Canara bank offers home loan to fulfill your dream of owning a home. It offers the right housing finance scheme to your needs. Canara bank home loan helps you in building a home or buying a flat of your own. It provides home loan at low interest rate starting from 6.90% p.a for women and 6.95% p.a for others. It comes with the repayment tenure of up to 30 years.

The bank charges the nominal processing fee of 0.50% of the loan amount and zero prepayment charges for floating rate home loan. The eligible home loan amount is 6 times the gross annual income for salaried and self-employed. It offers Rs. 15 lakhs in case of repairs and renovations. You can avail loan up to 90% of the property value for new house or flat.

What are the features and benefits of Canara Bank Home Loan?

Canara bank home loan comes with the following features and benefits.

- Lower interest rate starting from 6.90%

- No prepayment penalties for housing loans carrying floating interest rate

- Balance transfer facility available

- No part payment fee

- Security includes mortgage of house/flat

Canara bank offers home loan to fulfill your dream of owning a home. It offers the right housing finance scheme to your needs. Canara bank home loan helps you in building a home or buying a flat of your own. It provides home loan at low interest rate starting from 6.90% p.a for women and 6.95% p.a for others. It comes with the repayment tenure of up to 30 years.

The bank charges the nominal processing fee of 0.50% of the loan amount and zero prepayment charges for floating rate home loan. The eligible home loan amount is 6 times the gross annual income for salaried and self-employed. It offers Rs. 15 lakhs in case of repairs and renovations. You can avail loan up to 90% of the property value for new house or flat.

What are the features and benefits of Canara Bank Home Loan?

Canara bank home loan comes with the following features and benefits.

- Lower interest rate starting from 6.90%

- No prepayment penalties for housing loans carrying floating interest rate

- Balance transfer facility available

- No part payment fee

- Security includes mortgage of house/flat

| Interest Rate | 6.90% onwards |

| MCLR Rate (1 year) | 7.55% |

| Loan Amount | Maximum 6 times of the gross income |

| Loan Tenure | Up to 30 years |

| Processing Fee | 0.50% of the loan amount |

| Prepayment Charges | NIL |

| Rate Packages | Floating rate |

What is the interest rate for Canara Bank Home Loan?

The interest rate for Canara bank home loan may vary for each home loan scheme. The interest rates of all Retail Lending Schemes are linked to Repo Linked Lending Rate (RLLR). The interest rates for each home loan scheme are as follows.

| Canara Home Loan Schemes | Interest Rates (p.a) |

|---|---|

| Canara Housing Loan | 6.95% - 8.90% |

| Canara Housing Loan to Corporates | 8.15% |

| Canara Home Improvement Loan | 9.40% - 11.45% |

| Canara Home Loan Plus | 7.45% - 9.50% |

| Canara Home Loan Secure | 7.00% |

| Canara Mortgage Loan | 9.95% - 12.00% |

| Canara Site Loan |

7.95% - 9.00% |

What are the home loan schemes available in Canara Bank?

Canara bank offers different types of home loan schemes to meet your needs including Canara Housing Loan, Canara Home Loan Plus, Canara Home Improvement Loan and Canara Site Loan.

Canara Housing Loan

- Ideal for purchase of plot, purchase/construction of house and expansion/renovation

- The interest rate ranges from 6.95% to 8.90% p.a

- The processing fee is 0.50% (Rs.1500 to Rs.10,000)

- Available for persons aged 60 or more who fulfil some conditions

- Also available for individuals with stable income for at least 3 years.

Canara Home Loan Plus

- Additional amount on an existing home loan from the bank

- The interest rate ranges from 6.45% to 9.50% p.a

- The processing fee is not applicable

- Available only for borrowers with at least 1-year good repayment history

- Available in the form of term loan of up to 10 years and overdraft of up to 3 years.

Canara Home Improvement Loan

- Ideal for purchase of household appliances and home furnishing

- The interest rate ranges from 9.40% to 11.45% p.a

- The processing fee is 0.50% (Rs.1500 to Rs.10,000)

- Available for NRIs

- Maximum repayment tenure is 5 years

- Borrowing up to Rs. 2 lakhs on top of existing home loan from the bank.

Canara Site Loan

- Ideal for purchase of sites sold by the State/Central governments, town planning departments or any recognized government organization

- The interest rate ranges from 7.95% to 9.00% p.a

- The processing fee is 0.50% (Rs.1500 to Rs.10,000)

- Additional home loan can be taken for construction of house on the site

- Maximum repayment tenure is 10 years.

Pradhan Mantri Awas Yojana

- Ideal for purchase of house/flat, construction of house on the site owned and purchase of flats under construction.

- Individuals including EWS, LIG, MIG I, and MIG II are eligible for this scheme.

- For EWS and LIG categories, interest subsidy of 6.5% is available. For MIG I and MIG II category, interest subsidy of 4% and 3% are available respectively.

- Interest subsidy for the tenure of 20 years or tenure of loan whichever less is applicable.

What is the eligibility required to avail Canara Bank Home Loan?

Some of the eligibility criteria required to avail home loan from Canara bank are given below.

| Eligibility Criteria | Requirements |

|---|---|

| Age of the Applicant | 21 to 70 years |

| Nationality | Resident Indians/Non-Resident Indians |

| Work Experience | Minimum 3 years |

| Employment Type | Salaried/Self-Employed/Professionals/Businessmen |

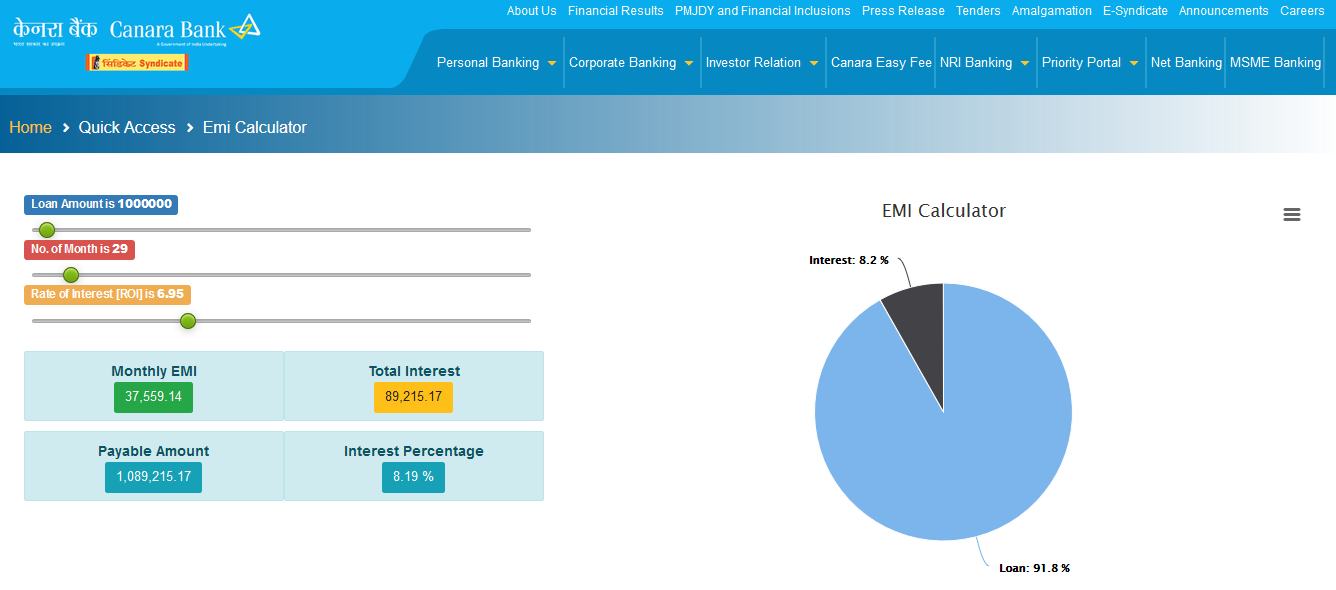

How to calculate Canara Bank Home Loan EMI?

With Canara Bank Home Loan Calculator, you can calculate the approximate EMI which you need to pay for your home loan. This tool eases your planning. To calculate EMI for your home loan, just follow the simple steps given below.

Step 1: Visit Canara Bank Home Loan Calculator page

Step 2: Select the loan amount, loan tenure and rate of interest

Step 3: Once you have provided all these details, the EMI and interest for the loan amount will appear on the screen.

What are the documents required to apply for Canara Bank Home Loan?

In order to apply for home loan in Canara bank, you need to submit the following list of documents.

- Duly filled application form with 2 passport size photos

- Sale deed

- Sale agreement

- Detailed construction cost estimate or valuation report from Bank's Panel Chartered Engineer/Architect

- Certified copy of sanctioned property plan

- Allotment letter of Co-operative Housing Society/Housing Board/Apartment Owner's Association/NOC from the Society/Builders/Housing Board/Association

- EC for the past 13 years, Legal Scrutiny Report, Property Tax paid receipt, Permission for mortgage and Khata wherever required

- Form No.16 and Salary Certificate

- Past 3 years IT returns (non-salaried)

- A brief note on nature of business, established year, organization type, etc. (self-employed)

- Balance Sheet and P&L Account for past 3 three years (self-employed)

Canara Bank Home Loan Customer Care

You can contact Canara bank home loan customer care service for any complaints/issues regarding home loan. Call Canara Bank Home Loan Toll-Free Numbers 1800 425 0018, 1800 103 0018, 1800 208 3333, 1800 3011 3333. Customers from outside India can call to the non-toll free number 91-80-22064232.