Gold loan is a secured loan which requires gold as collateral deposit. When compared with personal loan, gold loan offers higher loan amount at lower interest rates. Among various gold loan providers, Manappuram Finance Ltd offers gold loan up to Rs. 1.5 crore. Manappuram Finance Ltd is India's first listed and highest credit rated gold company registered under Reserve Bank of India.

With Manappuram gold loan, you can draw instant cash by pledging your gold ornaments and jewellery. Depending on the purity and net weight of the gold, you will get higher loan amount. Manappuram gold loan offers wide range of schemes from which you can choose the one that is right for your needs.

What are the key features of Manappuram Gold Loan?

| Age limit | Above 18 years |

| Minimum loan amount | Rs.1000 |

| Maximum loan amount | Rs.1.5 crore |

| Security | Gold ornaments |

| Loan tenure | Up to 3 months |

| Interest rate | 9.90% p.a onwards |

| Processing Charge |

At the time of settlement: Rs.10 At the time of repledge: 0.07% of new pledge value |

What are the benefits in Manappuram Gold Loan?

Some of the benefits of Manappuram gold loan are given below.

- It offers gold loan at interest rate as low as 9.90% p.a.

- You can easily get gold loan from any of your nearest Manappuram Finance branch.

- It comes with different gold loan schemes with which you can choose the one you need.

- It offers highest Loan to Value (LTV) for those who seek maximum loan amount for their jewel.

- The interest rate is calculated on reducing balance basis. So, the interest and risk premium is collected only for the days the money was actually used.

- There are no prepayment penalties or lock-in period for gold loan.

- It provides safe custody for your gold ornaments as it comes with electronic surveillance technology.

- It offers free insurance for your pledged gold ornaments.

- You can make online payment of interest and full or partial repayment of principal.

What are the schemes available in Manappuram Gold Loan?

| Scheme Name | Loan Tenure | Slab | Interest Rate in Kerala State (p.a) | Annualized Interest Rate | Interest Rate in Other States (p.a) |

Annualized Interest Rate | Loan Amount |

| GL-DS Scheme | 90 days | 0-30 days | 12% | 22.03% | 12% | 22.03% | Rs.5000 to Rs.30,000 |

| 30-60 days | 25% | 25% | |||||

| 60-90 days | 28% | 28% | |||||

| GL-SY Scheme | 90 days | 0-30 days | 18.50% | 24.30% | 18.50% | 24.30% | Up to Rs.1,00,000 |

| 30-60 days | 25% | 25% | |||||

| 60-90 days | 28% | 28% | |||||

| Privilege Loan (GL-PL) | 90 days | 0-30 days | 20.50% | 26.21% | Subject to individual exposure limit fixed | ||

| 30-60 days | 27.50% | ||||||

| 60-90 days | 29% | ||||||

| Express Gold Loan Plus (GL-XG+) | 180 days | 0-30 days | 22% | 29.19% | 26% | 29.94% | |

| 30-60 days | 27.50% | 27.50% | |||||

| 60-90 days | 29% | 29% | |||||

| Super Loan Plus (GL-SG+) | 270 days | 0-30 days | 22% | 29.79% | 26% | 30.32% | |

| 30-60 days | 27% | 27% | |||||

| 60-90 days | 28% | 28% | |||||

|

Samadhan Plus (GL-SA+) |

365 days | 0-30 days | 22% | 31.15% | 26% | 31.57% | |

| 30-60 days | 27% | 27% | |||||

| 60-90 days | 28% | 28% | |||||

| Swarna Shakthi (GL-SX) | 90 days | 0-30 days | Applicable only in Tamil Nadu, A&N and Pondichery | 25% | 27.78% | ||

| 30-60 days | 27.50% | ||||||

| 60-90 days | 29% | ||||||

| 90 days | 0-30 days | Applicable only in AP, Telegana, J&K, Karnataka, Punjab, Chandigarh, Goa, Gujarat and Delhi | 25.75% | 28.04% | |||

| 30-60 days | 27.50% | ||||||

| 60-90 days | 29% | ||||||

| 90 days | 0-30 days | Applicable only in Tier 1 branches in Northern states | 25.75% | 28.04% | |||

| 30-60 days | 27.50% | ||||||

| 60-90 days | 29% | ||||||

| 90 days | 0-30 days | Applicable only in Northern states other than Tier 1 branches | 26.75% | 28.39% | |||

| 30-60 days | 27.50% | ||||||

| 60-90 days | 29% | ||||||

| GL B1+N | 90 days | 0-30 days | 20% | 25.17% | 23% | 26.21% | Subject to individual exposure limit fixed |

| 30-60 days | 26% | 26% | |||||

| 60-90 days | 28% | 28% | |||||

| GL B1-N | 90 days | 0-30 days | 19% | 23.43% | 20% | 23.78% | |

| 30-60 days | 24% | 24% | |||||

| 60-90 days | 26% | 26% | |||||

| GL B2+ | 90 days | 0-30 days | 17% | 21.36% | 18% | 21.71% | |

| 30-60 days | 22% | 22% | |||||

| 60-90 days | 24% | 24% | |||||

| GL H3+ | 90 days | 0-30 days | 15% | 19.29% | 15% | 19.29% | |

| 30-60 days | 18% | 18% | |||||

| 60-90 days | 24% | 24% | |||||

| Business Loan (GL BL) | 90 days | 0-90 days | 24% | 24.48% | 24% | 24.48% | Minimum Loan Value: Rs.50 lakhs |

| GL B4+ | 90 days | 0-90 days | 15% | 15.19% | 15% | 15.19% | Subject to individual exposure limit fixed |

Note: Branches in Mumbai city, Mumbai city, Lucknow, Pune, Kanpur Nagar, Kanpur Dehat, Bhopal, Indore, Kolkata, Khordha and Cuttack districts in Northern states are considered as Tier 1 branches.

How much interest rate rebate is available in Manappuram Gold Loan?

- Customers who are regularly paying their monthly interest will be provided the initial interest rate during the loan tenure.

- Customers who are registered in Online Gold Loan service will get attractive interest rate rebate by repledging via online mode in BL/PL/SX schemes according to the repledge frequency given below.

| Repledge Frequency | Interest rate rebate |

| 4 repledges in every 15 days from the date of creation of inventory. | 12% per annum (BL - 9.9%) |

| 3 repledges in every 15 days from the date of creation of inventory. | 4% |

| 2 repledges in every 15 days from the date of creation of inventory. | 2% |

| 2 repledges in every 30 days from the date of creation of inventory. (1st repledge in 1-15 days and 2nd repledge in 16-30 days) | 1.5% |

| 1 repledge in every 30 days from the date of creation of inventory. | 1% |

What are the fees and charges for Manappuram Gold Loan?

| Fees/Charges | Amount to be paid |

| Postage charges |

|

| Auction intimation charge |

|

| Delivery of gold against lost pawn ticket |

|

| Statement of accounts |

|

| Gold processing charge |

|

| Custody charge for Nil balance accounts |

|

Who are eligible to avail gold loan in Manappuram Finance?

In order to apply for gold loan in Manappuram Finance,

- One must be 18 years of age and above.

- One should possess gold ornaments within a karat range of 18 to 24.

What are the documents required to apply for Manappuram Gold Loan?

The following documents are needed to apply for gold loan in Manappuram Finance.

- Identity proof - Passport, Aadhaar card, Driving Licence, PAN card, Voter ID, Ration card.

- Address proof - Passport, Aadhaar card, Driving Licence, Voter ID, Ration card, Utility bills, Bank account statement.

- One recent passport size photograph

- PAN or Form 60.

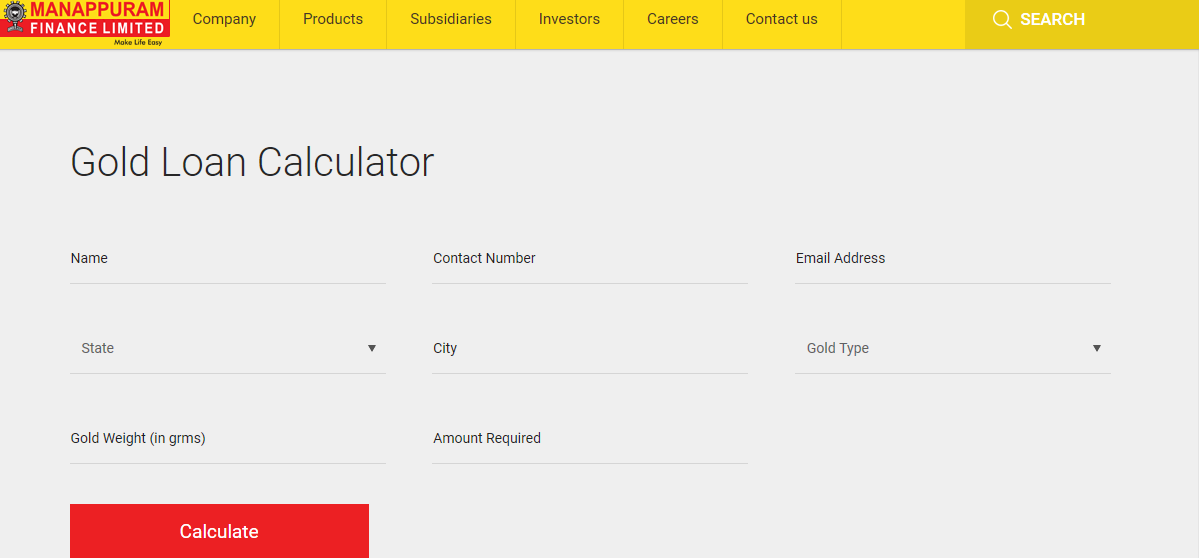

How to calculate gold loan in Manappuram Finance?

You can easily calculate the loan amount for the gold ornaments you have with gold loan calculator. To calculate gold loan, just follow the simple steps given below.

Step 1: Click here to visit Manappuram gold loan calculator.

Step 2: Enter your name, contact number, email id, state, city, gold type and gold weight.

Step 3: Once you have entered all details, the loan amount for the gold will appear on the screen.

How to apply for Gold Loan in Manappuram Finance?

You can apply for gold loan in Manappuram Finance either in online or offline.

Offline:

To apply for gold loan in offline, you need to visit any one of your nearest Manappuram Finance branch. To find your nearest branch, click here.

At the branch, fill the application form and submit the necessary documents. Submit your gold ornaments and get it appraised. After evaluating the ornaments, the loan value will be determined.

Online:

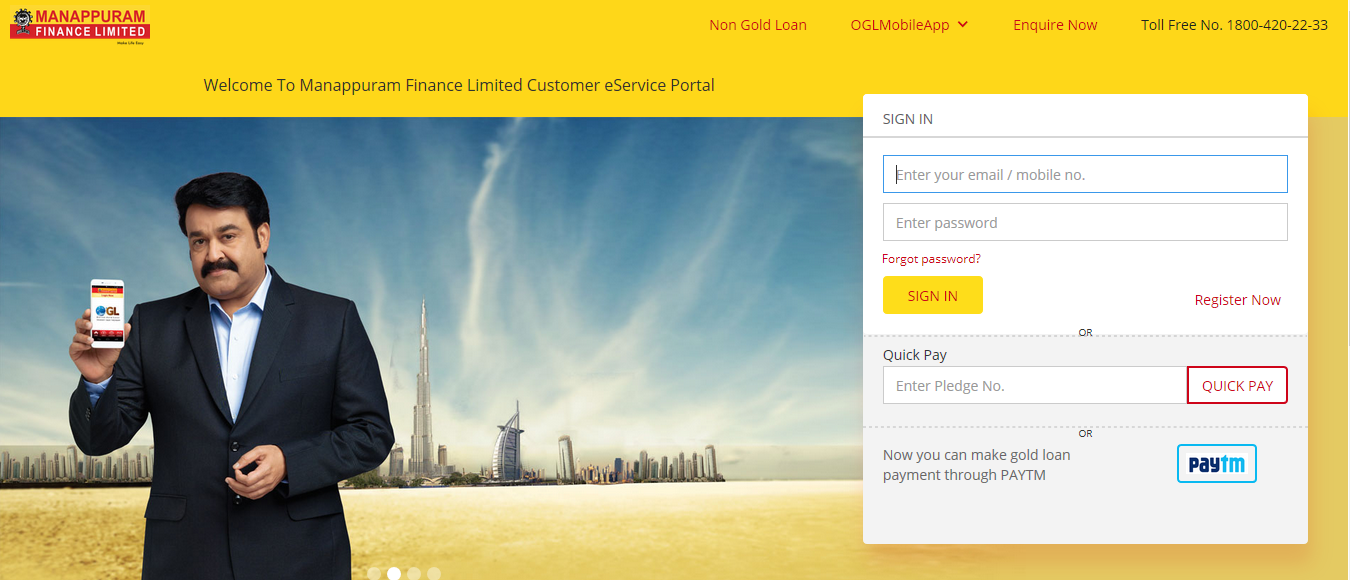

You can apply for gold loan in online either by downloading Manappuram gold loan app or in Manappuram Online Gold Loan portal.

With Online Gold Loan, you can apply for gold loan from anywhere and at anytime. On the basis of the value of your pledged gold ornaments in the branch, the loan amount will be credited instantly to your savings bank account registered with the branch. To apply for gold loan,

Step 1: Safelock your gold ornaments at your nearest Manappuram Finance branch.

Step 2: Register for online gold loan service and link your savings bank account.

Step 3: Visit Manappuram's Online Gold Loan portal. Then enter your name, email id, mobile number, pin code and branch.

Step 4: Once you have submitted all these details, the customer care service will contact you within an hour.

To avail gold loan via mobile app, follow the simple steps given below.

- Download Manappuram OGL app and install it on your mobile.

- Select the language and login using your customer id/mobile number/email id and password. You can also login with MPIN.

- If you are a new user, click on 'Create New Account' and enter customer id, mobile number, email id and captcha. Then click 'Continue'

- Select the scheme and then finalize the amount.

- The loan amount will be credited instantly to your bank account.

How to pay Manappuram gold loan in Online?

You can pay your gold loan in online either in Manappuram OGL portal or in Manappuram OGL app. You need not visit the branch to pay your gold loan.

To pay your gold loan in OGL portal,

Step 1: Visit Manappuram OGL portal

Step 2: Sign in using your email/mobile number and password. You can also use the 'Quick Pay' option by entering your pledge number.

Step 3: The loan details and the loan amount you need to pay will appear on the screen. Enter the amount and make payment.

To pay your gold loan in OGL app,

Step 1: Download Manappuram OGL app and install it on your mobile.

Step 2: Login to your account and click 'Check dues and pay online'. You can also use the 'Quick Pay' option or scan the QR code in the pledge form to pay your gold loan.

Step 3: Select the account number for repayment. Then select interest payment/full payment/part payment.

Step 4: Select the payment mode and click 'Pay Now'

Step 5: A message upon successful payment will appear on the screen.