Gold loan is a loan offered against gold ornament or gold coin. In offering gold loan, State Bank of India (SBI) provides higher loan amount at lower interest rates to its customers. SBI gold loan can be availed by pledging gold ornaments and gold coins sold by banks. With minimum paperwork, customers can easily get gold loan in SBI. Let's take a look on SBI gold loan in detail.

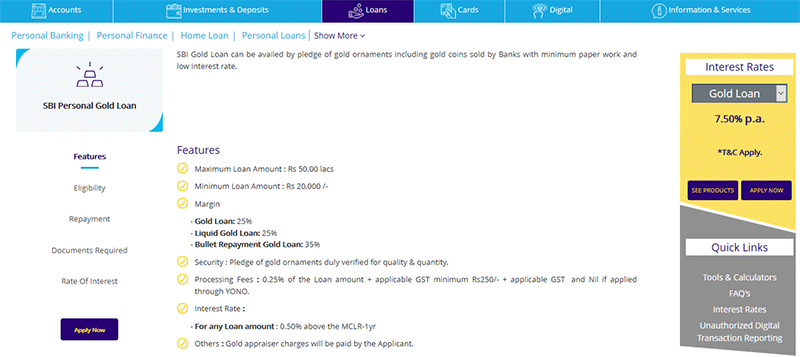

What are the key features of SBI Gold Loan?

| Age | 18 years and above |

| Maximum Loan Amount | Rs. 50 lakhs |

| Minimum Loan Amount | Rs. 20,000 |

| Margin |

Gold Loan: 25% Liquid Gold Loan: 25% Bullet Repayment Gold Loan: 35% |

| Security | Gold ornaments |

| Processing Fees | 0.25% of the loan amount + Minimum GST of Rs. 250, NIL if applied through YONO app. |

| Interest Rate | 7.50% per annum |

| Loan Tenure | Up to 36 months |

What are the benefits of SBI Gold Loan?

SBI gold loan comes with the following benefits.

- SBI gold loan comes with a flexible loan amount ranging from Rs. 20,000 to Rs. 50 lakhs depending upon the quality, quantity and net weight of gold ornaments pledged.

- The loan amount can be repaid in EMIs with the maximum loan repayment period ranging from 12 months to 36 months.

- Customers are provided with the option to choose schemes such as gold loan, liquid gold loan or bullet repayment gold loan to repay their gold loan.

- SBI gold loan involves only minimum paperwork. So, customers can avail this loan easily and quickly.

- The processing fee for availing SBI gold loan is comparatively low.

- There is no hidden cost or administrative charges in availing SBI gold loan.

- Customers can opt for loan prepayment as there is no prepayment penalties charged.

What is the rate of interest for SBI Gold Loan?

The rate of interest for SBI gold loan varies according to the scheme.

| Scheme | 1 year MCLR | Spread over 1 year MCLR | Effective Interest Rate |

|---|---|---|---|

| Gold Loan (all variants) | 7.00% | 0.50% | 7.50% |

| Realty Gold Loan - An exclusive product for SBI Housing Loan Customers (all variants) | 7.00% | 0.30% | 7.30% |

What are the repayment options available in SBI Gold Loan?

SBI comes with various repayment options for different kind of gold loans.

Gold Loan: The repayment of Principal and Interest will be started from the month following the month of loan disbursement. The maximum repayment period is 36 months.

Liquid Gold Loan: Overdraft Account with transaction facility and monthly interest should be given. The maximum repayment period is 36 months.

Bullet Repayment Gold Loan: The loan should be repaid on or before the loan term or on the closure of account. The maximum repayment is 12 months.

| SBI Gold Loan Schemes | Repayment Period |

|---|---|

| Gold Loan | 36 months |

| Liquid Gold Loan | 36 months |

| Bullet Repayment Gold Loan | 12 months |

What are the eligibility criteria required to avail SBI Gold Loan?

In order to apply for SBI gold loan, the applicant should fulfil the following eligibility conditions.

- The applicant's age should be 18 years and above.

- The applicant should be an individual with steady source of income. He/she should have the financial ability to repay the loan.

What are the documents required to apply for SBI Gold Loan?

While applying for SBI gold loan, an applicant should submit the following documents.

- Duly filled application form

- Two passport size photographs

- Proof of Identity

- Proof of Address

- Witness letter in case of illiterate borrowers

The applicant should submit the following documents at the time of disbursement of loan amount.

- Demand Promissory (DP) Note

- Demand Promissory (DP) Note Take Delivery Letter

- Gold ornaments Take Delivery Letter

- Arrangement Letter

How to apply for SBI Gold Loan in Online?

You can apply for SBI gold loan easily in online itself by just following the simple steps given below.

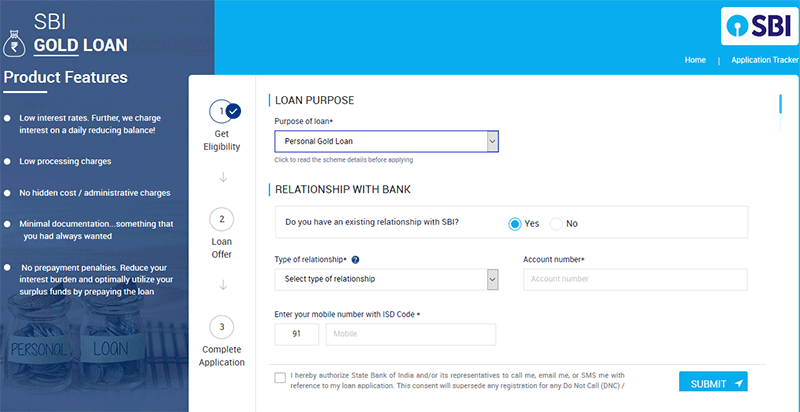

Step 1: Visit the official portal of State Bank of India

Step 2: On the home page, go to the 'Loans' menu and click 'Gold Loan'.

Step 3: Once you are taken to the SBI personal gold loan page, click 'Apply Now' button.

Step 4: You will be redirected to the application page where you need to select the loan purpose. Then select your relationship with the bank and enter your account number and mobile number. Enable the checkbox and click 'Submit'.

Step 5: On the next page, enter your email id and OTP sent to your registered mobile number. Then click 'Confirm'

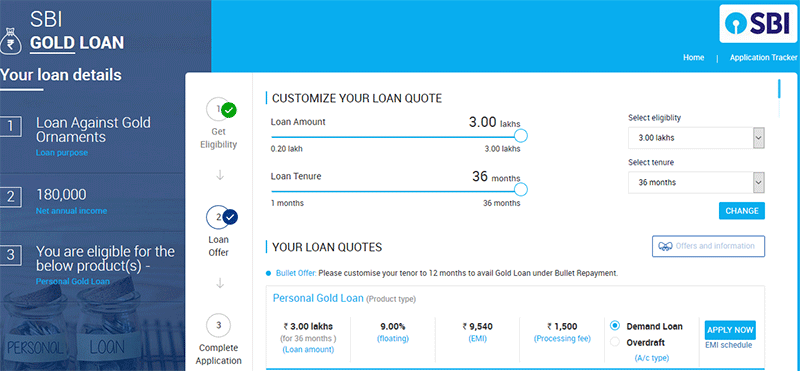

Step 6: Fill all the fields such as applicant details, income details, personal details, workplace details and contact details. After providing all details, click 'Get Loan Quote'.

Step 7: On the next page, your loan quote will appear on the screen. Then click 'Apply Now'

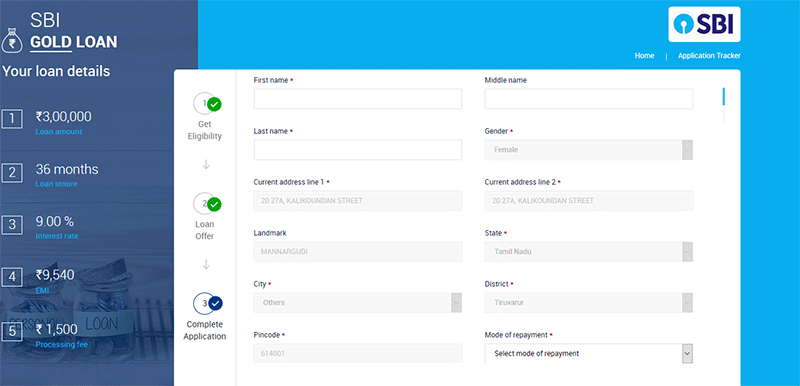

Step 8: On the next page, all loan details such as your loan amount, loan tenure, interest rate, EMI and processing fee will appear. Enter all necessary details and click 'Submit Application'.

Step 9: Print the filled-in application form and submit it along with required documents at the bank branch.

How to apply for gold loan in SBI YONO app?

You can easily apply for gold loan in your mobile through SBI YONO app. No processing fee will be charged if you have applied for gold loan through SBI YONO app. To apply for gold loan in SBI YONO app, go through the following steps.

- Download and install SBI YONO app in your mobile.

- Login to your account using user id and password.

- Once logged into your account, tap the menu button. Click 'Loans' and then click 'Gold Loan'

- Then click 'Apply Now' button.

- Check all the details and select the checkbox if all the details are correct. Then click 'Next'

- Next, enter your gold ornament details such as gold ornament type, quantity, quality and net weight in grams. Select the declaration checkbox and click 'Next'

- Check the loan details. You can customize the loan amount and tenure. Then click 'Next'

- Provide additional details such as loan purpose, educational qualification, resident type, marital status, income details, EMI details and account details. Then click 'Next'

- Select your nearest bank branch. Check the loan summary and click the declaration checkbox. Then tap 'Submit'

- On the next page, a message upon successful submission of application will appear. Note down the reference number and download the gold loan application.

- Visit your nearest bank branch with the gold loan application reference number, gold ornaments and necessary documents and get the loan amount.