Dewan Housing Finance Corporation Limited (DHFL) is one of the leading housing finance companies in India, committed towards creating, safeguarding and maintaining the dream home of every customer by offering home loans at attractive interest rates. DHFL focuses on providing hassle-free home loans to lower and middle income groups in India by transforming their dreams into reality.

DHFL offers quick and transparent home loans at lower interest rates starting from 8.75% per annum with the loan tenure of up to 25 years. DHFL housing loan suits various housing requirements such as purchase of home, renovation or expansion of existing home or purchase of plot of land and construction of new home. Serving customers over 36 years, DHFL has more than 300 branches across India.

What are the features and benefits of DHFL Home Loan?

Some of the features and benefits of DHFL home loan are,

- It offers higher home loan at lower interest rate starting from 8.75% p.a

- It comes with the loan term of up to 25 years

- The processing fee is significantly low

- The loan processing is quick and transparent

- It offers variety of home loans according to the individuals' requirements.

- It has various repayment options for your convenience.

- It offers online tools such as DHFL Home Loan Eligibility Calculator and DHFL Home Loan EMI Calculator with which you can calculate your home loan eligibility and monthly repayment of home loan.

- The principal amount and interest amount are eligible for tax benefits.

| Interest rate | 8.75% p.a onwards |

| Loan Amount | Depends upon annual income and repayment capacity |

| Loan Tenure | Up to 25 years |

| RPLR | 19.42% |

| Processing Fees |

0.5% + GST for salaried/self-employed professionals 0.5% + GST (Net PAT)/1.5% + GST (others) for self-employed non-professionals. |

| Rate Packages | Floating rate |

| Penal Interest Rate | 18% p.a on the outstanding amount |

| Part Pre-payment/ Foreclosure Charges | 2% - 3% + GST |

What are the home loan products available in DHFL Housing?

DHFL home loan offers five different home loan products according to the customer's needs. DHFL charges Rs.2500 or applicable processing fee, whichever is lower with applicable GST. These home loan products are available for both salaried and self-employed individuals. The products available in DHFL home loan are given below.

DHFL New Home Loans

- This loan facility helps you to buy constructed or under-construction house/flat or resale property.

- 90% of the property value for loan up to Rs.30 lakh.

- Maximum loan term is up to 25 years or 60 years of age, whichever is earlier.

DHFL Home Construction Loans

- This loan facility can be used to construct your dream home on your own plot.

- Loans up to 100% of the construction estimate under the condition of a maximum of 90% of its market value, whichever is lower, for the loan need up to Rs.30 lakh.

- The loan amount depends on your annual income and loan repayment ability.

DHFL Home Extension Loans

- This loan facility can be used to extend your existing home like adding bedroom, extra room, etc.

- Loans up to 100% of the construction estimate under the condition of a maximum of 90% of its market value, whichever is lower, for the loan need up to Rs.30 lakh.

- Maximum loan term is up to 25 years or 60 years of age, whichever is earlier.

DHFL Home Renovation Loans

- This loan facility can be used to redesign your home by giving it a fresh look.

- Loans up to 100% of the construction estimate under the condition of a maximum of 90% of its market value, whichever is lower, for the loan need up to Rs.30 lakh.

- The maximum loan tenure is up to 10 years or 60 years of age, whichever is earlier.

Pradhan Mantri Awas Yojana

- Under PMAY scheme, our Indian Government aims to fulfil the dream of first-time home buyer in India by offering home loan at affordable rates to buy a 'pucca' residential house.

- The home loan amount depends on your annual income and loan repayment ability.

- The maximum interest subsidy benefit under this scheme is Rs.2.67 lakh

What is the interest rate for DHFL Home Loan?

The interest rate for DHFL home loan starts from 8.75% onwards. The interest rates are linked to Retail Prime Lending Rate (RPLR). The interest rates for DHFL home loan products are given below.

| DHFL Home Loan Products |

Interest Rate |

| DHFL New Home Loans | 8.75% p.a |

| DHFL Home Construction Loans | 8.75% p.a |

| DHFL Home Loans Balance Transfer | 8.75% p.a |

| DHFL Home Extension Loans | 8.75% p.a |

| DHFL Home Renovation Loans | 8.75% p.a |

What are the eligibility criteria required to avail DHFL Home Loan?

In order to avail home loan in DHFL, you need to meet the following eligibility requirements.

| Eligibility criteria | Requirement |

| Minimum age of the applicant | 21 years |

| Maximum age of the applicant | 65 years |

| Residential status | Indian/Non-Resident Indian |

| Employment type | Salaried/Self-Employed businessmen or professionals |

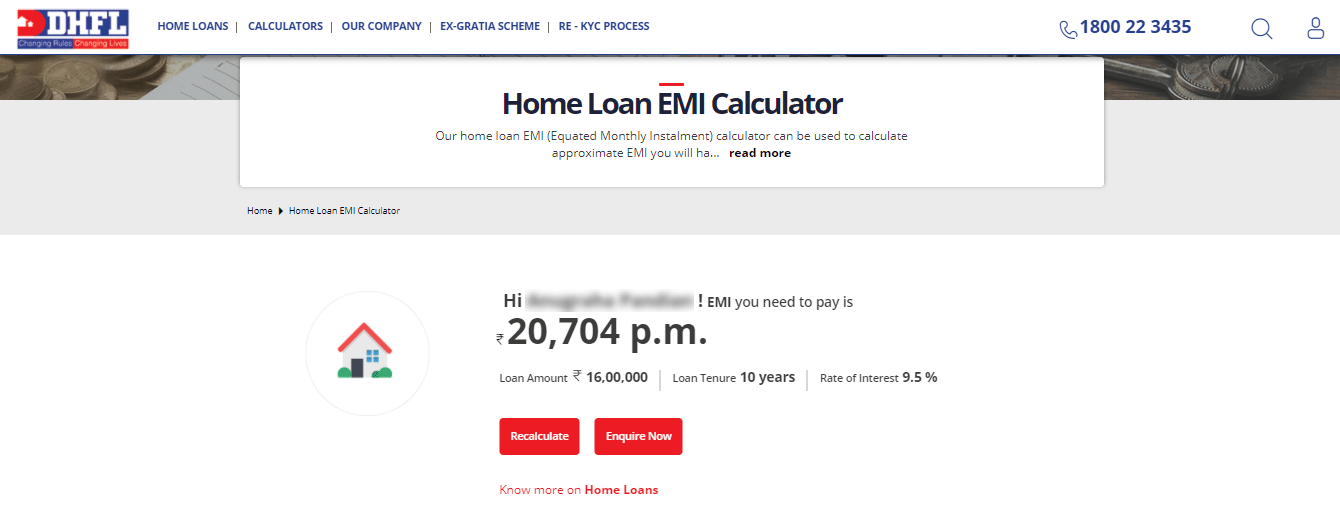

How to calculate EMI for DHFL Home Loan?

With DHFL Home Loan EMI Calculator, you can calculate the approximate EMI which you have to pay for your home loan. This tool can be used to plan your regular cash flow to take informed decision.

Step 1: Visit DHFL Home Loan EMI Calculator page

Step 2: Select the home loan amount you need and enter your name and mobile number. Then click 'Calculate EMI'.

Step 3: Now enter the OTP sent to your mobile number.

Step 4: The EMI amount which you need to pay per month along with the loan amount, loan tenure and rate of interest will appear on the screen.

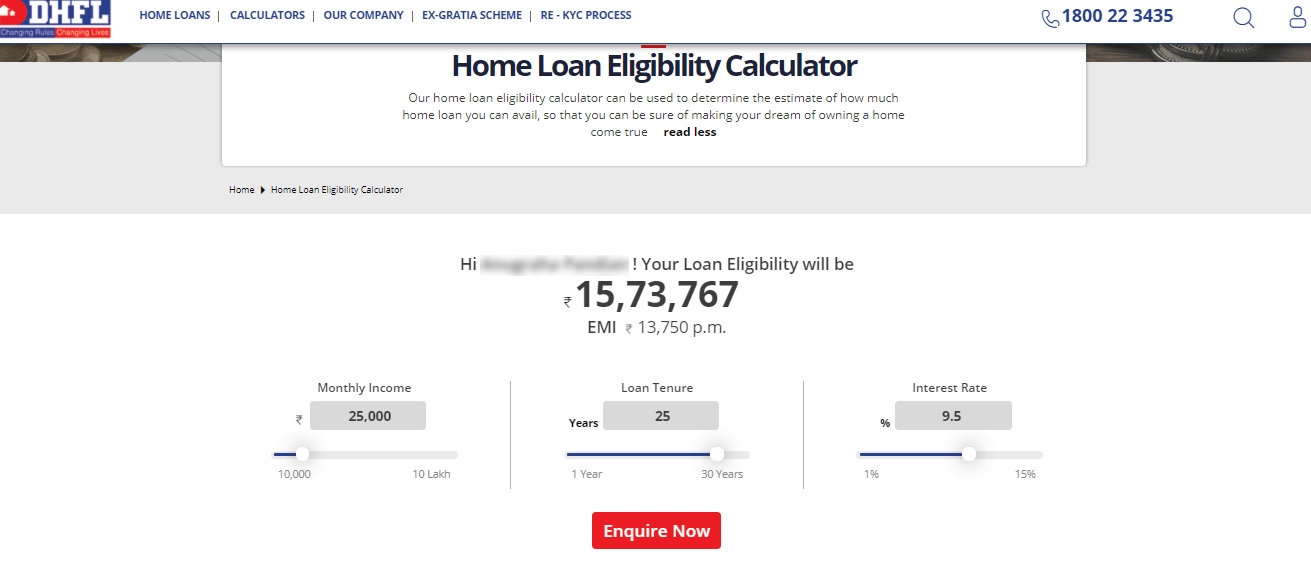

How to calculate DHFL Home Loan Eligibility?

With DHFL Home Loan Eligibility Calculator, you can estimate how much loan amount you can avail. The home loan eligibility is based on the factors such as your monthly income, fixed monthly obligations, current age, retirement age and other criteria. Apart from this, financial factors such as your income, loan, tenure and interest rate also determine your loan value.

Step 1: Visit DHFL Home Loan Eligibility Calculator site.

Step 2: Select your monthly income and click 'Calculate Eligibility'

Step 3: On the next page, the home loan amount you are eligible for will appear.

What are the documents required to apply for DHFL Home Loan?

To apply for home loan in DHFL, you need to submit the following list of documents.

KYC Documents

ID & Address Proof (Any One)

- Aadhaar card

- PAN card

- Valid Passport

- Voter ID

- Driving License

Residence Proof (Any One)

- Utility Bill (Electricity bill, Telephone bill, Water bill, etc.)

- Ration card

- Letter from Employer

- Bank statement/Copy of Passbook

- Sale deed

- Valid Rent Agreement

Income Documents

Salaried Individuals

- Salary certificate or last 2 months salary slips

- Cash salary with income details on Company Letterhead

- Copy of last three months' bank statements

Self-Employed Professionals and Non-Professionals

- Qualification certificate for CA, Doctors or Architects (Only for Professionals)

- Copy of last two years' income tax returns with income computation

- Copy of last two years' P/L account with all schedules and audited balance sheet

- TDS certificate or VAT or Service Tax returns

- Last 6 months' bank statement

Property Documents

- Allotment letter from builder

- Sale agreement

- Sale deed

- Registration and stamp duty receipt

- Own contribution receipt

- Development agreement

- Tripartite agreement

- Partnership deed

- NOC from builder

- Index-ii

- Title search report

- NA order

- All documents related to the builder

DHFL Home Loan - Important Links

- To apply for DHFL home loan, click here

- To track your DHFL application status, click here

- To locate your nearest DHFL Housing branch, click here

DHFL Home Loan Customer Care

For any DHFL home loan related queries, you can contact DHFL home loan customer care service.

| Call DHFL Home Loan Toll-Free Number |

For New Customer: 1800 22 34 35 For Existing Customer: 1800 3000 1919 |

| Send SMS | DHFL to 56677 |

| reponse@dhfl.com | |

| Register in Online | https://grids.nhbonline.org.in |

| Write to NHB Office |

National Housing Bank Department of Regulation & Supervision, 4th Floor, Core 5-A, India Habitat Centre, Lodhi Road, New Delhi-110003. |