Muthoot Finance, India's largest gold loan company, helps you to get loan in turn of your gold jewellery, gold ornaments, etc. If you are unable to get loan from bank or unable to get the exact amount you need, then gold loan is the easiest and quickest way to get the money you need. Muthoot gold loan comes with attractive interest rates and quick loan disbursal. You can choose the scheme which is ideal for your needs from the variety of gold loan schemes.

Muthoot Finance offers gold loan in online through which you can avail gold loan from anywhere and at anytime. The interest rate for Muthoot gold loan starts from 12% per annum. It comes with different loan disbursement options and digital payment services. Go through this article to know more about Muthoot Gold Loan!

What are the key features of Muthoot Gold Loan?

| Age | Above 18 years |

| Minimum loan amount | Rs.1500 |

| Maximum loan amount | No Limit |

| Security | Gold ornaments |

| Processing fee | Rs.40 to Rs.600 |

| Interest rate | From 12% per annum |

| Loan tenure | 1 week to 36 months |

| Loan schemes | 12 schemes available |

What are the benefits of Muthoot Gold Loan?

Some of the benefits of Muthoot gold loan are given below.

- It provides customer-oriented services.

- It has the facility of quick loan disbursal.

- You can avail minimum loan amount of Rs.1500 with no maximum limit.

- Prepayment option is available without any penalty.

- The process involves only minimal documentation.

- It provides in-house evaluation facility.

- It offers prompt customer service within a short span of time.

- It has strong rooms for safe custody of your gold ornaments.

- It offers free insurance for your pledged gold ornaments.

- There are no hidden charges.

- Interest will be charged only for the days the amount is used (Minimum 7 days applicable)

- It offers 24x7 online payment facility.

- It provides part release facility.

What are the schemes available in Muthoot Gold Loan?

Muthoot gold loan offers 12 different kinds of gold loan schemes. The features, interest rate, loan amount, loan tenure and penal interest for Muthoot gold loan may vary according to each gold loan scheme. Just compare the features and interest rates of different gold loan schemes and choose the right scheme which is ideal for you!

| Gold Loan Scheme | Features | Minimum Loan Amount | Maximum Loan Amount | Loan Tenure | Rate of Interest per annum | Penal Interest |

| Muthoot One Percent Loan |

|

Rs.1500 | Rs.50,000 | 12 months | 12% | 1% for delayed payment above 360 days |

| Muthoot Premier Loan |

|

Rs. 1 lakh | No limit | 12 months | 23% | - |

| Muthoot Ultimate Loan (MUL) |

|

Rs. 1500 | No limit | 12 months | 22% | - |

| Muthoot Overdraft Scheme (MOS) |

|

Rs. 2 lakhs | Rs. 50 lakhs | 12 months | 19% to 21% | 2% for delayed payment above 12 months |

| Muthoot Delight Loan |

|

Rs. 1500 | Rs. 2 lakhs | 12 months | 26% to 27% | 1% for delayed payment above 360 days. |

| Muthoot EMI Scheme (MES) |

|

Rs. 20,000 | No limit | 6, 12, 18, 24, 30 or 36 months | 21% (diminishing balance) | 75 paisa per Rs.1000/day if EMI is not paid within 3 days from the due date. |

| Muthoot Mahila Loan |

|

Rs. 1500 | Rs. 50,000 | - | 12% | 2% for delayed payment above 360 days. |

| Muthoot Advantage Loan |

|

Rs. 1500 | Rs. 5 lakhs | 12 months | 20% | 2% for delayed payment above 360 days. |

| Muthoot Super Loan |

|

Rs. 1500 | Less than Rs. 99,000 | 12 months | 23.5% | 2% for delayed payment above 360 days. |

| Muthoot High Value Loan Plus (MHP) |

|

Rs. 5 lakhs | No limit | 12 months | 12% onwards | 2% for delayed payment above 360 days. |

| Muthoot High Value Loan (MHL) |

|

Rs. 3 lakhs | No limit | 12 months | 18% onwards | 2% for delayed payment above 360 days. |

| Super Saver Scheme (SSS) |

|

Rs. 1.99 lakhs | No limit | - | 24% to 26% | 2% for delayed payment above 360 days. |

- Click here to check the applicable rebate for each scheme.

What are the fees and charges levied in Muthoot Gold Loan?

| Type of Charges | Applicable Rates |

| Service charges on loan amount |

|

| Service charges applicable per account |

|

| Security charges |

|

| Token charges |

|

| SMS charges |

|

| Notice charges |

|

| Token lost charges |

|

| Stamp duty |

|

| GCL |

|

Who are eligible to avail Muthoot Gold Loan?

- Any Indian citizen above 18 years of age can avail gold loan in Muthoot Finance.

- One should provide gold ornaments and required documents to avail gold loan.

What are the documents required to apply for Muthoot Gold Loan?

To apply for gold loan in Muthoot Finance, you need to submit the following documents.

- Any one Address Proof - Aadhaar card, PAN card, Passport, Driving License or Voter ID

- Any one ID Proof - Aadhaar card, Passport or Utility bills.

How to calculate your eligibility and EMI for gold loan in Muthoot Finance?

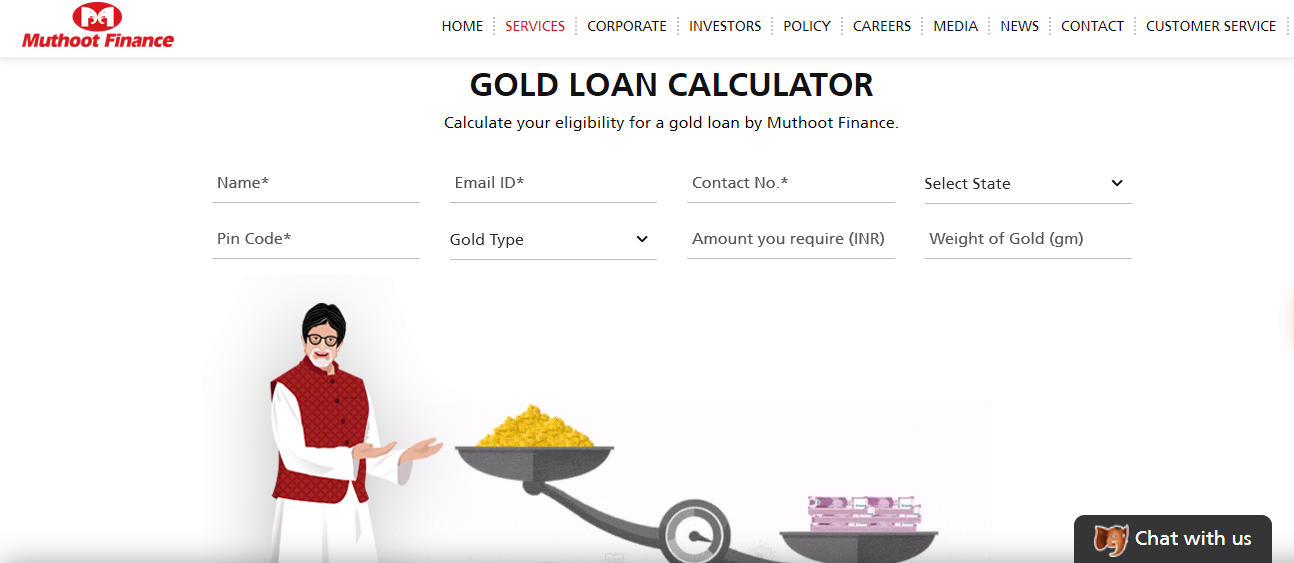

To calculate your eligibility for gold loan in Muthoot Finance, just follow the steps given below.

Step 1: Visit the official portal of Muthoot Finance Gold Loan

Step 2: Scroll down the home page and locate 'Gold Loan Calculator'.

Step 3: Enter your name, email id, contact number, state and pin code. Then select the gold type, loan amount you need and weight of the gold in grams. Then click 'Calculate'

Step 4: The loan amount you are eligible against your gold ornaments will appear on the screen. But this is only an approximate value. The final value depends on the gold evaluation done at the branch.

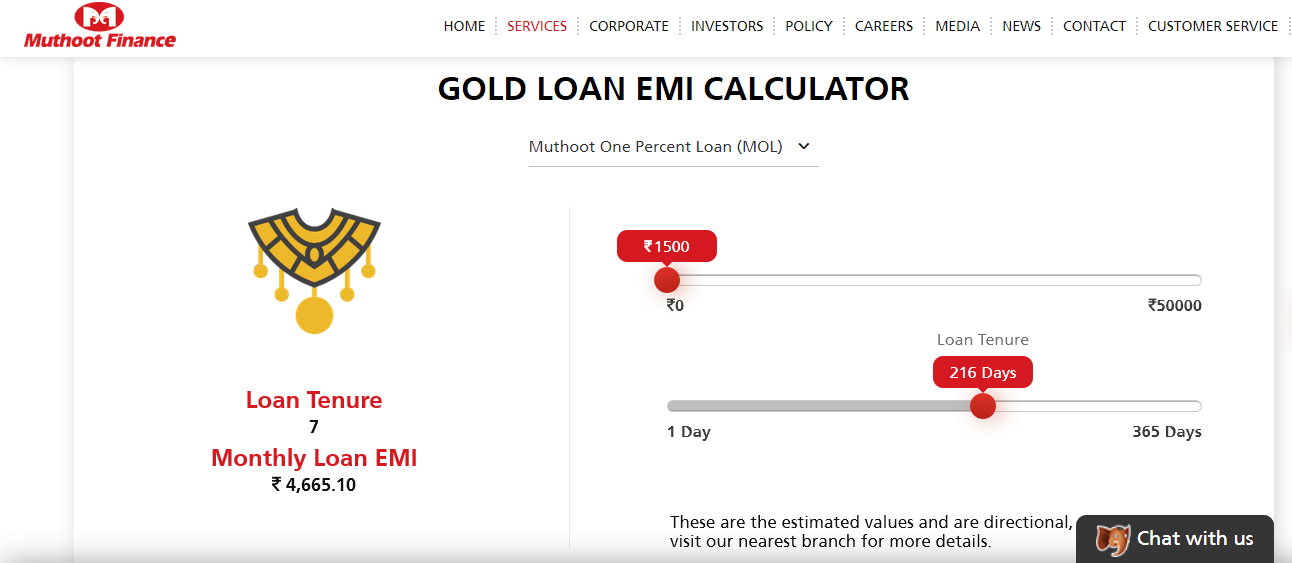

To calculate the monthly EMI for your loan amount,

Step 1: Scroll down further and locate 'Gold Loan EMI Calculator'

Step 2: Select the scheme, loan amount and loan tenure.

Step 3: On the right side of the page, the monthly loan EMI will appear.

How to apply for Muthoot Gold Loan?

To apply for gold loan in Muthoot Finance, just follow the simple steps given below.

- Visit the nearest Muthoot Finance bank branch and inform the customer care executive about availing gold loan.

- The executive will then help you to fill the KYC form and to complete the rest of the application process.

- You can also call the customer care executive by dialing 7666747899 and request them to visit your home to apply for gold loan.

- You can also apply for gold loan by registering in 'iMuthoot' app.

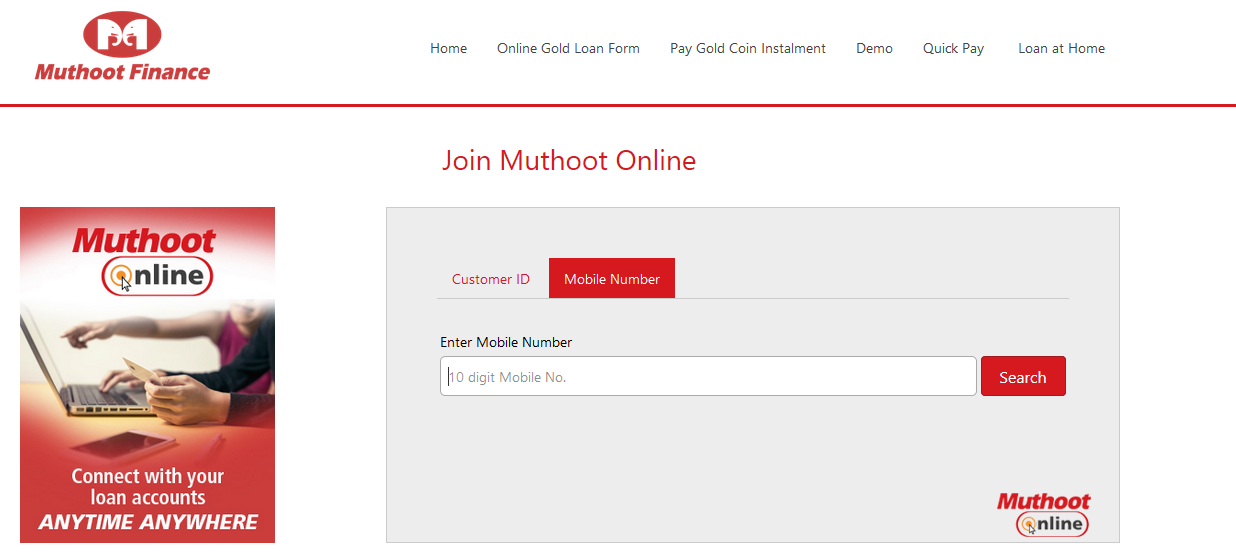

How to register for gold loan in Muthoot Online?

You need to register at first in order to avail online services in Muthoot Online. To register, follow the steps given below.

Step 1: Click here to visit the official website of Muthoot Finance.

Step 2: In the 'Pay and Transact Online' section, Click 'New user? Sign-up here' link.

Step 3: On the next page, enter your customer ID or mobile number registered with the bank and click 'Search'

Step 4: Once you have completed the registration process, you will get username and password.

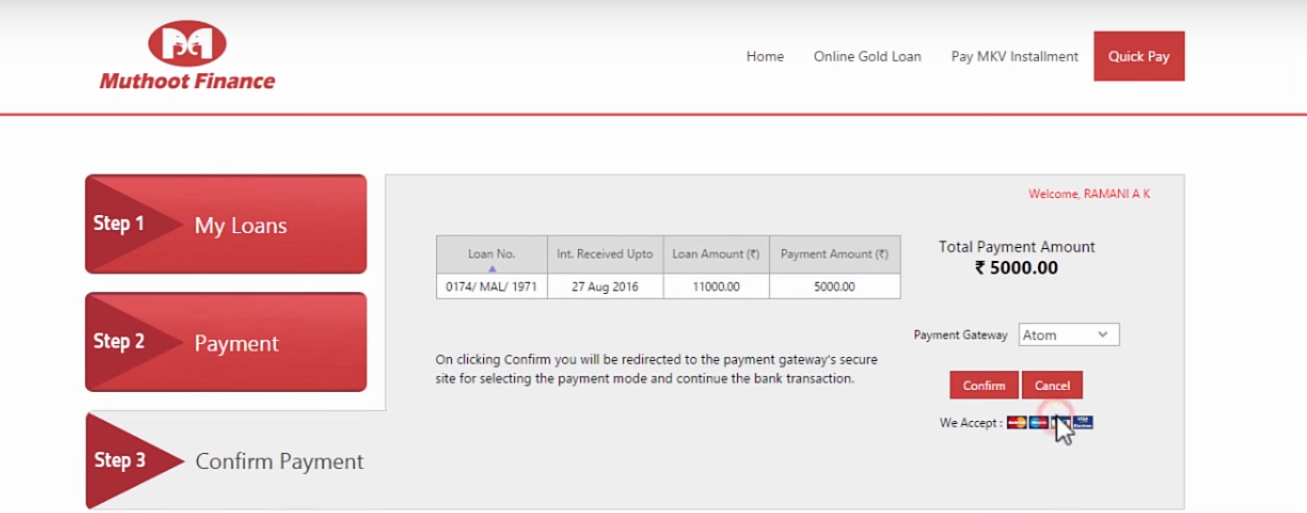

How to pay Muthoot Gold Loan in Online?

To repay your Muthoot gold loan in online, just follow the steps given below.

Step 1: Visit the official website of Muthoot Finance Online Gold Loan.

Step 2: Login to your account using your username and password.

Step 3: Once logged in to your account, you will see your gold loan details and amount to be paid.

Step 4: Select the mode of payment and complete the payment process in online.

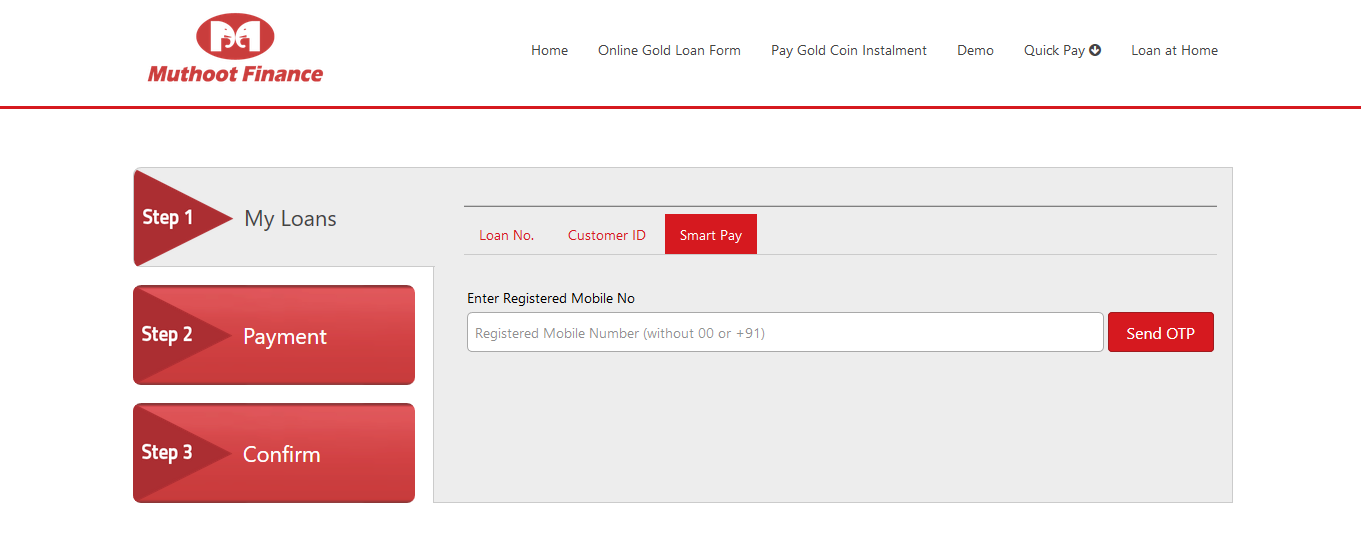

You can also pay gold loan using 'Quick Pay' option.

Step 1: In the Muthoot Finance Online Gold Loan page, click 'Quick Pay' menu and then select 'Gold Loan'

Step 2: Enter your loan number or customer ID. You can also make smart payment by clicking 'Smart Pay' option and entering your mobile number.

Step 3: Once you have accessed your loan details, enter the payment amount, select the payment mode and make payment.

How to pay gold loan via iMuthoot app?

You can also pay your Muthoot gold loan via iMuthoot app. Just go through the following steps to make payment.

- Download iMuthoot app from Google Play Store and install it on your mobile.

- Login using your user name and password.

- Click 'Quick Pay' option under 'Loans'.

- Enter your loan number or customer id or scan the QR code on the loan pledge form.

- Once you have accessed your loan details, make payment.