Bajaj Finserv home loan is the one stop solution for all your housing needs. If you want to purchase, construct, or renovate a home, you can get finance from Bajaj Finserv easily with simple procedures and minimal documentation.

Bajaj Finserv offers home loan at lower interest rate from 6.9% with loan amount of up to Rs.3.5 crore. It comes with the flexible loan tenure of up to 20 years, annual tax benefits and highest top-up loan up to Rs.50 lakh. With PMAY's interest subsidy, you can save up to Rs.2.67 lakh.

What are the features and benefits of Bajaj Finserv Home Loan?

Bajaj Finserv home loan comes with the following features and benefits.

- Lower interest rate starting from 6.9%

- Easy balance transfer facility

- Minimal documentation and easy home loan eligibility criteria

- Quick processing of loan

- Top-up loan up to Rs.50 lakh at nominal interest rate

- Property Dossier facility available

- No part-payment or foreclosure charges

- Flexible repayment tenure up to 20 years

- Online account management

- Customized insurance schemes for family protection

| Interest Rate | 6.9% onwards |

| Loan Amount | Up to Rs.3.5 crore |

| Loan Tenure | Up to 20 years |

| Processing Fee |

Salaried: Up to 0.80% of the loan amount Self-employed: Up to 1.20% of the loan amount |

| Penal Interest | Up to 2% |

| Rate Packages | Fixed/Floating |

What is the interest rate for Bajaj Finserv Home Loan?

The interest rate may differ for each home loan scheme offered by Bajaj Finserv. According to the employment type, the interest rate may vary.

| Bajaj Finserv Home Loan Schemes | Interest Rates | |

|---|---|---|

| Salaried | Self-Employed | |

| Loan for Land Purchase | 9.05% -10.30% | 9.35% - 11.15% |

| Top Up Loan | 9.05% -10.30% | 9.35% - 11.15% |

| Home Construction Loan | 9.05% -10.30% | 9.35% - 11.15% |

| Joint Home Loan | 9.05% -10.30% | 9.35% - 11.15% |

| Home Loan for Women | 6.9% onwards | - |

| Home Loan for Advocates | 6.9% onwards | - |

| Home Loan for Bank Employees | 6.9% onwards | - |

| Home Loan for Government Employees | 6.9% onwards | - |

What are the home loan schemes available in Bajaj Finserv?

Bajaj Finserv offers wide range of home loan schemes with which you can choose according to your requirement.

1. Loan for Land Purchase

This loan is ideal to buy a resale plot or to purchase a land through direct allotment.

- High value of loan amount up to Rs.3.5 crore

- Quick and easy loan disbursal

- Flexible loan tenure up to 20 years

- Exclusive balance transfer facility

- Instant loan approval within 5 minutes

- Tax benefits available

2. Top Up Loan

This is an exclusive financing option for expenses apart from the ones covered by the home loan.

- Attractive interest rate

- Quick and easy loan without any extra documentation

- High value of loan amount up to Rs.50 lakh

- No restriction in usage

- Foreclosure and part-prepayment facility available

- Tax benefits available

3. Home Construction Loan

This loan is ideal for construction of house on a vacant plot.

- High-value financing up to Rs.3.5 crore

- Easy repayment tenure

- Quick loan approval

- Faster loan disbursement within 72 hours

- High-value top-up loan

- Tax benefits available

4. Joint Home Loan

It is a secured loan that can be availed along with a co-borrower.

- Low interest rates

- High financing up to Rs.3.5 crore

- Balance transfer facility available

- High-value top-up loan at nominal rates

- Tax benefits available

- Quick loan approval and disbursal

5. Home Loan for Women

This home loan is exclusively meant for women.

- High loan amount ranging from Rs.30 lakh to Rs.3.5 crore

- Zero part-prepayment and foreclosure charges

- Long tenure up to 25 years

- Minimal documentation

- Home loan balance transfer facility available

6. Home Loan for Advocates

This home loan is exclusively meant for advocates, either working in a own company or own practice.

- High loan amount ranging from Rs.30 lakh to Rs.3 crore

- Zero part-prepayment and foreclosure charges

- Long tenure up to 20 years

- Minimal documentation

- Online account management

Home Loan for Bank Employees

This home loan is exclusively meant for bank employees.

- High loan amount ranging from Rs.30 lakh to Rs.10 crore

- Zero part-prepayment and foreclosure charges

- Long tenure up to 25 years

- Minimal documentation

- Online account management

Home Loan for Government Employees

This home loan is exclusively meant for government employees.

- High loan amount ranging from Rs.30 lakh to Rs.10 crore

- Zero part-prepayment and foreclosure charges

- Long tenure up to 25 years

- Minimal documentation

- Online account access

Home Loan for Private Employees

This home loan is exclusively meant for private employees.

- High loan amount of Rs.10 crore

- Flexi hybrid home loan facility

- Zero part-prepayment and foreclosure charges

- Long tenure up to 25 years

- Online account management

Pradhan Mantri Awas Yojana

For home loans taken under PMAY scheme, you will get interest subsidy of up to 6.5%. Individuals including EWS, LIG, MIG I, MIG II, Women, SC, ST and OBC are eligible for this scheme.

What is the eligibility required to avail Bajaj Finserv Home Loan?

The eligibility criteria required to avail home loan in Bajaj Finserv are simple and any Indian resident with good financial profile can avail home loan in Bajaj Finserv easily. The eligibility criteria may differ for salaried and self-employed individuals. Some of the eligibility criteria required to avail Bajaj Finserv home loan are given below.

| Eligibility Criteria | Salaried | Self-Employed |

|---|---|---|

| Nationality | Resident Indian | Resident Indian |

| Age | 23 - 62 years | 25 - 70 years |

| Work Experience/Business Continuity | 3 years or more | 5 years or more |

| Maximum loan amount | Rs.3.5 crore | Rs.3.5 crore |

| Minimum Salary | Rs.25,000 | Rs.25,000 |

| Minimum CIBIL score | Minimum 750 | Minimum 750 |

How to calculate Bajaj Finserv Home Loan Eligibility?

With Bajaj Finserv Home Loan Eligibility Calculator, you can easily calculate how much loan amount you can get based on your salary, tenure, and EMI. Apart from this, other factors such as your current age, location, credit score, total work experience and other monthly obligations also determines your home loan eligibility. To calculate your home loan eligibility, follow the simple steps given below.

Step 1: Visit Bajaj Finserv Home Loan Eligiblity Calculator page.

Step 2: Enter the details such as your date of birth and select your city, net monthly salary, tenure, other monthly income and current EMIs or monthly obligation if any. Click 'Check your Eligibility'

Step 3: Once you have provided all these details, the home loan amount you can avail from Bajaj Finserv will appear on the screen.

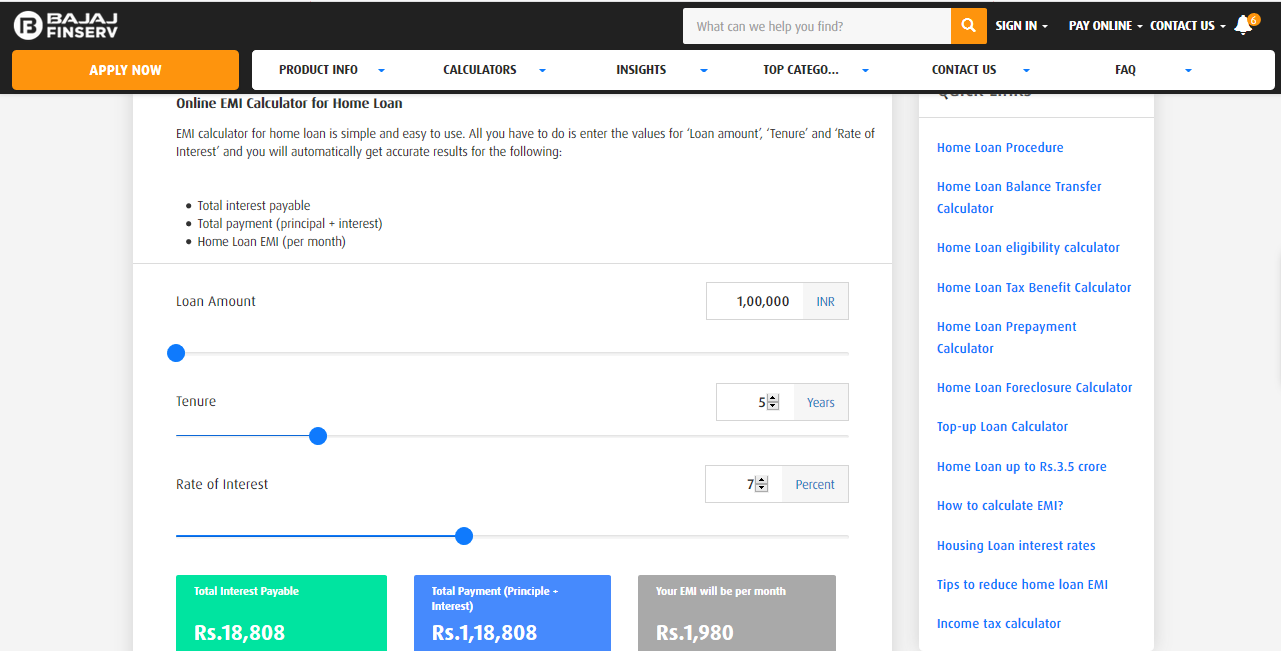

How to calculate Bajaj Finserv Home Loan EMI?

Bajaj Finserv Home Loan EMI Calculator helps you to calculate the EMI which you need to pay for the home loan amount. With this online tool, you can easily calculate the EMI by entering the loan amount, tenure and rate of interest. To calculate EMI, just follow the simple steps given below.

Step 1: Visit Bajaj Finserv Home Loan EMI Calculator page

Step 2: Select the loan amount, tenure and rate of interest.

Step 3: Once you have provided all these details, the total interest payable, total payment (principal and interest) and home loan EMI per month will appear on the screen.

What are the documents required to apply for Bajaj Finserv Home Loan?

In order to apply for home loan in Bajaj Finserv, you need to submit the following list of documents.

Proof of Identity (any one)

- PAN card

- Driving License

- Passport

- Voter ID

Proof of Address (any one)

- Aadhaar card

- Voter ID

- Driving License

- Passport

- Utility Bills

Income Proof (Salaried & Self-Employed)

- Form 16 or latest salary slips

- Last 6 months bank account statements

Other Documents

- Passport size photo

- Proof of 5 years of business continuity (For self-employed individuals)

Bajaj Finserv Home Loan - Important Links

- To apply for Bajaj Finserv home loan, click here

- To track your Bajaj Finserv home loan application status, click here

- To locate your nearest Bajaj Finserv home loan branch, click here

Bajaj Finserv Home Loan Customer Care

You can contact Bajaj Finserv home loan customer care for queries regarding home loan. The customer care contact details are given below.

| Call Bajaj Finserv home loan toll-free number | +91 8698010101 |

| Give Missed call | +91 9810852222 |

| Write Email | https://www.bajajfinserv.in/reach-us |

| Send SMS | HELP to 9227564444 |

| Write to Bajaj Finserv Corporate Office | 4th floor, Bajaj Finserv Corporate Office, Pune - Ahmedabad Road, Viman Nagar, Pune - 411014 |