HDFC offers home loan to its borrowers at affordable interest rates starting from 6.90% per annum with EMIs starting from Rs.659/lakh. HDFC home loans are exclusively designed for salaried individuals at attractive interest rates and long tenures. It comes with wide range of benefits such as low interest rate, long repayment period, easy EMIs and door step service to apply in online itself. With HDFC PMAY scheme, borrowers can get interest subsidy of up to 6.50% p.a and can save up to Rs.2.67 lakhs under PMAY CLSS. Read this article to know more about HDFC home loan!

What are the key features of HDFC Home Loan?

Some of the key features of HDFC home loan are as follows.

- Loan to buy flat, row house, bungalow from private developers in approved projects

- Loan to buy properties from Development Authorities such as DDA, MHADA, etc.

- Loan to buy properties in an existing Co-operative Housing Society/ Development Authorities settlement/ Privately built-up homes/ Apartment Owners' Association.

- Legal and technical counselling to help you in making right home buying decision.

- Integrated network of branches to avail home loan service anywhere in India.

- Special arrangement with AGIF for home loans for those who employed in the Indian Army.

| Interest rate | 6.90% p.a onwards |

| Retail Prime Lending Rate | 16.10% |

| Loan Amount | Based on customer's profile |

| Maximum Loan Tenure | 30 years |

| Processing Fees | 0.50% of the loan amount or Rs.3000 whichever is higher, with taxes applicable. |

| Penal Interest Rate | Up to 24% p.a |

| Prepayment Charges | 0 - 2% |

What are the benefits of HDFC Home Loan?

HDFC home loan comes with the following benefits.

- Long loan repayment period of up to 30 years

- Customized repayment options to suit your needs

- Less GST rates on home purchase

- Lower home loan interest rate from 6.90%

- Easy online home loan application process

- Multiple options for home loan buyers in affordable home segment

- Online home loan solutions to buy, construct and renovate your house

- 24x7 online home loan assistance

- No hidden charges.

What are the interest rates for HDFC Home Loan Schemes?

HDFC home loan comes with affordable interest rates starting from 6.90% for women borrowers as Monsoon Bonanza Offer. The usual home loan interest rate starts from 6.95% for women borrowers and 7% for others. Other home loan schemes offered by HDFC and its interest rates are given below.

| HDFC Home Loan Scheme |

Ideal For | Interest rates (p.a) |

| HDFC Home Loan | Purchasing flat, row house, bungalow or properties from development authorities. | 6.90% - 8.35% |

| HDFC Plot Loan | Purchasing of plot through direct allotment and purchasing of a resale plot. | 7.05% - 8.45% |

| HDFC Rural Housing Loan | Purchasing residential property in rural and urban areas for agriculturists, planters, dairy farmers, horticulturists. | 6.95% - 8.75% |

| HDFC Reach Loans | Purchasing new or an existing home or plot. | 8.75% - 15% |

| HDFC Home Improvement Loans | Renovation of your home. | 6.90% - 8.35% |

| HDFC Home Extension Loans | Extension of space to your home. | 6.90% - 8.35% |

| HDFC Home Top up Loans | Variety of personal or professional needs. | 8.30% - 8.80% |

| HDFC Home Balance Transfer | Transferring of your existing home loan to HDFC. | 6.90% - 8.35% |

| HDFC Loan Against Property | Business needs, marriage, medical expense and transferring of your existing home loan to HDFC. | 8.25% - 10.95% |

| HDFC Commercial Property Loans | Purchasing/extension of new or existing clinic or office. | 8.25% - 9.75% |

| HDFC Commercial Plot Loans | Purchasing new or existing commercial plot. | 9.60% - 10.95% |

| HDFC Loans for NRI/PIO | NRIs for purchasing flat, row house, bungalow or properties from development authorities. | - |

What are the eligibility criteria to avail HDFC Home Loan?

The eligibility of a borrower to avail home loan in HDFC bank is based on their income and loan repayment capacity. HDFC also considers other factors such as the applicant's age, credit history, credit score, etc. Some of the basic eligibility criteria for HDFC home loan are as follows.

| Age | 21 years to 65 years |

| Profession | Salaried/Self-Employed |

| Minimum Income |

Salaried: Rs.10,000 per month Self-Employed: Rs.2 lakh per annum |

| Maximum Loan Tenure |

30 years |

| Nationality | Resident Indian |

| Gender | All genders |

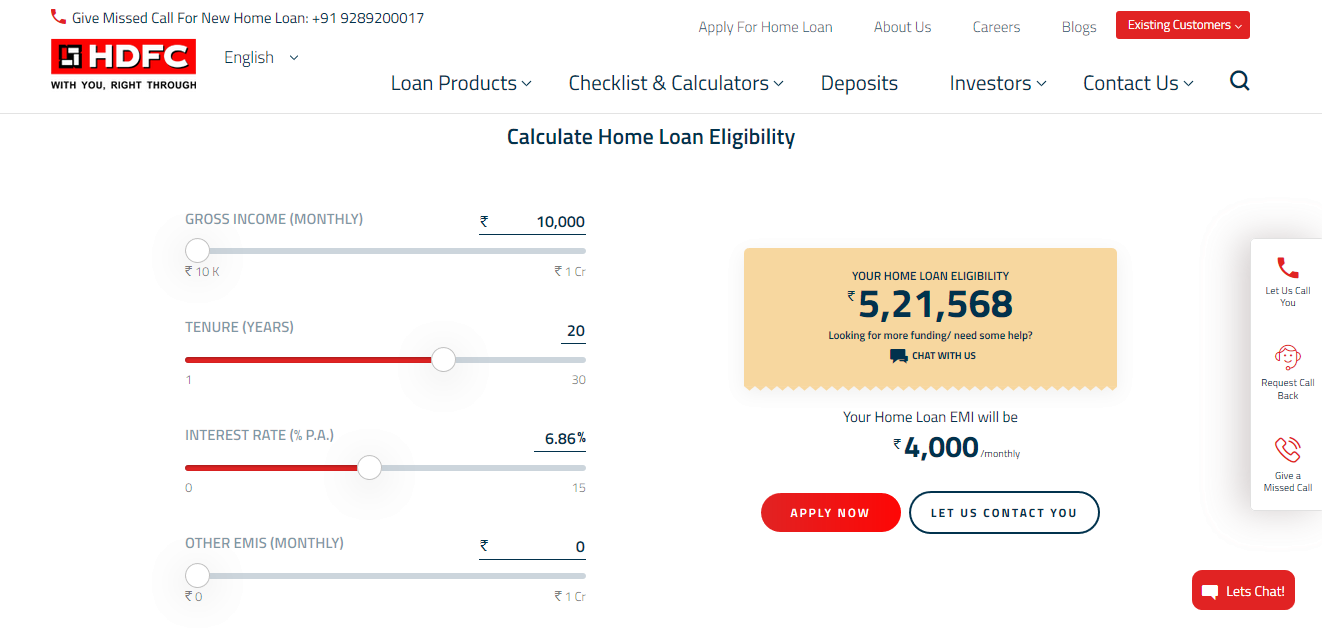

How to calculate HDFC Home Loan Eligibility?

Before applying for home loan, it is important to calculate the loan amount you are eligible for. To calculate loan eligibility, you need to provide your income details with which your loan repayment capacity will be calculated. Home loan eligibility is based on the factors such as your age, monthly income, credit history, credit score, retirement age, other monthly EMIs, etc.

- Click here to calculate HDFC home loan eligibility.

- Select your gross monthly income, tenure, interest rate and other monthly EMIs if any.

- Once you have provided all these details, your home loan eligibility will appear on the screen.

How to calculate EMI for HDFC Home Loan?

With HDFC Home Loan EMI Calculator, you can easily calculate the EMI for your home loan taken in HDFC bank. Using EMI calculator, you can pre-decide your plan of purchasing a new house. HDFC offers home loan with EMI from Rs.659/lakh at the interest rate of 6.90% p.a with some additional features. To calculate EMI for HDFC home loan, follow the simple steps given below.

- Click here to visit HDFC Home Loan EMI Calculator.

- Select the loan amount, tenure and interest rate.

- The monthly home loan EMI will appear on the screen.

What are the documents required to apply for HDFC Home Loan?

In order to apply for HDFC home loan, the applicant need to submit the following documents along with the duly filled and signed home loan application form.

Proof of Identity and Residence:

- PAN card

- Passport

- Voter ID

- Driving Licence

Proof of Income:

- Last 3 months salary slips

- Last 6 months bank statements with salary credits

- Latest Form-16 and Income Tax Returns

Property Related Documents:

For New Home:

- Copy of Allotment letter/Buyer Agreement

- Receipts of payments made to the developer

For Resale Home:

- Title deeds including previous chain of property documents

- Receipts of payments initiated to the seller

- Copy of the sale agreement

For Construction:

- Title deeds of the plot

- Proof of no encumbrances on property

- Copy of plans approved by Local Authorities

- Construction estimate by a Civil Engineer/Architect

Other documents for Home Loan:

- Proof of own contribution

- Appointment letter/employment contract if the present employment is less than year old

- Last 6 months bank statements showing repayment of ongoing loans

- Passport size photograph of the applicant/co-applicant affixed on the application with signature

- Processing fee paid via cheque favouring HDFC Ltd.

HDFC Home Loan - Important Links:

- Click here to apply for HDFC home loan.

- Click here to track the status of HDFC home loan application.

- Click here to locate your nearest HDFC home loan office.

HDFC Home Loan Customer Care:

If you need any help regarding home loan, you can contact HDFC home loan customer care.

| Call HDFC Toll-Free Number | 1800 258 38 38 and 1800 22 40 60 |

| Give a Missed Call | 9289200017 |

| Send SMS | HDFCHOME to 56767 |

| Register in online | Click here |

| Write to HDFC Corporate Office Address | HDFC House, HT Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai - 400 020. |