Savings bank account is introduced in banks particularly to bring the habit of savings among customers. With savings bank account, customers can park their excess money with bank and can earn interest for that money from the bank. Savings bank account also comes with easy withdrawal facility for customers.

State Bank of India (SBI), India's largest public sector bank, offers savings account for its customers in which customers can easily open savings accounts in both online and offline. With savings account, customers can easily avail all the services from their nearby SBI bank branch. Let's see how to open a new savings bank account in SBI in online and offline.

Benefits of SBI Savings Bank Account:

- Mobile Banking, Net Banking and YONO app facility

- Nomination facility

- Facility to transfer accounts through net banking

- First ten cheque leaves are available free in a financial year

- Based on the maintenance of monthly average balance, free withdrawals without restrictions.

- Statement of accounts will be sent through mail.

- No monthly average balance

- No maximum balance limit

- SBI quick missed call facility.

- Free passbook

Types of SBI Savings Bank Account:

1. Basic Savings Bank Deposit Account

Any individual with valid KYC documents can open this account. It is especially meant for weaker sections of the society which brings in them the habit of savings without any charges or fees.

- No minimum balance

- Basic RuPay ATM cum debit card will be given.

- No limit for maximum balance.

2. Basic Savings Bank Deposit Small Account

Individuals who are above 18 years of age without any valid KYC documents can open this account. Upon submission of KYC documents, this account can be changed into Regular Savings Account.

- No minimum balance

- Maximum balance is Rs. 50,000

- Basic RuPay ATM-cum-debit card will be provided.

3. Savings Bank Account

- No maximum limit and monthly average balance

- Nomination facility is available

- Facility to transfer accounts through net banking.

4. Savings Account for Minors

Pehle Kadam and Pehli Udaan are complete packages of this banking product which will bring in children the importance of saving money.

- Maximum balance is Rs.10 lakh

- Mobile banking and Internet banking facilities available.

- Monthly average balance requirement is not applicable.

5. Savings Plus Account

It is a savings bank account linked to MODS in which the excess amount above the threshold limit in the account will automatically get transferred to Term Deposits.

- Deposit period 1-5 years

- Loan against MOD deposits available

- No monthly average balance

6. Motor Accidents Claim Account (MACT)

- Minimum/maximum balance requirement is not applicable.

- Nomination is available

- In case of minor accounts, legal guardian will manage the accounts.

7. Resident Foreign Currency Domestic Account

Resident Indians can open and operate foreign currency accounts. Accounts can be maintained in currencies such as USD, EURO and GBP.

- It is a current account without any interest.

- No cheque book or ATM card available.

- Minimum balance requirement is GBP 250, USD 500 and Euro 500.

Eligibility conditions to open SBI Savings Bank Account:

Customers who wish to open new savings account in SBI should fulfill the following eligibility criteria.

- The individual should be an Indian citizen.

- The individual should be 18 years of age and above.

- For individuals below 18 years of age, their parents or guardian can open savings account on behalf of them.

- The applicant should possess a valid, government approved ID and address proof.

- Upon approval of the account, the applicant should make an initial deposit. The initial deposit amount depends on the bank's minimum balance requirement for the savings account opted by the applicant.

Documents required to open SBI Savings Bank Account:

Customers need to submit the application form with any one of the following documents which support their identity and address and a passport size photograph.

Proof of Identity (any one of the following)

- Driving Licence

- Passport

- Voter ID

- PAN card

- Govt/Defence ID card

- ID cards of reputed employers

Proof of Address (any one of the following)

- Income Tax/Wealth Tax Assessment order

- Salary slip

- Credit card/Bank account statement

- Telephone Bill

- Electricity Bill

- Ration card

- Letter from reputed employer

- Letter from a government authority

Steps to open SBI Savings Bank Account in Online:

You can instantly open savings bank account in online by just following the simple steps given below.

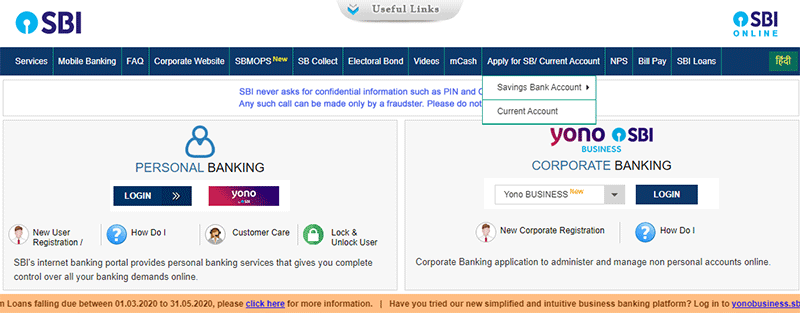

Step 1: Visit SBI's official portal www.onlinesbi.com

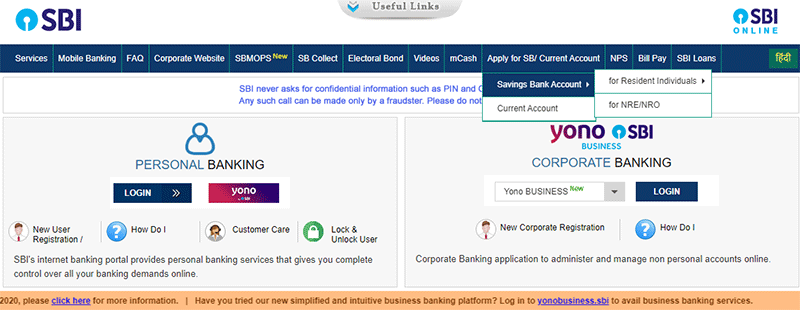

Step 2: On the home page, click 'Apply for SB/ Current Account' from the top menu.

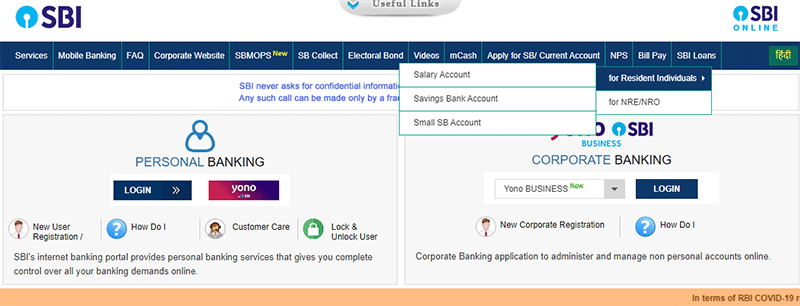

Step 3: Click 'Savings Bank Account' and then click 'For Resident Individuals'.

Step 4: Then select the type of savings bank account you want.

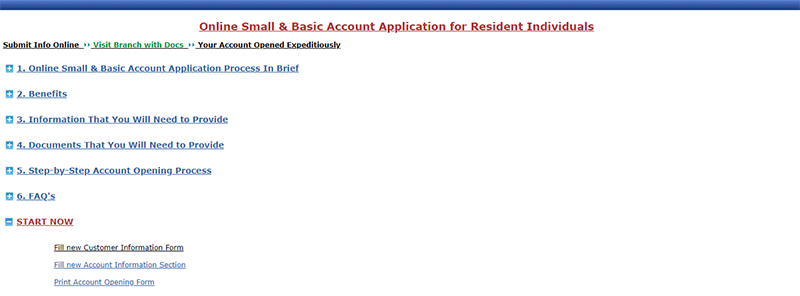

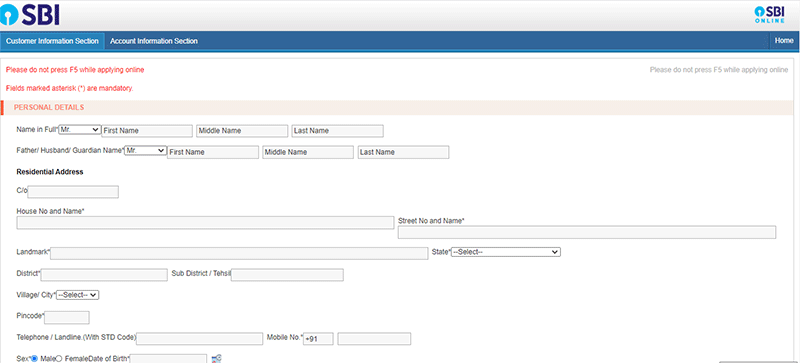

Step 5: Click 'Small SB Account'. You will be redirected to a new page where you need to click 'Start Now'. Then click 'Fill new customer information form'

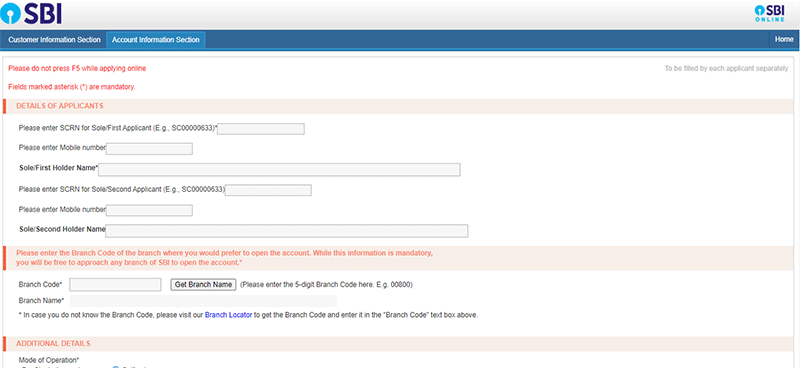

Step 6: Enter all your personal details and provide your PAN or fill form 60. Then enter your KYC details and click 'Proceed'

Step 7: After submitting your personal details, fill the 'account information section'. Enter the required details and click 'Proceed'.

Step 8: Print the account opening form and attach the required documents such as photographs, proof of identity and proof of address and submit in your bank branch.

Step 9: A customer reference number will be generated and sent to your registered mobile number. Note it down for future reference.

Step 10: After verification, the bank will activate your account within 3-5 working days.

Steps to open SBI Savings Bank Account in Offline:

In order to open new savings account in SBI in offline mode, go through the following steps.

Step 1: Visit your nearby SBI bank branch.

Step 2: Make a request with the bank manager to provide new savings account opening form.

Step 3: You need to fill two forms. In Form-1, enter your basic details such as name, address, signature and assets. If you don't have PAN card, then you need to fill Form-2.

Step 4: Check whether the details you provided in the form matches with the submitted KYC documents.

Step 5: Make an initial deposit of Rs. 1000

Step 6: You will be given free passbook and cheque book upon successful verification.

Step 7: Submit the net banking form along with it.

Contents of SBI Savings Bank Account Welcome Kit:

Upon approval of your new account, SBI will provide a savings account welcome kit. Check whether the kit comes sealed on arrival. The welcome kit contains,

- Personalized Cheque book

- ATM card

- Pay-in slips

- Internet banking user ID and Password in separate post.

Nomination Facility in SBI Savings Bank Account:

As per the official order of Indian government, it is compulsory for all savings bank account holders to choose a nominee who can operate the accounts on behalf of them. You need to nominate the beneficiary while filling the application form. If the beneficiary chosen by the customer is minor, he/she can operate the account only after turning 18 years of age. The beneficiary can manage the account if the account holder is dead.

SBI Savings Bank Account Contact Centre:

If you have any queries or issues regarding savings bank account, you can contact SBI's 24x7 helpline numbers - 1800 11 2211, 1800 425 3800, 080-26599990.