Union Bank of India, one of the largest Public Sector Undertaking Enterprise is owned by Government of India. Soon, Union Bank is going to be merged with two other public sector banks, Andhra Bank and Corporation Bank, to become the fifth largest bank in India. Union bank offers 24 hours banking service to its customers through net banking, SMS banking, mobile banking and missed call banking. With these facilities, customers can easily access their bank account.

Features of Union Bank Net Banking:

Union bank's net banking facility has the following features through which customers can

- Get Account/ transaction details

- View and print account statement

- Transfer funds within the same bank accounts

- Transfer funds to other bank accounts via RTGS/ NEFT

- Pay Utility bills

- Make Credit card, Insurance and Mutual Fund payments

- Pay Direct/ Indirect tax

- Book tickets in online

How to Open Net banking Account in Union Bank?

Union bank offers all banking facilities via net banking. To open net banking account in Union bank, follow the steps given below.

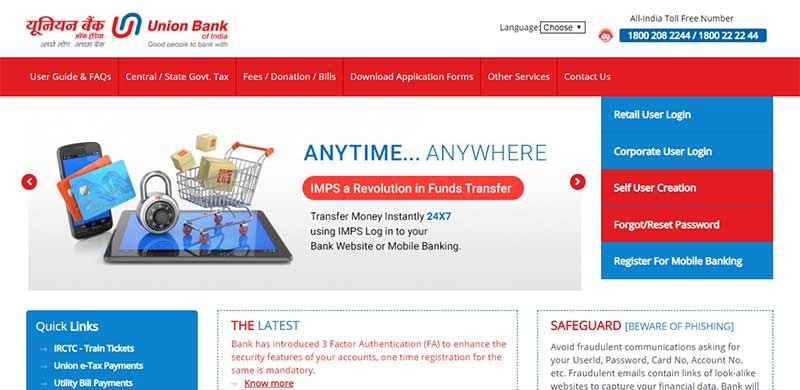

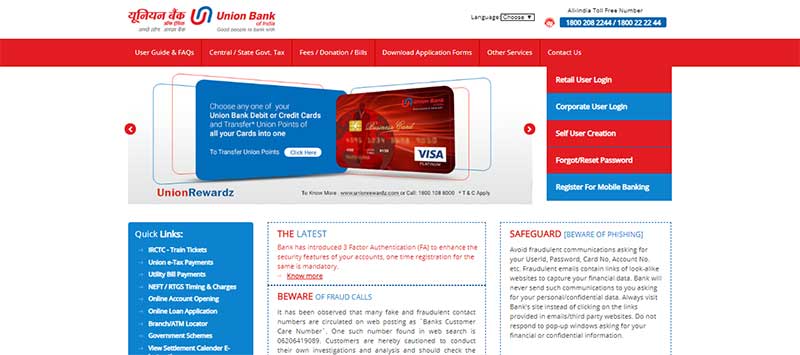

Step 1: Visit Union bank's official portal https://www.unionbankonline.co.in/

Step 2: On the home page, click 'Self User Creation' to create your net banking account.

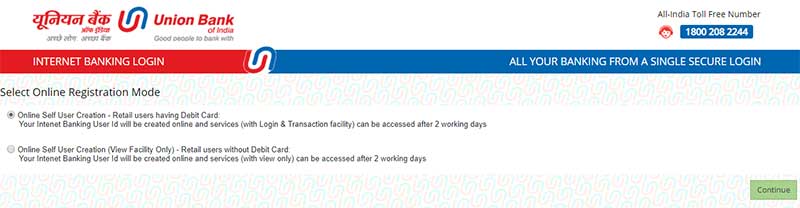

Step 3: On the next page, select any one online registration mode and click 'Continue'. If you have debit card, select the first option. If you don't have debit card, select the second option.

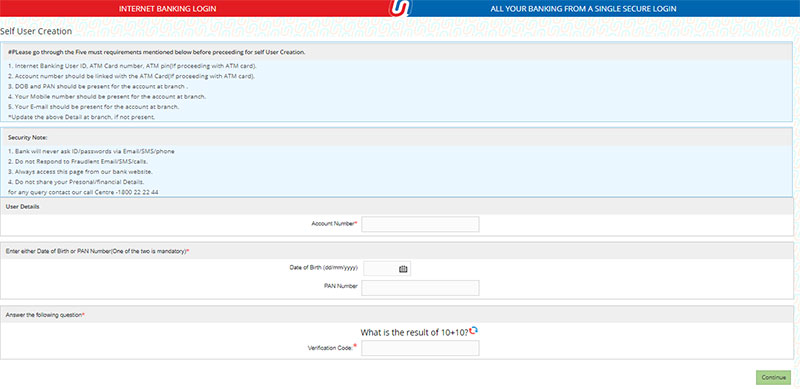

Step 4: Go through the basic requirements for net banking and read the security tips. Enter your account number, date of birth or PAN number and verification code. Then click 'Continue'.

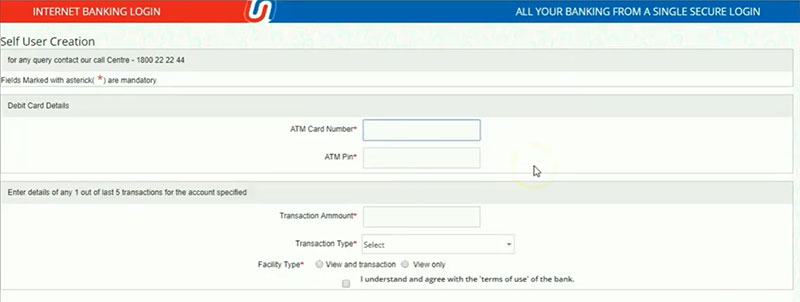

Step 5: On the next page, enter your ATM card number and PIN. Then enter any one of your last five transactions amount, select the transaction type and facility type. Agree to the terms and conditions and click 'Submit'.

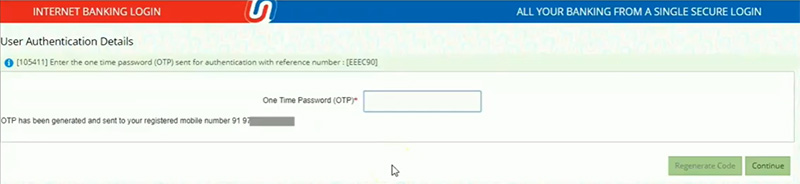

Step 6: Enter the OTP sent to your registered mobile number and then click 'Continue'

Step 7: After OTP verification, you will be taken to the User ID and Password section where you need to set your User ID and Password. Then click 'Submit'.

Step 8: You can now login and operate your net banking account.

How to Login to Union Bank's Net Banking Account?

To login to your Union bank's net banking account, go through the procedures mentioned below.

Step 1: Visit Union bank's official portal https://www.unionbankonline.co.in/

Step 2: On the home page, click 'Retail User Login' to login to your net banking account.

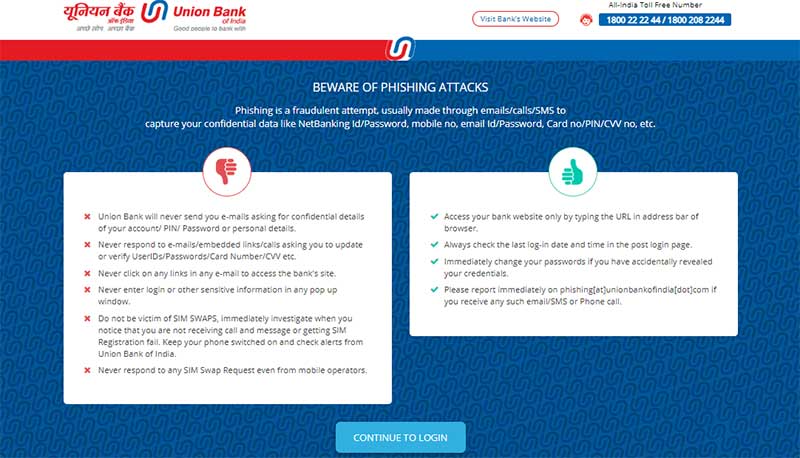

Step 3: Read the instructions given for safe access to your net banking account and click 'Continue to Login'

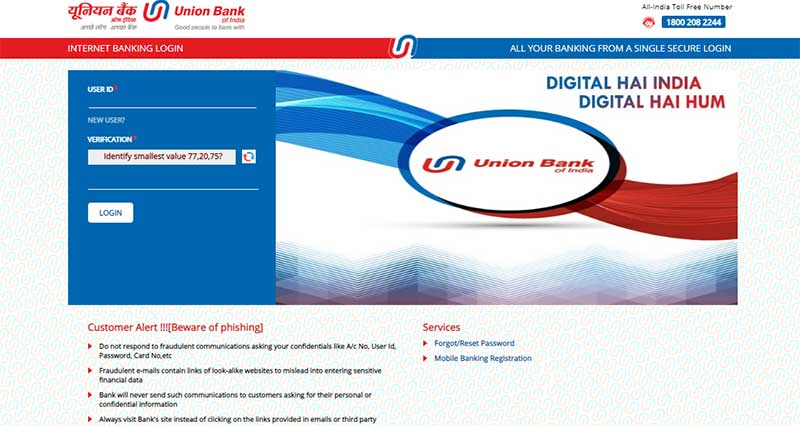

Step 4: You will be redirected to the Union Bank's Internet Banking Login site. Enter your user ID and answer the verification question. Then click 'Login'.

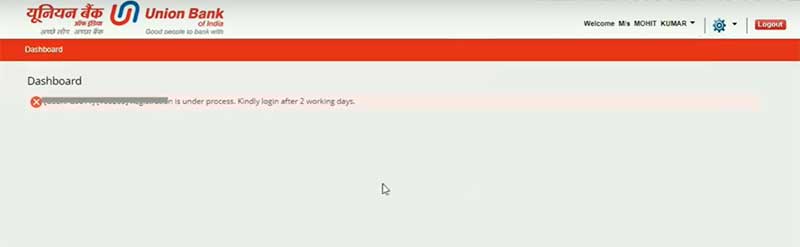

Step 5: Once logged into your account, a message will be displayed regarding the status of your account. The bank will take 2 days to complete the login process. Click 'Logout' to log out from the site.

Step 7: Login after two days to get complete access to your net banking account.

Union Bank SMS Banking:

Union bank's SMS banking facility helps customers to get instant notifications related to transactions through which they can detect suspicious access to their account. Along with that, you can get balance enquiry and mini statement of your account instantly by sending an SMS. The bank will charge Rs.15 for every three months from customers to use this SMS banking service.

You can register for SMS banking service either by,

- Visiting your nearest Union bank branch or

- Calling Union bank's 24 x 7 Call Centre 1800 22 22 44/ 1800 208 2244

Customers who have registered for SMS banking facility should send SMS with the following keywords according to the service needed from their registered mobile number to 09223008486

| Services | SMS Format |

| Balance Enquiry |

For Primary Account: UBAL For Other Account: UBAL (space) Account No. |

| Mini Statement |

For Primary Account: UMNS For Other Account: UMNS (space) Account No. |

| Cheque Status |

For Primary Account: UCSR (space) Cheque No. For Other Account: UCSR (space) Cheque No. (space) Account No. |

| To Locate Nearest Branch | UBRANCH (space) Pincode (space) Location/ City |

| To Locate Nearest ATM | UATM (space) Pincode (space) Location/ City |

| To Block Debit Card | UBLOCK (space) Last 4-digits of your Debit card No. |

| Aadhaar Number Seeding | UID (space) Account No. (space) Aadhaar No. |

Union Bank Mobile Banking:

Union bank offers convenient and user-friendly mobile banking service through 'UMobile' app. With this mobile app, customers can easily check their account balance, send and receive money to Union bank and other bank accounts, donate money and get cheque related services with just a single touch.

To get this mobile banking facility, customers should possess Smartphone, Union bank debit card and their mobile number registered with the bank.

Customers can get this mobile banking service by visiting Union bank branch or Union bank's ATMs or through net banking. To get the 'UMobile' app in your mobile, follow any one of the method.

- Download the app link sent via SMS at the time of registration.

- Give a missed call to 09223060000 from your mobile.

- Go to Google Play Store and download 'UMobile' app.

To use the 'UMobile' app in your mobile,

Step 1: Install the app on your mobile.

Step 2: Select your language.

Step 3: Click 'Activate' and then enter your mobile number.

Step 4: Enter the confirmation code sent via SMS.

Step 5:Login to your account using Mobile number and PIN.

Step 6: Once logged into your account, you can access your account.

Features of Union Bank Mobile Banking:

- Balance Enquiry

- Mini Statement

- Fund Transfer via IMPS/ NEFT

- Mobile Recharge

- Utility Bill Payment

- Cheque Status

- Generate OTP/ MMID

- Change MPIN

- Locate ATM/ Branch

- Change MPIN

- Block Debit card

Union Bank Missed Call Banking:

Union bank provides missed call banking facility to its customers through which they can get their primary account balance via SMS.

To avail this facility, you should have your mobile number registered with your bank.

To know your account balance,

Step 1: Give a missed call to 09223008586 from your registered mobile number.

Step 2: Your call will get disconnected automatically in few rings.

Step 3: You will receive an SMS stating your account balance.