Citibank offers personal loan with which you can get funds quickly and easily. With personal loan, you can finance for the wedding or pay an emergency medical bill. Citibank personal loan comes with fast loan approval and minimal documentation. It offers personal loan at attractive interest rates with flexible loan tenures and easy EMIs.

Citibank offers personal loan at lower interest rate starting from 9.99% per annum with the maximum loan tenure of up to 5 years. It provides the maximum loan amount of up to Rs.30 lakhs. The bank charges the processing fee of up to 2% of the loan amount.

What are the features and benefits of Citibank Personal Loan?

Citibank personal loan comes with the following features and benefits.

- Instant loan sanction within 2 days

- Personal loan eligibility in just 4 hours

- Loan amount up to Rs.30 lakhs

- Part pre-payment facility available

- Fixed interest rate available for predictable monthly payments

- Balance transfer facility available for credit card and personal loan outstanding

| Interest Rate | 9.99% onwards |

| Loan amount | Up to Rs.30 lakhs |

| Loan Tenure | Up to 5 years |

| Processing Fee | Up to 2% of the loan amount |

| Pre-closure charge | Up to 4% on total principal outstanding |

What is the interest rate for Citibank Personal Loan?

The interest rate for Citibank Personal loan is given below.

| Instant Personal Loan | |

|---|---|

| Rate of Interest | 9.99% - 14.99% |

| Processing Fee | Up to 2% |

| Buy Now Pay Later | |

|---|---|

| Rate of Interest | 16% |

| Processing Fee | Nil |

What is the eligibility required to avail Citibank Personal Loan?

The eligibility required to avail personal loan in Citibank are as follows.

| Eligibility Criteria | Requirements |

|---|---|

| Age |

Salaried: 23 years to 60 years Self-Employed: 25 years to 65 years |

| Employment Type | Salaried/ Self-Employed |

| Salary |

Salaried: Rs.25,000 per month Self-Employed: Rs.5 lakh in gross annual receipt |

What are the documents required to apply for Citibank Personal Loan?

In order to apply for personal loan in Citibank, you need to submit the following list of documents.

- Photograph

- Proof of Identity - Passport/ Driving License/ Voter ID/ Aadhaar card/ Job card issued by NREGA/ National Population Register

- Proof of Address- Passport/ Driving License/ Voter ID/ Aadhaar card/ Job card issued by NREGA/ National Population Register

- Proof of Age- Passport/ Driving License/ Voter ID/ Aadhaar card/ Job card issued by NREGA/ National Population Register

- Proof of Income (For Salaried) - Last 3 months bank statement/Latest 2 pay slips

- Proof of Length of Employment (For Salaried) - Letter from Employer/ HR check by designated CPA resource/ Current and previous Employer's pay slips/ Form 16

- Proof of Occupation (For Self-employed) - Last 3 months bank statement/ Computation of Income Schedule/ 1-year audited P&L/ 1-year Individual IT Return

- Proof of Continuity of Business - Utility bills/ Ownership documents/ Lease deed/ Read receipts/ Tax Returns from the same city/ 3-year-old bank statement.

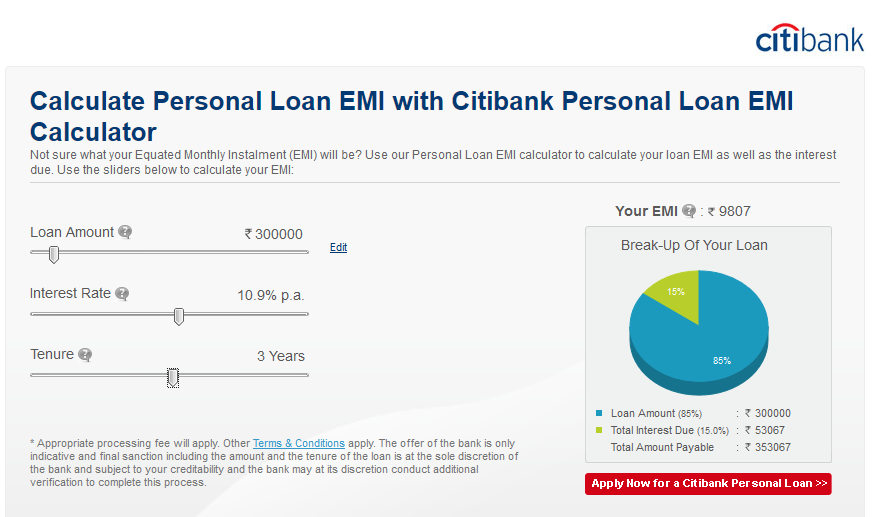

How to calculate EMI for Citibank Personal Loan?

You can easily calculate the EMI for the personal loan taken in Citibank using the online tool Citibank Personal Loan EMI Calculator. Using this online tool, you can calculate your monthly expenses based on the amount, interest rate and repayment tenure. It also helps you in planning your loan requirements. To calculate EMI, just follow the simple steps given below.

Step 1: Click here to calculate your Citibank personal loan EMI.

Step 2: Select the loan amount, interest rate and loan tenure.

Step 3: Once you have provided the details, it will automatically show the amount which you need to pay every month for the loan.

How to apply for Citibank Personal Loan?

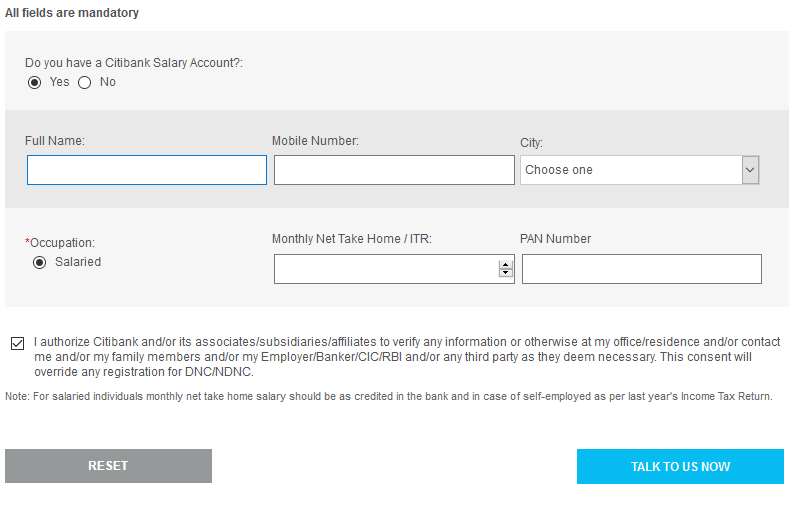

You can easily apply for personal loan in Citibank in online itself. Before applying for personal loan, you need to check the eligibility requirements and should possess necessary documents. To apply for Citibank personal loan, just follow the steps given below.

Step 1: Click here to apply for Citibank personal loan

Step 2: Fill all the mandatory fields and click 'Talk To Us Now'

Step 3: Once you have clicked 'Talk To Us Now', a representative from the bank will contact you regarding the personal loan.

How to login to Citibank Personal Loan Account?

You can access your Citibank personal loan account by logging in using your net banking credentials.

Step 1: Click here to login to your Citibank personal loan account

Step 2: Enter your User ID and IPIN and click 'Login'

Step 3: Once logged in, you can now access your personal loan account.

How to check the Citibank Personal Loan Status?

Once you have applied for personal loan in Citibank, you can easily check the loan status in online itself. In order to check the loan status, you need to have the personal loan application number. The personal loan application number will be sent to your mobile number via SMS after the completion of the loan application process.

You can check the loan status using Citibank's internet banking platform. The steps to check the loan status are given below.

Step 1: Login to your Citibank's internet banking account using your user ID and IPIN.

Step 2: In the account information section, select 'Personal Loan' from the drop-down menu

Step 3: Enter your 16-digit customer ID or Loan ID

Step 4: Enter the exact EMI amount, your date of birth and account number.

Step 5: Agree to the terms and conditions and click 'Proceed'

Step 6: Enter the OTP sent to your registered mobile number and create your new IPIN and password.

Step 7: Now login to the portal and check your Citibank personal loan status.

Citibank Personal Loan Customer Care

You can contact the Citibank personal loan customer care if you have any queries regarding personal loan. The customer care details are given below.

| Call Citibank Toll-free Number | 1800 266 2400 |

| Call 24x7 CitiPhone Number | 1860 210 2484 |

| Send SMS | Send PL to 52484 |

| Write to Citibank Head - Customer Care | Click here |

| Write to Principal Nodal Office | Principal Nodal Officer, Hema L. Venkatesh, Citibank N.A., Mail Room, ACROPOLIS, 9th Floor, New Door No.148 (Old No.68), Dr. Radhakrishnan Salai, Mylapore, Chennai - 600 004. |