Gold is a valuable asset with which you can avail loan at any time. With HDFC gold loan, you can able to meet the needs on your own. Whether it is for education, wedding, business expansion or medical expenses, gold loan helps you to fulfil all these emergency financial needs. In offering gold loan, HDFC bank comes with attractive features and benefits. In HDFC, you can get gold loan within 45 minutes over the counter with less paperwork and at transparent charges.

HDFC offers secured gold loan up to 90% of your gold value. With HDFC gold loan, you can borrow money by pledging your gold ornaments under triple-layered security. Let's see the features and benefits of HDFC gold loan in detail.

What are the key features of HDFC Gold Loan?

| Age | 21 years to 60 years |

| Maximum Loan Amount | Rs.1 crore |

| Minimum Loan Amount | Rs.25,000 |

| Gold Loan Offering | Term Loan, Over Draft and Bullet Repayment |

| Security | Gold ornaments |

| Processing Fees | Maximum of 1% |

| Interest Rate | 9.90% onwards |

| Loan Tenure | 3 months to 24 months |

What are the benefits of HDFC Gold Loan?

HDFC gold loan comes with the following benefits.

- It has different loan offerings with which you can avail Term loan, Overdraft or Bullet repayment.

- It offers gold loan at lower interest rates for you to repay loan in easy EMIs.

- It offers unique triple layered security for your gold.

- The loan tenure ranges from minimum 6 months to maximum 24 months.

- It comes with flexible repayment option. So, you can pay the interest beforehand and the principal amount at the end of the loan tenure.

- You can avail gold loan within 45 minutes over the counter as it involves easy and quick processing.

- The process involves only minimal documentation and there are no hidden charges.

- The minimum loan amount starts from Rs.25000.

What are the eligibility criteria required to avail HDFC Gold Loan?

In order to avail gold loan in HDFC bank, you need to fulfil the following eligibility conditions.

- The applicant should be an Indian resident.

- The age of the applicant should be between 21 and 60 years.

- The applicant should be a businessman, farmer, trader, salaried or self-employed.

What is the interest rate for HDFC Gold Loan?

Interest rate offered to customers:

| Product Group | Minimum | Maximum | Average |

| Gold Loan | 9.50% | 17.55% | 11.32% |

Annual Percentage Rate offered to customers:

| APR Minimum | APR Maximum | APR Average |

| 9.90% | 26.58% | 11.76% |

Note: GST and other Government taxes, levies, etc. applicable as per prevailing rate will be charged. Loan approval and Rate of Interest at the sole discretion of HDFC Bank Ltd.

What are the fees and charges levied for HDFC Gold Loan?

| Fees/Charges | Amount to be paid |

| Loan Processing Charges | Maximum of 1% |

| Valuation Fee |

Rs.250 + applicable tax up to 1.5 lakhs Rs.575 + applicable tax above 1.5 lakhs |

| Foreclosure Charges | 2% + applicable tax |

| Stamp Duty and other statutory charges | At Actual |

| Renewal Processing Fees | Rs. 350 + applicable tax |

| Auction charge | As per actual |

| Prepayment charges | 2% + applicable tax |

What are the documents required to apply for HDFC Gold Loan?

If you wish to apply for HDFC gold loan, you need to submit any one of the following documents.

- One passport size photograph

- PAN card or Form 60

- Passport (Not expired)

- Driving Licence (Not expired)

- Voter ID

- Aadhaar card

- Agri Allied Occupation Documentation (for agriculture customers in case of bullet repayment)

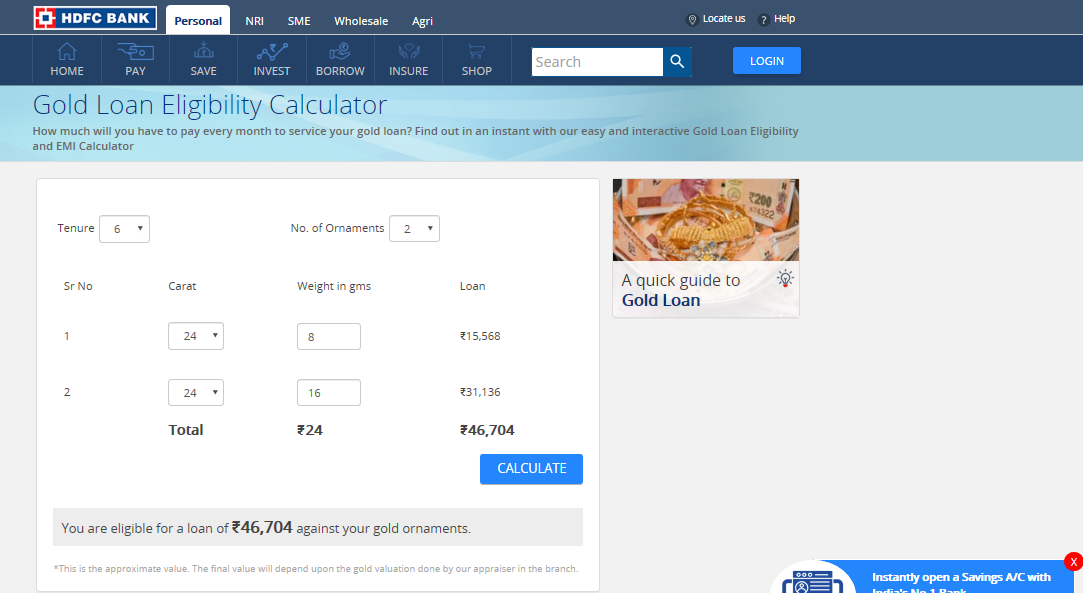

How to calculate eligibility and EMI for HDFC Gold Loan?

Click here to calculate your eligibility for gold loan in HDFC and just follow the simple steps given below.

Step 1: Once you have entered the page, select the tenure and the number of ornaments.

Step 2: Then select the quality of your gold ornaments and its weight in grams.

Step 3: Once you have provided all these details, the loan amount for the gold will appear on the screen. Then click 'Calculate Now'.

Step 4: The loan amount you are eligible against your gold ornaments will appear on the screen.

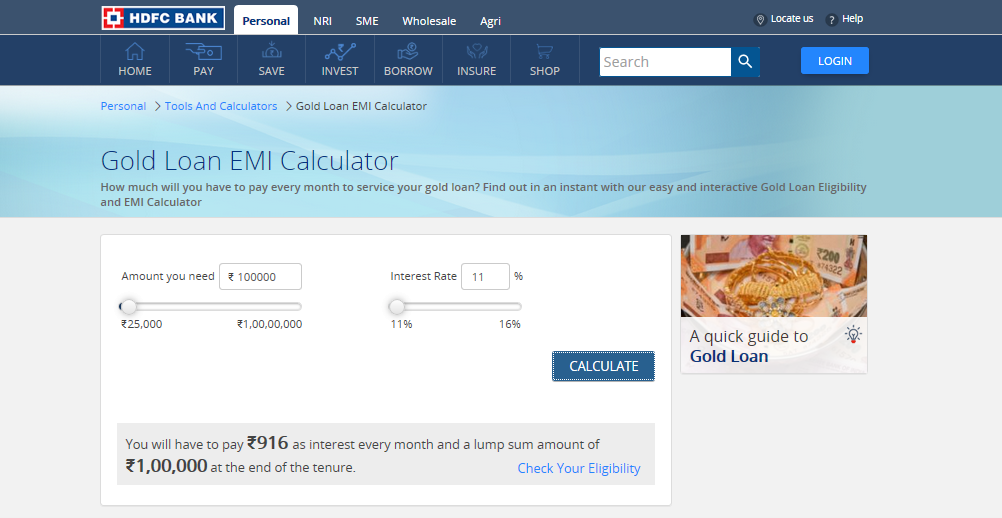

Click here to calculate the EMI for your gold loan in HDFC and follow the steps given below.

Step 1: After visiting the page, select the amount you need and interest rate. Then click 'Calculate'

Step 2: The EMI which you have to pay for the gold loan and the principal amount which you have to pay at the end of the tenure will appear on the screen.

How to apply for HDFC Gold Loan in Online?

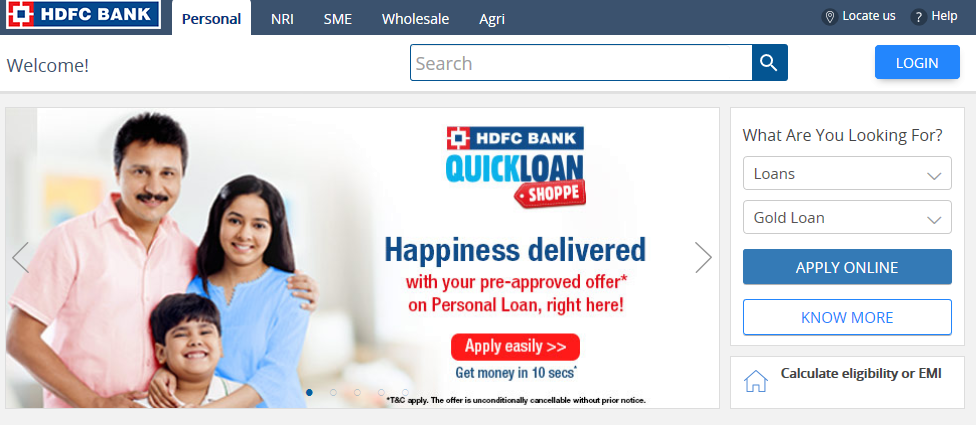

You can easily apply for HDFC gold loan in online by just following the quick steps given below.

Step 1: Visit the official portal of HDFC bank

Step 2: On the right side of the home page, under 'What are you looking for?', select the product type as 'Loans' and select the product as 'Gold Loan'. Then click 'Apply Online' button.

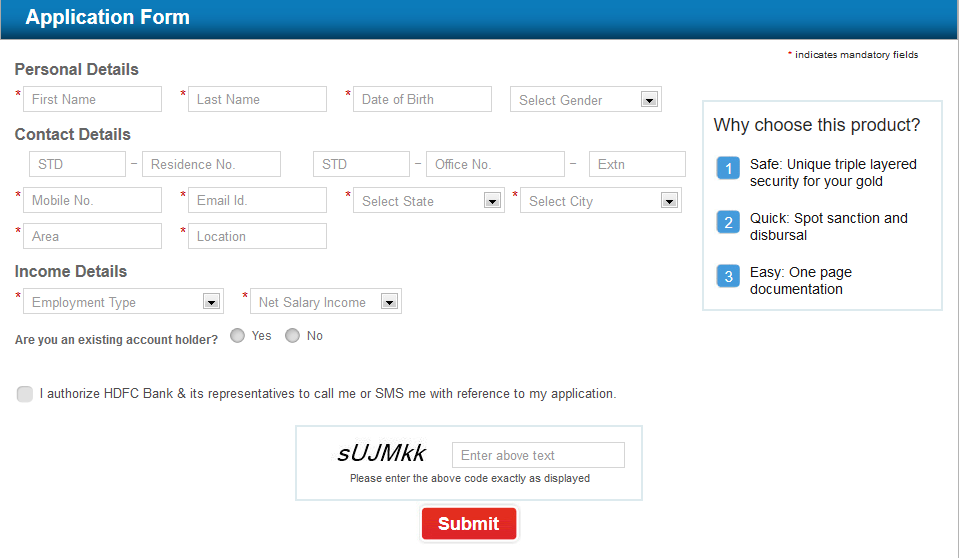

Step 3: You will be taken to the online application page where you need to fill your personal details, contact details and income details. Select the checkbox and click 'Submit'

Step 4: If the information you have provided meets the eligibility criteria, a representative from HDFC bank will contact you.

Step 5: After this process, your completed loan application form will be collected. Based on the documents you have submitted, your loan eligibility will be determined.

Step 6: At last, you need to visit your nearest bank branch to avail gold loan.

How to repay HDFC Gold Loan in Online?

Once you have availed gold loan from HDFC, you can repay the loan in online itself without visiting the bank branch. Here are the steps to repay your HDFC gold loan in online.

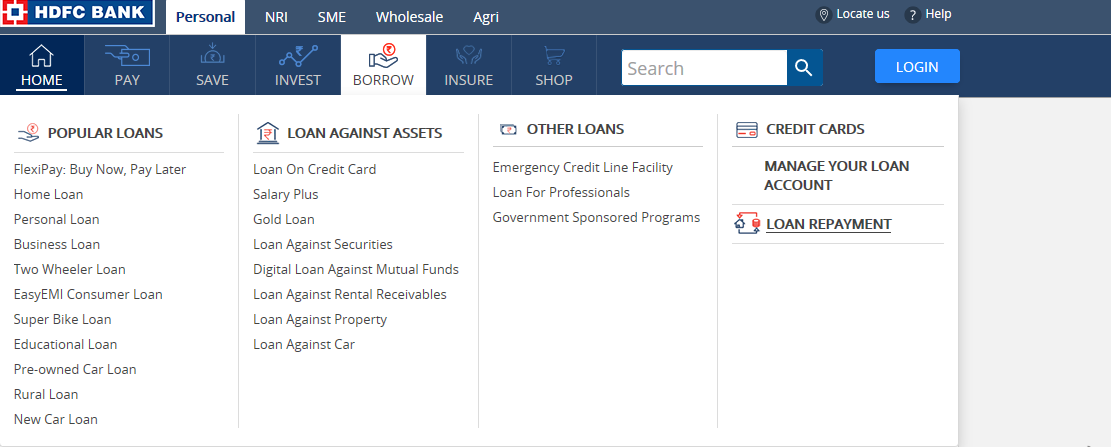

Step 1: Visit the official portal of HDFC bank

Step 2: On the home page, click the 'Borrow' menu and then click 'Loan Repayment'

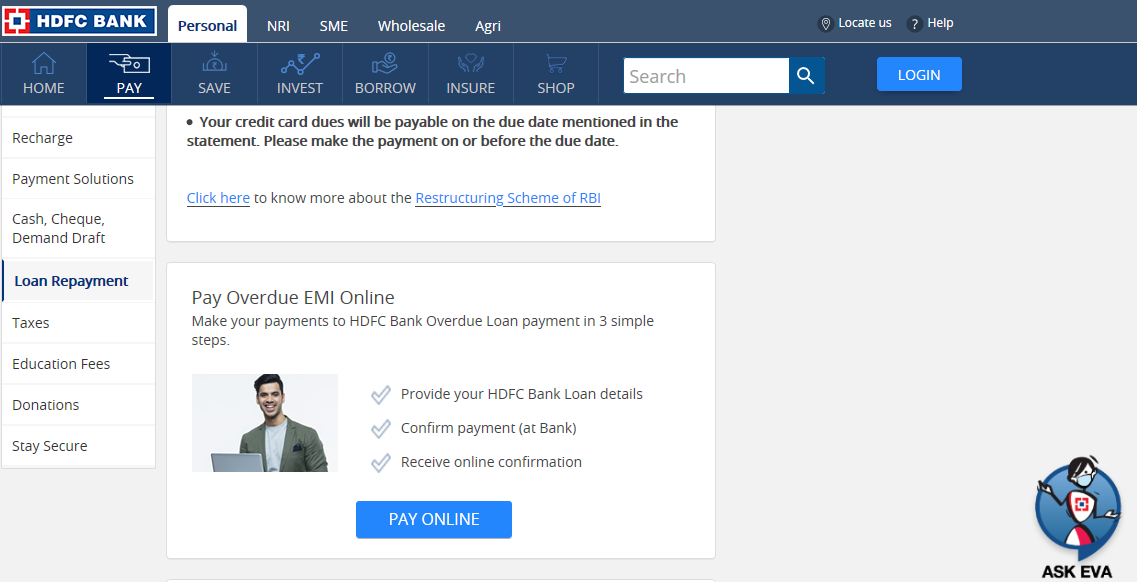

Step 3: You will be taken to the loan repayment page. Click 'Pay Online' button.

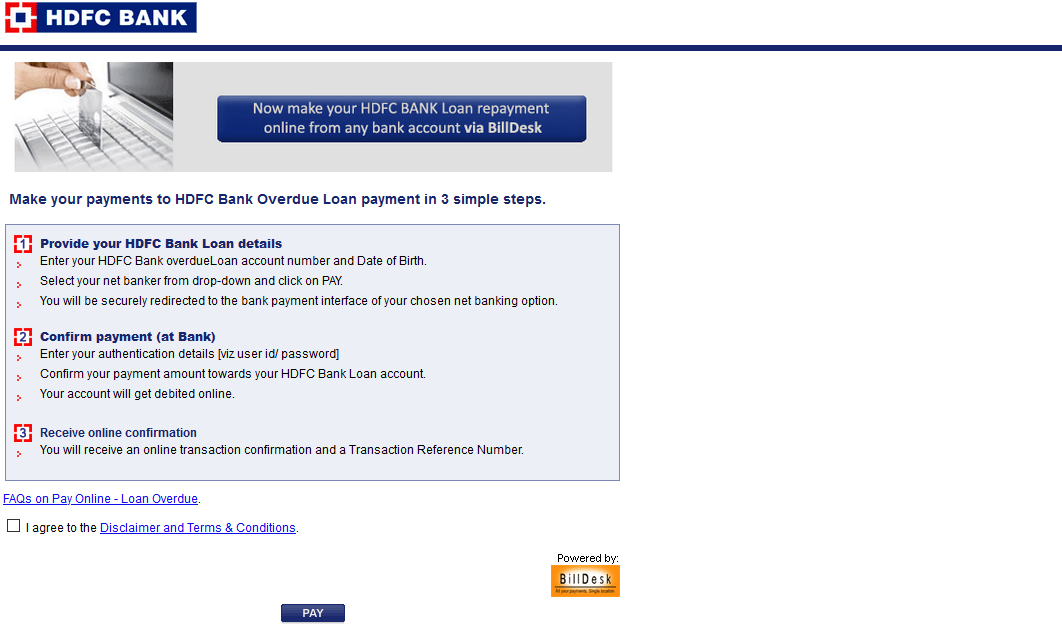

Step 4: Click the 'I agree' checkbox and then click 'Pay'

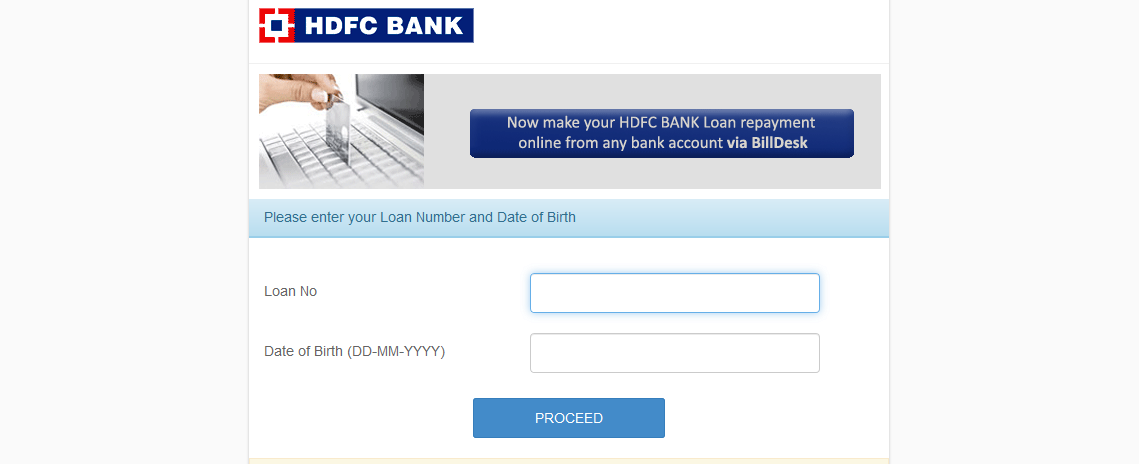

Step 5: Enter your loan number and date of birth. Then click 'Proceed'

Step 6: Select your net banker and click 'Pay'.

Step 7: Enter your User ID and Password and confirm your payment.

Step 8: Once you have made payment, you will receive an online transaction confirmation message and a transaction reference number.