HDFC bank, one of the leading personal loan providers in India, offers instant personal loan to its customers. HDFC bank provides different loan options with wide range of features and benefits. With HDFC personal loan, you can plan for vacation, wedding and other unplanned or immediate needs.

HDFC personal loan comes with different EMI repayment options, flexible tenures, quick loan disbursal and online application process. The bank also offers personal loan to pre-approved HDFC bank customers in 10 seconds without any documents. HDFC personal loan is designed to meet various financial requirements easily and quickly.

What are the features and benefits of HDFC Personal Loan?

HDFC personal loan comes with the following benefits.

- Lower interest rate

- Quick loan sanction

- Easy online application process

- Insurance for personal protection

- 24x7 online assistance

- Balance transfer facility available

- Pocket-friendly EMIs starting from Rs.2149 per lakh

- Personal loan up to Rs.40 lakhs

- Flexible loan tenure

- Easy repayment option

| Interest Rate | 10.5% to 21% per annum |

| Loan Amount | Rs.50,000 to Rs.40 lakhs |

| Loan Tenure | Up to 5 years |

| Minimum Income Required | Rs.25,000 per month |

What are the interest rates for HDFC Personal Loan Schemes?

The interest rate for HDFC personal loan may vary according to the scheme. The interest rate for each personal loan scheme is given below.

| Types of HDFC Personal Loan | Interest Rate |

| Marriage Loan | 10.50% - 20.40% |

| Travel Loan | 10.50% - 20.40% |

| Emergency Loan | 10.50% - 20.40% |

| Debt Consolidation Loan | 10.50% - 20.40% |

| Home Renovation Loan | 10.50% - 20.40% |

| Personal Loan for Students | 10.50% - 20.40% |

| Personal Loan for Teachers | 10.50% - 20.40% |

| Personal Loan for Women | 10.50% - 20.40% |

| Personal Loan for Salaried | 10.50% - 20.40% |

| Personal Loan for Government Employees |

10.50% - 21.00% |

What are the types of HDFC Personal Loan?

HDFC bank offers you different types of personal loan to meet your requirements such as Marriage Loan, Travel Loan, Emergency Loan, Debt Consolidation Loan, Personal Loan for Students, Teachers, Women, Salaried and Government Employees.

Marriage Loan

Marriage Loan helps you to avail fund for your dream wedding.

Some of the benefits of Marriage Loan are,

- No security needed

- Quick and easy loan disbursal

- Easy online application process

- Instant assistance

- Variety of EMI repayment options

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Travel Loan

Travel Loan helps you to avail fund for your dream vacation.

Some of the benefits of Travel Loan are,

- Competitive interest rates

- Instant loan disbursal

- Flexible tenure

- Pocket-friendly EMIs

- Easy application process

- Insurance cover available

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Emergency Loan

Emergency Loan can be availed to meet sudden and unfortunate expenses.

Some of the benefits of Emergency Loan are,

- Minimal documentation

- No end-use restriction

- Quick and easy loan disbursal

- Flexible tenure

- Easy repayment in EMIs

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs.40 lakhs |

| Repayment Tenure | Up to 5 years |

Debt Consolidation Loan

Debt Consolidation Loan can be taken to repay various dues.

Some of the benefits of Debt Consolidation Loan are,

- No need to seek help from others

- Competitive interest rates

- Quick loan approval and disbursal

- Unsecured, collateral-free loan

- Flexible loan repayment options and tenure

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs.40 lakhs |

| Repayment Tenure | Up to 5 years |

Home Renovation Loan

You can avail Home Renovation Loan to renovate your home.

Some of the benefits of Home Renovation Loan are,

- Flexible EMI repayment and loan repayment options

- Instant and easy loan approval

- Improves future home sale value

- Minimal documentation

- Improves aesthetic appeal

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Personal Loan for Students

Personal Loan for Students can be used by students to meet sudden education plans for yourself, child or family member.

Some of the benefits of Personal Loan for Students are,

- Instant loan approval

- Tax benefits on interest payments

- Minimal documentation

- Flexible loan tenure and EMIs

- No end-use restriction

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Personal Loan for Teachers

Personal Loan for Teachers can be used by teachers to meet some unexpected expenses.

Some of the benefits of Personal Loan for Teachers are,

- No end-use restriction

- Considerable loan amount

- Minimal Paperwork

- Instant loan sanction

- Collateral-free, unsecured loans

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Personal Loan for Women

Personal Loan for Women can be availed by women to meet their growing financial needs.

Some of the benefits of Personal Loan for Women are,

- Collateral-free loan

- No end-use restriction

- Instant loan approval and disbursal

- Easy online application

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Personal Loan for Salaried

Personal Loan for Salaried can be used by salaried employees to meet any extra expenses.

Some of the benefits of Personal Loan for Salaried are,

- Competitive interest rates

- Minimal documentation

- Multiple purpose

- Easy and quick loan disbursal

- Easy source of funds

| Interest Rate | 10.50% - 20.40% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 5 years |

Personal Loan for Government Employees

Personal Loan for Government Employees can be used by government employees to meet their personal needs.

Some of the benefits of Personal Loan for Government Employees are,

- Quick, stress-free loan

- Minimal or zero documentation

- Easy online application

- Collateral-free loan against salary

| Interest Rate | 10.50% - 21.00% |

| Maximum Loan Amount | Up to Rs. 40 lakhs |

| Repayment Tenure | Up to 6 years |

What are the fees and charges for HDFC Personal Loan?

The fees and charges for HDFC bank personal loan is given below.

| Processing Fee | Up to 2.50% of the loan amount |

| Stamp duty and other statutory charges | As per applicable laws of the state |

| Pre-payment charges | 2% to 4% of the outstanding loan amount |

| Late payment penalty | 2% of the overdue amount per month |

What is the eligibility required to avail HDFC Personal Loan?

In order to avail personal loan in HDFC bank, one should fulfill the following eligibility requirements.

- One should be an employee of private limited companies or public sector undertakings such as central, state and local bodies.

- The age of the individual should be 21 to 60 years.

- One should have job experience for at least 2 years with at least 1 year with the current employer.

- One should earn a minimum of 25,000 net income per month.

What are the documents required to apply for Personal Loan in HDFC Bank?

The following list of documents are needed to apply for personal loan in HDFC Bank.

- ID Proof - Aadhaar/Voter ID/Passport/Driving Licence

- Address Proof - Passport/Voter ID/Driving Licence/Aadhaar

- Last 3 months account statement

- Current dated salary certificate with the latest Form 16/Two latest salary slip

How to apply for HDFC Personal Loan?

You can apply for personal loan in HDFC bank in online via HDFC bank portal. You can also apply in offline by visiting your nearby HDFC bank branch.

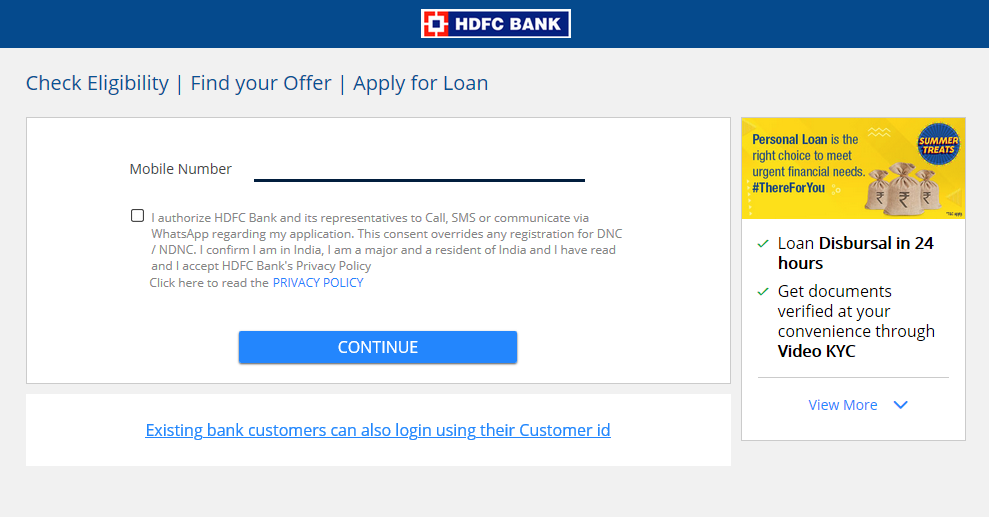

- In order to apply for personal loan in HDFC bank via HDFC bank portal, click here.

- If you are an existing customer of HDFC bank, click the 'Existing customer login' link given below the page. If you are a new customer, enter your mobile number, click the checkbox and tap 'Continue'.

- Enter the OTP sent to your registered mobile number and click 'Continue'

- Check your loan eligibility, enter the loan amount and tenure and then click 'Apply for Loan'

- Then enter your address and personal details. Upload required documents in online.

- A message upon successful submission of loan application will appear on the screen. The bank will contact you with further steps.

- The reference number for your application will be generated automatically. Note down the reference number to check your loan application status later.

How to login to HDFC Personal Loan Account?

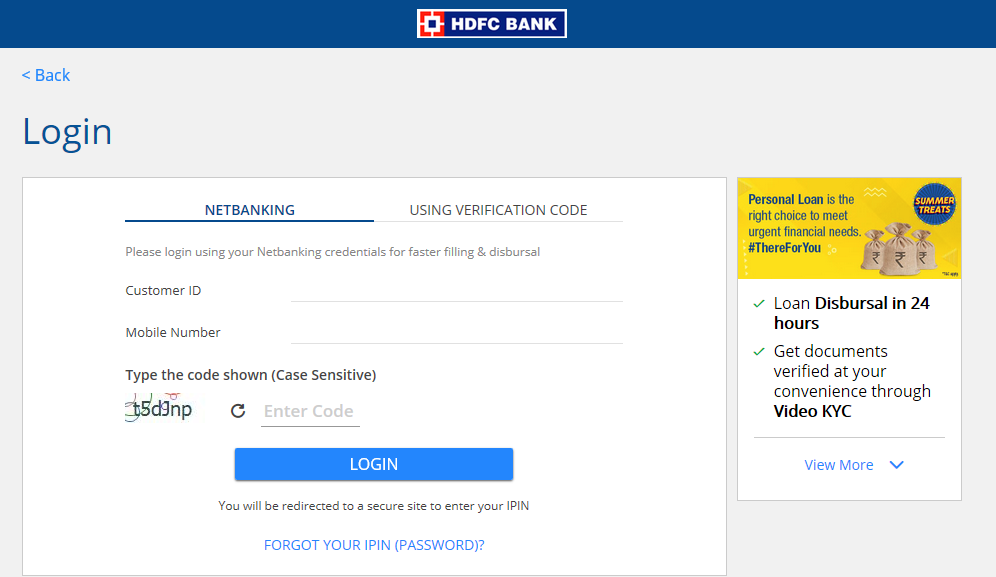

You can access your HDFC personal loan account by logging into HDFC portal. In order to log into your account, you need to have your HDFC netbanking login credentials.

Step 1: To login to your HDFC netbanking account, click here.

Step 2: Enter your customer ID, mobile number and code. Then click 'Login'

How to check HDFC Personal Loan Status?

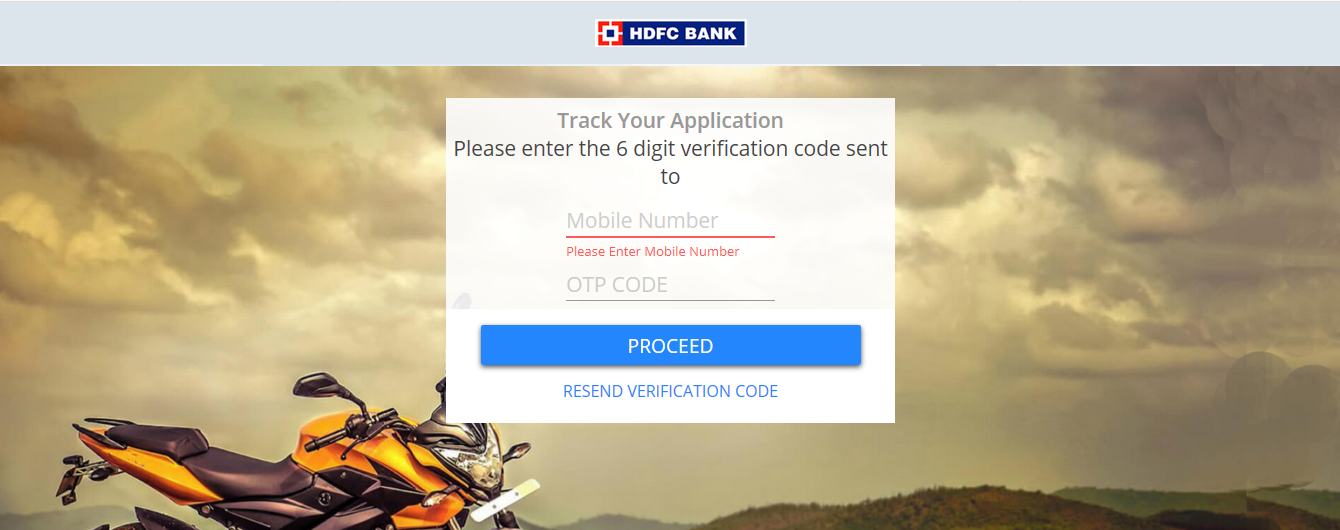

Once you have successfully submitted your personal loan application, you can check the status of your loan application in online using your registered mobile number.

Step 1: To check your HDFC personal loan application status, click here.

Step 2: Enter your mobile number and click 'Proceed'

Step 3: Enter the OTP sent to your mobile number and click 'Proceed'.

Step 4: Once you have provided the details, the status of your personal loan will appear on the screen.

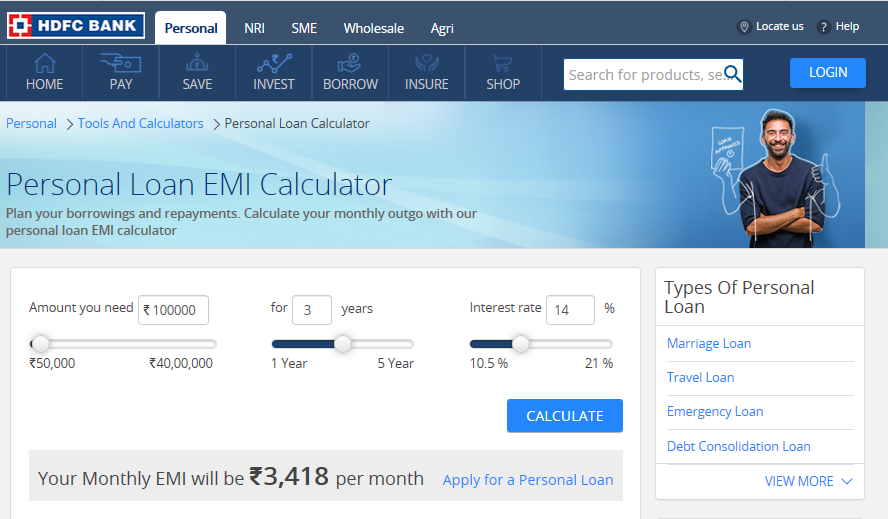

How to calculate HDFC Personal Loan EMI?

You can easily calculate your EMI for the personal loan taken from HDFC bank using HDFC bank Personal Loan EMI Calculator. Just follow the simple steps given below to calculate your loan EMI.

Step 1: Click here to calculate HDFC bank personal loan EMI.

Step 2: Select the amount you need, loan tenure and rate of interest. Then click 'Calculate'

Step 3: Once you have provided the loan details, the EMI for your personal loan will appear on the screen.

HDFC Personal Loan Customer Care

You can contact HDFC bank personal loan customer care if you have any queries regarding personal loan. The contact details are given below.

| Call HDFC Bank Toll-free number | 1800-258-3838 |

| Register in online | Click here |

| Write to HDFC Office |

HDFC Bank Ltd.Empire Plaza I, 1st Floor, LBS Marg, Chandan Nagar, Vikhroli West, Mumbai - 400 083 |