You can earn reward points for the variety of transactions you made using SBI debit card. The accumulated reward points can be redeemed to pay for different redemption options. In order to avail this reward, you need to register in the SBI rewardz.

How to register in SBI Rewards?

To register in SBI rewards, go through the steps given below.

Step 1: Visit the SBI rewards official site https://www.rewardz.sbi/ and click 'register' or download SBI rewardz app in your mobile and click 'Sign up'

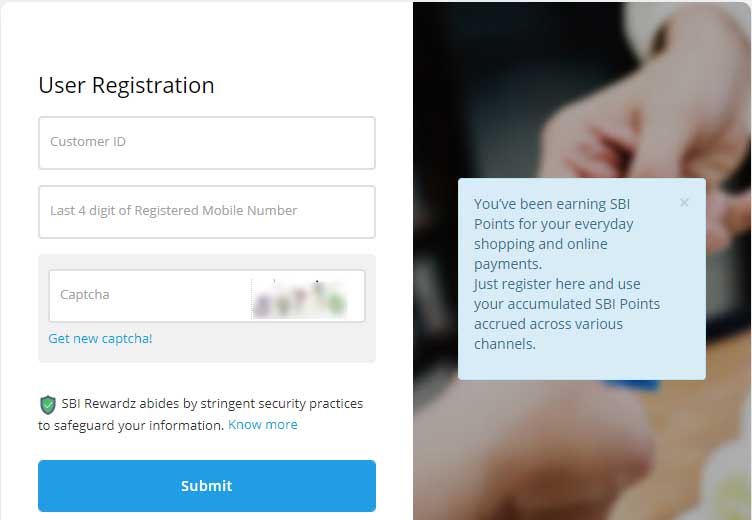

Step 2: On the user registration page, enter your user ID and the last four digits of your mobile number. Enter the captcha code and then click 'Submit'

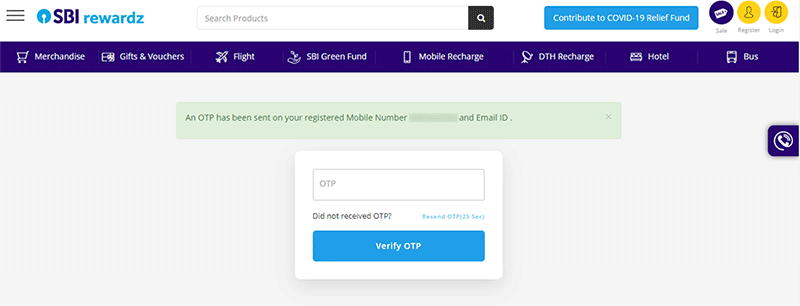

Step 3: On the next page, click 'Get OTP' and enter the OTP sent to your registered mobile number.

Step 4: On the next page, your details will be pre-filled automatically. Select user ID, create password and then click 'Register'.

Step 5: You are now successfully registered in the website. Now you can login to your SBI rewardz accounts and check your reward points.

SBI Debit Card Reward Points:

You can redeem your reward points to get free gifts, merchandise and services in SBI Rewardz platform. 1 reward point equals to INR 25 paise. If your total reward points earned is 1000, you will get Rs. 250. The reward points will be valid for 36 months from the date of transaction made.

- All type SBI debit card holders will earn 2 reward points as standard points for spending every Rs. 200 per card on PoS or e-Commerce.

- All IOCL co-branded SBI debit card holders will be awarded 6 reward points as IOCL points for spending per Rs. 200 per IOCL co-branded card at IOCL outlets.

- An activation bonus of 200 points will be awarded for usage of debit card thrice within a month of the issuance of debit card.

- A birthday celebration bonus of double reward points on transactions during the birthday month.

- For spending Rs. 200 using debit card in Indian Oil Retail outlets, you will earn 6 reward points.

What are the charges for SBI Debit Card?

SBI Debit Card Issuance Charges:

- Classic/ Silver/ International/ Contactless Debit Card - No Charge

- Gold Debit Card - Rs. 100 + 18% GST

- Platinum Debit Card - Rs. 300 + 18% GST

SBI Debit Card Annual Maintenance Charges:

- Classic Debit Card - Rs. 125 + 18% GST

- Silver/ International Contactless Debit Card - Rs. 125 + 18% GST

- Yuva/ Gold/ Combo/ Image Debit Card - Rs. 175 + 18% GST

- Platinum Debit Card - Rs. 250 + 18% GST

- Pride/ Premium Business Debit Card - Rs. 350 + 18% GST

SBI Debit Card Replacement Charges:

- For all type debit cards - Rs. 300 + 18% GST

Duplicate PIN/ Regeneration of PIN Charges:

- For all type debit cards - Rs. 50 + 18% GST

International Transaction Charges:

- Balance enquiry at ATMs - Rs. 25 + 18% GST

- ATM cash withdrawal transactions - Rs. 100 + 3.5% of transaction amount + 18% GST

- PoS/ e-Commerce transactions - 3% of transaction amount + 18% GST.