If an employee is unemployed or retired, he/she can claim for EPF withdrawal. An employee can withdraw 75% of the PF amount after one month of unemployment and 25% of remaining PF balance after three months of unemployment. In order to withdraw your EPF amount, you need to make withdrawal claim by filling EPF withdrawal form in online. You can withdraw your EPF amount only if you have your Aadhaar card linked with UAN.

What are the documents required to apply for EPF Withdrawal?

To apply for EPF withdrawal, the following documents are needed.

- Composite Claim Form

- Two revenue stamps

- Bank account statement

- Address proof

- Identity proof

- A blank, cancelled cheque with account number and IFSC code clearly visible.

- Personal details such as father's name, date of birth which should match with the identity proof.

An employee who withdraws his EPF amount before 5 years of continuous service need to fill Income Tax Return Forms 2 and 3 to confirm a detailed breakup of the whole amount contributed in EPF account each year.

What are the conditions for EPF Withdrawal?

In order to withdraw EPF, an employee should meet the following eligibility conditions.

- EPF amount can be fully or partially withdrawn. You can withdraw EPF fully only after retirement. EPFO considers early retirement only if the person is above 55 years of age.

- Partial withdrawal of EPF is allowed only on certain cases such as medical emergency, higher education, purchasing or construction of house.

- 90% of EPF withdrawal is allowed one year before retirement.

- In cases of unemployment before retirement due to retrenchment or lockdown, EPFO allows members to withdraw EPF amount.

- After one month of unemployment, employees can only withdraw 75% of EPF amount according to the new rule. After getting employment, the remaining EPF amount will get transferred to the new EPF account.

- To withdraw EPF amount, employees need not wait for the approval of the employer. If you have your UAN linked with Aadhaar in your EPF account, you can easily submit your claim in online.

- To make claim in online, your

- UAN should be active

- Bank details should be linked with UAN

- PAN and Aadhaar should be linked with EPF account.

What are the Forms related to EPF Withdrawal?

The EPF withdrawal forms differ according to the age, claim reason and the status of employee. For partial PF withdrawal and final PF settlement, employees need to submit the Composite Claim Form. EPF withdrawal forms such as Form 19, Form 31 and Form 10C are now replaced with Composite Claim Form which requires only the Aadhaar details of the employee. Attestation of the employer is not required to submit composite claim form.

To apply for EPF withdrawal claim in offline, you need to fill the Composite Claim Form which serves the function of three forms,

- Form 19 (For Final PF Settlement)

- Form 10C (For Pension withdrawal)

- Form 31 (For Partial PF Withdrawal)

How to make EPF Withdrawal in online?

You can easily withdraw your EPF by submitting your withdrawal claim in online itself. All you need is to follow the easy steps given below.

Step 1: Visit UAN Member portal https://unifiedportal-mem.epfindia.gov.in/

Step 2: Login to your EPF account using your UAN, Password and Captcha. Click the 'Sign in' button

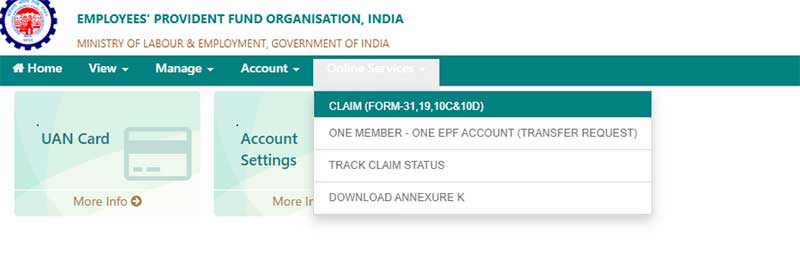

Step 3: Once logged into your account, click the 'Online Services' tab and select 'Claim (Form-31, 19, 10C and 10D)'

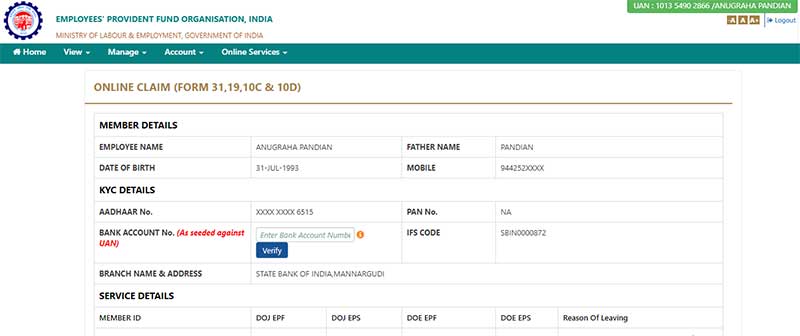

Step 4: Your details will be displayed on the screen. Enter your bank account number and click 'Verify'

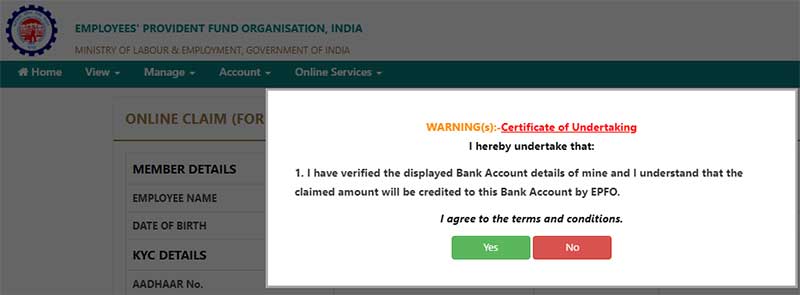

Step 5: Click 'Yes' to agree with the terms and conditions of EPFO.

Step 6: Then click 'Proceed for online claim' once you have verified your details.

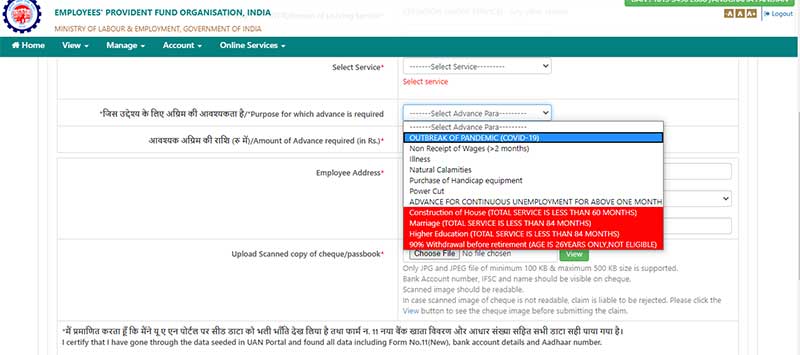

Step 7: Select the claim form type as 'PF Advance'

Step 8: After selecting the 'PF Advance' option, select the service, purpose for which PF advance is required, PF amount required and employee address. After providing all details, upload the scanned copy of cheque/passbook and select the checkbox.

Step 9: After entering all details, click 'Get Aadhaar OTP'. Enter the OTP sent to your registered mobile number and click 'Validate OTP and Submit Claim Form'

Step 10: Once your OTP validation is successful, your claim form will be submitted. The EPFO will accept your claim form only if your details match with the proof. If EPFO accepts your claim form, the PF advance will be credited to your bank account.

How to file online claim for the purpose of 'Outbreak of Covid-19 Pandemic'?

Eligibility:

In order to file online claim for the purpose of outbreak of Covid-19 pandemic, you need to fulfill the following procedures.

- Activate your UAN

- Link your verified Aadhaar with UAN

- Link your bank account along with IFSC Code with UAN

Withdrawal Amount:

You can withdraw up to 75% of PF balance which includes the share of Employee and Employer or PF amount for 3 months or the claimed amount by the EPF member, whichever lowest is applicable.

Steps to file online claim for the purpose of outbreak of Covid-19 Pandemic:

- Login to UAN Member Portal using your UAN and password https://unifiedportal-mem.epfindia.gov.in/

- Go to 'Online Services' and click 'Claim Form'

- Enter your bank account number linked with UAN and verify.

- Click 'Proceed for online claim'

- From the drop-down menu, select PF Advance (Form 31)

- Select the purpose of withdrawal as 'Outbreak of Pandemic (Covid-19)' from the drop-down menu.

- Enter the amount you need and upload the scanned copy of your bank passbook.

- Click 'Get Aadhaar OTP' and enter the OTP.

- Your claim is submitted successfully.

How to check the status of EPF Claim in online?

To check the status of your EPF claim, just follow the steps given below.

Step 1: Log into UAN Member Portal using your UAN, password and captcha code.

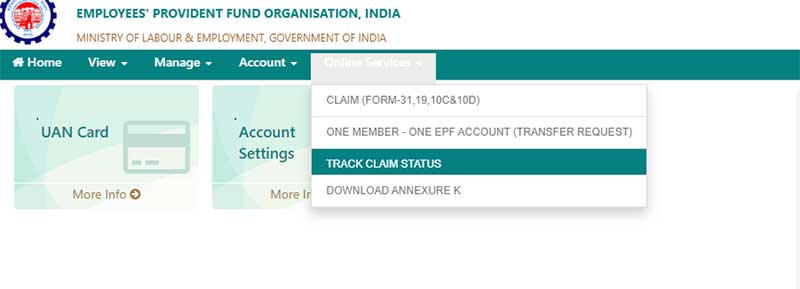

Step 2: Once logged into your account, click 'Online Services' tab and select 'Track Claim Status'

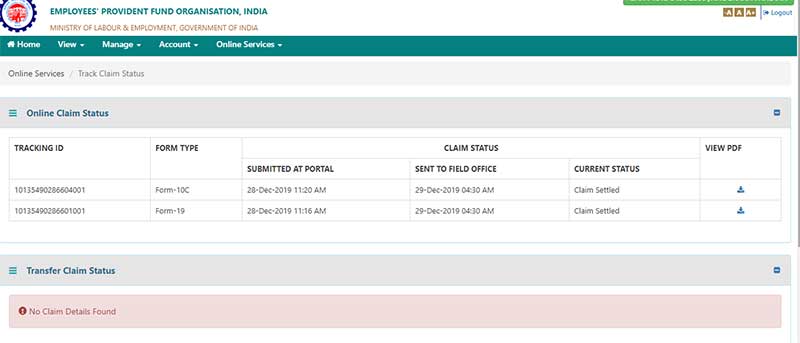

Step 3: On the next page, your claim status for EPF withdrawal will appear along with tracking ID and form type.

What are the benefits of online EPF Withdrawal?

There are many benefits in withdrawing EPF in online. Some of the benefits are,

Convenience:

With online mode, you can easily submit your EPF withdrawal claim form without any need to visit your PF office and waiting for long hours in queue.

Less time-consuming:

By submitting your claim in online, your claim will be processed faster. Your PF amount will be credited to your account within 15-20 days of submission. The processing time is further reduced according to the new government order.

No verification required from Employer:

When compared to offline mode where you need to get your proofs attested by the employer, your claims will be verified automatically in online. For people who shifted to a new city, this online mode will save them from the trouble of sending documents via post and travelling to long distances.

What are the limitations in EPF Withdrawal?

Employees can withdraw their EPF amount only on the following conditions.

Purchase/ Construction of House:

- Only the EPF account holder and his/her spouse can claim for withdrawal.

- The employee should be in 5 years of continuous service.

- For purchasing purpose, the withdrawal amount is restricted to 24 times the monthly salary. For purchase and construction, it is 36 times the monthly salary.

Repayment of Home loan:

- Only the EPF account holder and his/her spouse can claim for withdrawal.

- The employee should be in 3 years of continuous service.

- Up to 90% of EPF amount can be withdrawn from EPF account.

Renovation of House:

- Only the EPF account holder and his/her spouse can claim for withdrawal.

- The employee should be in 7 years of continuous service.

- The withdrawal amount is 12 times the monthly salary.

Marriage:

- The EPF account holder, his/her siblings or children can claim for withdrawal.

- The employee should be in 7 years of continuous service.

- Up to 50% of employee's contribution along with interest can be withdrawn.

Medical Treatment:

- The EPF account holder, his/her parents, spouse or children can claim for withdrawal.

- There is no requirement of minimum work time period.

- EPF amount equal to 6 times the monthly salary or an amount equal to employee's share with interest, whichever is lower can be withdrawn.

What is the taxation on EPF Withdrawal?

The EPF withdrawal amount is exempted from tax. In the following conditions, the tax exemption for EPF withdrawal is not available.

- The employee should have made EPF contribution for 5 years of continuous service. However, withdrawals made before 5 years of service are taxable.

- If there is a break in the 5 years of continuous service, the entire EPF amount is taxable.

- For premature withdrawal of EPF amount above Rs. 50,000, TDS is deducted.

- 10% of TDS will be deducted if the employee provides PAN card with the application. In case the employee fails to provide PAN card with the application, 30% of TDS will be deducted along with tax.

- The employee should fill Form 15H/15G as declaration if his/her total income is exempt from taxation.

- The tax payable depends upon the salary in the withdrawal year.

- If an employee opts to transfer his/her PF amount to National Pension Scheme (NPS), such withdrawal is not taxable.

- According to Section 80C, if an employee has made claims for exemption on EPF contribution for past years on EPF, he should pay tax on employee's contribution, employer's contribution and interest on each deposit. If the employee did not make any claim in past year, only the employee's contribution is applicable for tax exemption.

What are the things to consider before applying for EPF Withdrawal?

- EPF withdrawal within 5 years of service is taxable.

- You need not withdraw your PF amount if you are changing for new job. All you need to do is to transfer your PF amount to the new account.

- Loan or partial withdrawal of PF balance is available with some limitations.

- If you are currently working, you are not allowed to withdraw your PF balance for the job.

- After 54 years of age, you can withdraw 90% of the available PF balance.

- To claim for EPF withdrawal, you need to

- Link your Aadhaar number in the UAN portal

- Authenticate your Aadhaar with the employer

- Update Aadhaar number in UAN portal

- Fill EPF withdrawal claim form in online.