In order to make bulk transactions and to file Income Tax returns, it is essential for you to possess PAN card. While applying for PAN Card, many of you might have faced difficulty in filling a particular section which asks for AO Code. If you don't have any idea about AO Code, just pay a glance here and know what this AO Code is all about and how to find it in online!

What is AO Code?

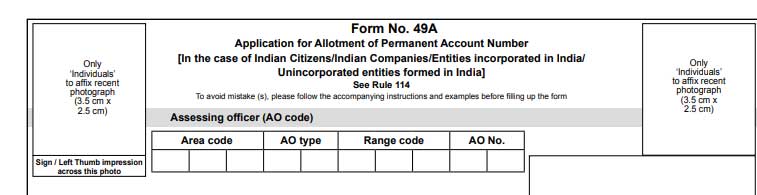

While applying for a new PAN card, you may notice that one part of the PAN application form 49A will ask you to enter AO code. It is mandatory to mention the AO Code in the PAN application form and you need to select the AO Code carefully. You can obtain this information from the Income Tax office. You can also search AO Codes in online based on the description provided. The AO Code helps to know the jurisdiction under which the applicant falls. AO code comprises of Area Code, AO Type, Range Code and AO number.

According to the Income Tax Department policy, the AO code for the PAN may change from time to time. In order to identify your AO under whom you are assessed forever, you need to contact your local Income Tax office.

Who is AO?

AO stands for Assessing Officer. An Assessing Officer is appointed by the Income Tax Department whose job is to assess the Income Tax Return filing. If the officer finds any mismatch in the ITR file, he has the rights to question the assessee. According to the income tax ward or circle, the Assessing Officer's jurisdiction will be mentioned. As the taxation laws differs according to the category, AO checks whether the individuals and companies are assessed as per the entity type and by proper Assessing Officers. Assessing Officer may vary for each category and applicant type.

How to search for AO Code in Online?

You can easily find your AO Codes in online from tin-NSDL website. To find your AO Code, go through the steps given here.

Step 1: Visit the tin-NSDL official portal.

Step 2: On the home page, click 'Services' menu and then select 'PAN'

Step 3: You will be taken to the PAN application page where you need to click 'AO Codes' located on the side bar.

Step 4: Select the type of PAN AO Code according to the taxation.

Step 5: Once you have selected the option, the AO Code list will be downloaded in Excel sheets.

Step 6: Open the file and locate the city according to your office/residential address.

Step 7: Identify the correct AO Code with the additional descriptions provided for cities and note down the Area Code, AO Type, Range Type and AO Number to get AO Code.

How to check PAN AO Code in Online?

If you already have PAN card, you can check your AO Code in online by following the simple steps given below.

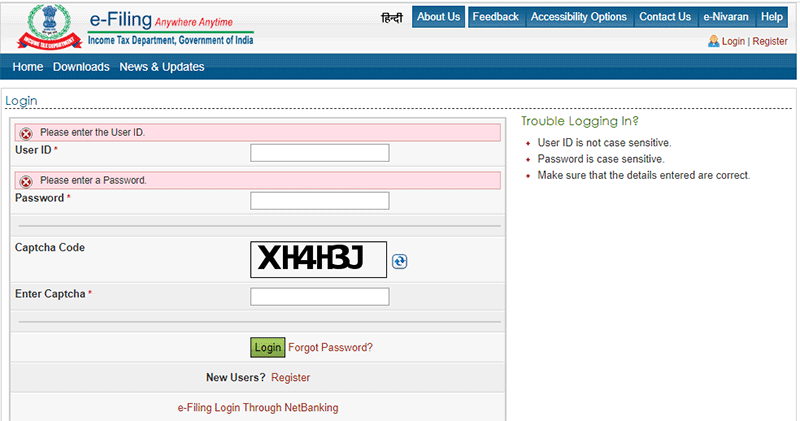

Step 1: Visit income tax portal https://www.incometaxindiaefiling.gov.in/

Step 2: On the home page, click 'Login' and login to your account using your user id and password.

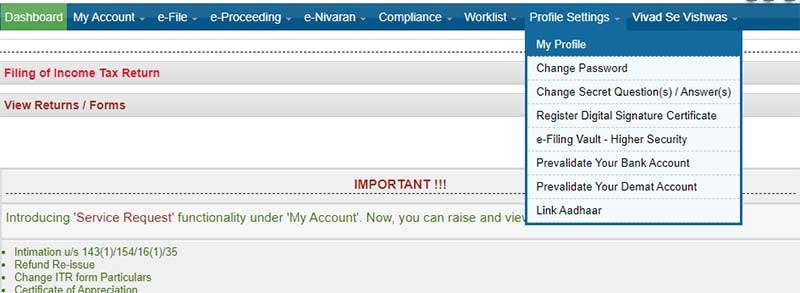

Step 3: Go to Profile Settings and click 'My Profile'

Step 4: Click 'PAN details' in 'My Profile' and check your AO Code under 'Jurisdiction Details'

Check your AO Code thoroughly to avoid submitting incorrect details to PAN issuing authorities.

How to find jurisdictional AO?

If you want to change your PAN to new Assessing Officer, you need to identify the jurisdiction of your new Assessing Officer at first. To find jurisdictional Assessing Officer (AO), just follow the steps mentioned below.

Step 1: Visit income tax portal https://www.incometaxindiaefiling.gov.in/

Step 2: On the home page, Click 'AO' from the 'Quick Links' given on the side of the page.

Step 3: On the next page, enter your PAN and mobile number. Click 'Submit'.

Step 4: Enter the OTP sent to your mobile number in the OTP field and click 'Submit'

Step 5: The details of jurisdictional Assessing Officer (AO) for your PAN will appear on the next page.

What is the selection criteria for AO Code?

- If you are in the status of Individual category and your source of income is salary or combination including salary, then your AO Code should be as per your office address.

- If you are in the status of Individual category and your source of income is from business or a combination including business income, then your AO Code should be as per your office address.

- For all other cases who belong to the Individual category, the AO Code should be as per the residential address.

- If you are in the status such as Partnership Firm, Company, Hindu Undivided Family (HUF), Trust, Body of Individuals, Local Authority, Association of Persons, Artificial Juridical Person, Limited Liability Partnership and Company, then your AO Code should be as per your office address.

- If you are in the status of Individual category and are in Army or Air Force, then the AO Code will be as follows.

| Category | Description | Area Code | AO Type | Range Code | AO NO |

|---|---|---|---|---|---|

| Army | ITO WARD 4(3), GHQ, PNE | PNE | W | 55 | 3 |

| Air-Force | ITO WARD 42(2) | DEL | W | 72 | 2 |

What are the components of AO Code?

In each area, Assessing Officers are allotted to assess the taxation of the people. Each officer are assigned particular AO code. When you fill the PAN Application Form- 49A, you may notice AO Code at the beginning of the form itself. The AO Code is divided into four columns as Area code, AO type, Range Code and AO No. AO code is the combination of these four components.

Area Code: Area code is a three letter code which helps to identify the geographical location of the individual or the company.

AO Type: AO type is a two letter code which denotes the type of Assessing Officer such as Ward/ Circle/ Range/ Commissioner.

Range Code: Range code is a three digit code which refers the range in which the Assessing Officer operates.

AO Number: AO number is a two digit unique code which is assigned to the Assessing Officer and is published in NSDL. It is the last segment of the AO Code.

What are the types of PAN AO Code?

According to the operational area type of the entity, the PAN AO Code is divided into four types. According to the type of the assessee, the taxation and AO Codes for the purpose of ITR assessment may vary. The type of PAN AO Codes are given below.

International Taxation: If you are a foreigner or having company that is not registered in India, then you fall under this category.

Non International Taxation (Outside Mumbai): If you are an Indian resident residing apart from Mumbai and having company registered in India outside Mumbai, then you come under this type.

Non International Taxation (Mumbai Region): This PAN AO Code is applicable if you are an Indian resident residing in Mumbai or company that is registered in India particularly in the region of Mumbai city.

Defence Personnel: If you are an Indian Army or Indian Air Force officer, this type of PAN AO Code is applicable for you.