Banking became very easy after the advancement in online transactions. Online banking transaction creates new waves in banking industry. The transactions are done through NEFT, RTGS and other modes, electronically with the use of Internet.

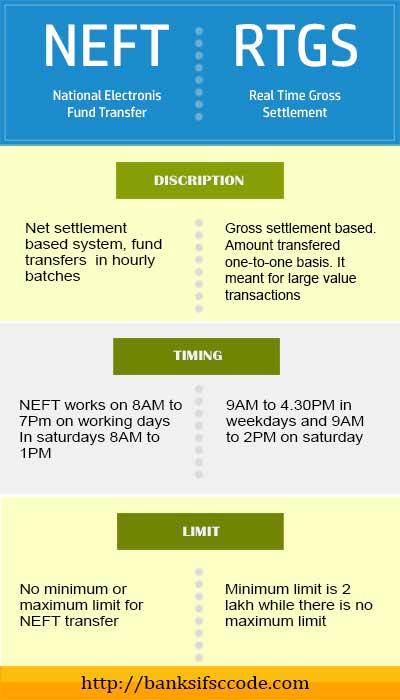

NEFT is a short form of National Electronic Funds Transfer which is used to transfer funds between banks. In NEFT, all the settlements are done in batch, on hourly basis. Banks that support NEFT should be a participant in NEFT network which is managed by RBI.

RTGS is the short form of Real Time Gross Settlement in which transactions take place on real time. Here, immediate response will be provided that the transfer will be at once. It is used to transfer large amount of transactions. Here, all the settlements are done individually.

What is NEFT Transfer?

NEFT is a one-to-one fund transfer payment system.

The fund transfer using NEFT can be used byindividuals, firms or corporates who have account with bank branches.

Only the NEFT enabled bank branches can transfer fund through the NEFT system.

The customers who have internet banking or mobile banking can use NEFT facility. Even, customers who don’t have bank account can also transfer money through NEFT enabled branches and the amount is limited as Rs.50000 per transaction.

NEFT Timings:

NEFT operates in hourly batches. There will be 12 settlements between 8 am and 7 pm on week days.

NEFT timings on Saturday:

During Saturdays, only five settlements will be done between 8 am and 1 pm. Transaction doesn’t take place in second and fourth Saturday of a month.

Transfer on Sunday and holidays:

NEFT doesn’t work on Sunday and public holidays. If any request is made on these times, it will be processed only on the next working day.

NEFT Charges:

There is no transfer charge for inward transaction.That means, if one receives fund through NEFT, no charges will be applied.

But for the outward transactions, that if one sends funds through NEFT to other party, charges are applied.

If a transaction is done below the limit of 1 lakh, Rs.5+service tax is charged.

For the transaction between Rs.1 lakh and Rs.2 lakhs, Rs.15+service tax is charged.

For the transaction above Rs.2 lakhs, Rs.25+service tax is charged.

The above details are applied to most of the banks like ICICI bank, HDFC bank and SBI.

Let’s see the NEFT charges of Indian Bank.

Indian bank NEFT charges:

For the transaction below Rs.10000, Rs.3 will be charged per transaction.

For the transaction between Rs.10000 and Rs.1 lakh, Rs.6 will be charged per transaction.

For transaction between Rs.1 lakh and Rs.2 lakhs, Rs.14 will be charged per transaction.

For transaction above Rs.2 lakhs, Rs.29 will be charged.

NEFT Limit:

For NEFT transfer, there is no minimum or maximum limit. Only for the case based remittance, maximum amount transfer through NEFT is limited to Rs.50000.

What is RTGS Transfer?

RTGS is meant for large transaction.

In RTGS, funds are transferred individually and not on hourly basis.

Hence, the time taken to transfer the money to the beneficiary account is quicker than NEFT.

Unlike NEFT, beneficiary branches receive the fund immediately after transferred by the remitting bank.

The received fund will be credited to the beneficiary account within 30 minutes by the beneficiary bank.

RTGS timings:

In RTGS, transaction timing is between 9 am and 4.30 pm in working days.

RTGS timing on Saturday:

Transaction timing on Saturdays is between 9 am and 2 pm.

These schedules will vary from bank to bank. For example, in ICICI bank, RTGS timing is 8 am to 4.30 pm.

In Indian bank also, the RTGS timing is the same as ICICI bank.

But SBI timing is between 8 am and 7 pm.

RTGS charges:

For inward transaction, there is no charge.But charges are applied for the outward transaction.

For transaction between Rs.2 lakhs and 5 lakhs, the charge is Rs.30 per transaction.

For transaction above Rs.5 lakhs, the charge is Rs.55.

Indian bank RTGS charges:

For transaction between Rs.2 lakhs and Rs.5 lakhs, the amount will vary between Rs.29 and Rs.35 per transaction.

And for the transaction above Rs.5 lakhs, the amount varies between Rs.58 and Rs.63 per transaction.

RTGS Limit:

The minimum transfer limit of RTGS is 2 lakhs.

This service don’t have maximum transfer amount limit, but some banks have the maximum limit.

For example, ICICI bank and HDFC bank have the maximum limit of Rs.10 lakhs.

IMPS is an another transfer mode, read detailed explanation about IMPS.

Difference between NEFT and RTGS:

- Both are different kinds of services provided by most of the banks.

- RTGS is applicable for large amount transaction as it requires a minimum limit of Rs.2 lakhs while NEFT is meant for transferring minimum amount.

- In NEFT, the personinitiating a transfer should wait in a transaction queue of hourly batches as the process takes place on net settlementbasis. On contrary, RTGS is processed in real time basis.

- RTGS is faster than NEFT.

- NEFT is suitable for small transfers and RTGS is suitable for large transfers.

Comments:

Mukesh yadav - Sep 24, 2017

Well explained and very informative, states how IMPS is robust then NEFT and RTGS.