GST is the short form of Goods and Services Tax. It is an indirect tax levied on consumer products and services. It has been a great reform on the tax system of India. In order to eliminate the tax over tax on goods and services, it is introduced..

What is GST?

To understand GST clearly, knowing the previous tax system of India is important. In India, two types of taxes were levied viz., Direct tax and Indirect tax.

Direct Tax

Taxes that are paid directly by a person to the government when transactions are made on income and property, comes under direct taxes.

Example – Income tax, tax on property and corporate tax.

Indirect Tax

Taxes which are charged on purchase of goods and on the services made, comes under Indirect taxes. These are collected through the intermediaries (End supplier). When a purchase or service is made, some amount of tax will be added and collected along with the cost. Then this tax is paid to the government. Here, we don’t pay directly in person.

Examples of indirect taxes are Excise duty, Service Tax, VAT, Entry Tax, Luxury Tax, Entertainment Tax and CST.

GST is a collective tax embracing all the central and state based indirect taxes. So, it is rather welcomed by the majority. Introduction of GST have no impact on the Direct taxes, as it deals only with the Indirect taxes.

GST tax system is being followed by more than hundred countries all over the world. The First country that implemented GST was France.

GST is implemented to achieve the concept of single nation-single tax regime. And also, to eradicate paying of many taxes levied on a single product when it undergoes value addition, GST is introduced.

Why GST Important?

The GST system is a major reform in the tax system of India and thereby paves way for the economic development of the country. When a product is made and sold to a consumer, he has to pay its cost along with various tax burdens.

As the product undergoes various stages to become a final product, that from the procurement of raw materials, production, distribution, addition of value and retailing, it also undergoes taxation on its every stage. This is termed as Tax on Tax burden. And the taxation process will continue till the product reaches the consumer. So, for a single purchase one had to pay multiple taxes.

For example, if we buy coconut oil, taxation process starts from the collection of raw coconut. While purchasing raw coconut, the manufacturer buys it for some cost. From the raw coconut, he extracts the oil and distributes it for the price of Rs.10 with tax. Say for example Rs.2. So, the total here is Rs.12 along with the tax. Then the distributor sells it to another person with the profit of Rs.1 again and adds the tax, say for Rs.2, so the cost becomes Rs.15. Here the buyer adds some value to it, sells it with the profit of Rs.1 and tax of Rs.2 to a retailer. Now it costs Rs.18. So, when a consumer buys the coconut oil, he would have to pay much tax which results in high cost of the product.

What is CGST, SGST & IGST?

India is a democratic country with the separation of powers between the state and central government. The tax related items too have clear provisions for tax collection between state and central government.

CGST means Central GST in which the taxes are levied by the central government. It comes under the act of Central goods and services act, 2016. This gives revenue for the central government. All the central government based taxes subsumed under this.

SGST means State GST, where the state has the power to collect the tax. It comes under the act of State goods and services act, 2016. This tax gives the income to the state and all the pre-collected state taxes merged under this one.

IGST means Integrated GST which is used for the collection of tax between states and union territories. It comes under the act of integrated goods and services act, 2016. Revenue from this tax will be shared between the state and central government. IGST will be levied on the goods and services that are imported to India. The importer can claim the input credit paid on imports. No change is made to the exports side under GST. Former scenario will be continued.

GST Rates

GST is levied only on 50% of the consumer products. Some products are exempted from this tax.

How the tax rates are?

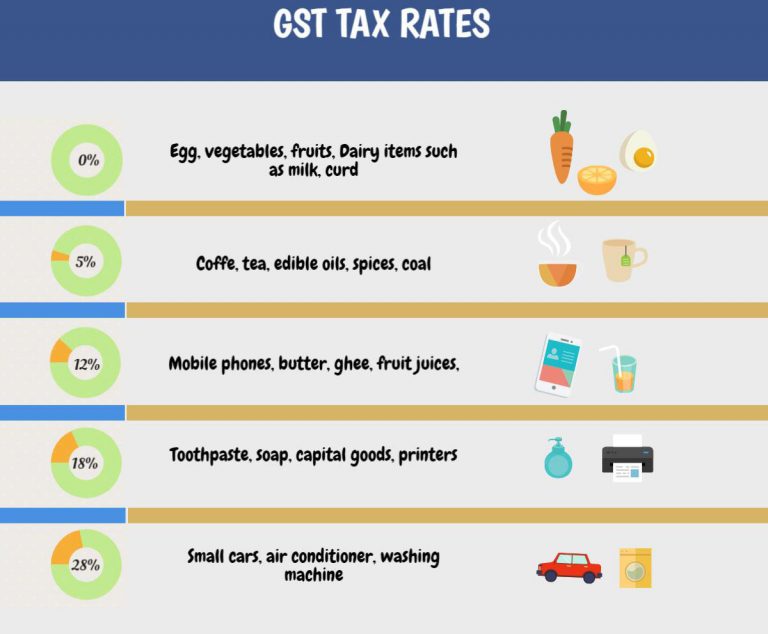

There are 5 types of tax rates in GST.

1) 0% tax rate

2) 5 % tax rate

3) 12% tax rate

4) 18% tax rate

5) 28% tax rate

These different rates are applied to different range of products. Let’s see the products under these rates.

Tax Exempted or 0% Tax Items

Basic household items and basic essentials are tax exempted.

- Dairy items like milk, curd

- Vegetables and fruits

- Salt and jaggery

- Judicial stamps and papers, newspapers

- Handloom items

- In service sector, hotels with room rent below Rs.1000 are fully exempted.

- Least GST rate of 0.25% is levied on some precious stones.

5% Tax Items

- Footwear below Rs.500

- Dresses below Rs.1000

- Nuts, spices and raisin

- Coffee and tea

- Coal, biogas and kerosene

- Frozen and packed items like veggies

- Small sized restaurants

12% Tax Items

- Dressings above Rs.1000

- Value added milk products like cheese, butter, ghee

- Fruit juices

- Frozen non-veg items

- Ayurvedic medicines

- Mobile phones

- Fertilizers

- Non-AC hotels

18% Tax Items

Luxurious items come under this category.

- Trademarked items

- Ice creams, sauces, soups, jams

- Cornflakes

- Pastries

- Steel items

- Electrical items like cameras, monitors,speakers

- Wooden furniture

- Footwear above Rs.500

- AC hotels

- IT services

- Hotels with room rent between Rs.2500 and Rs.7500

28% Tax Items

- Chocolates

- Tobacco products

- Shampoo and dye

- Home appliances like washing machine, water heater, vacuum cleaners

- Automobiles like motorcycle

- 5 Star hotels

- Hotels with room rent above Rs.7500

GST Bill

GST is launched in India on July 1, 2017 by our Prime Minister, Narendra Modi. The process began during the regime of Atal Bihari Vajpayee in 1999. Under the one hundred and twenty second amendment bill called as The Constitution Act, 2016, GST is introduced.

After various attempts, now in Modi government, Finance Minister, Arun Jaitley passed the GST BILL in Lok Sabha. The bill is called as THE CONSTITUTION BILL, 2014.

The bill had passed both the houses and was amended on August 2016. Then it goes among states to receive the states’ consent over GST implementation. After receiving the consent of majority of the states, the bill became THE CONSTITUTION ACT, 2017.

26 states gave their consent for the GST implementation. By this act, GST is implemented all over India.

GST is administered by a council called GST COUNCIL and its chairman is the Finance Minister of India. It had become the greatest tax reform in India since independence.

HSN Codes and Its Description

HSN means Harmonized System of Nomenclature. It is a product coding model. It is used during international trade. While classifying the goods for GST, in order to maintain uniformity, it is beingused. The codes are important during the import and export of goods. This coding system is widely accepted worldwide. Its structure has detailed categorization, comprises of 21 sections and 99 chapters.

During the enrolment and registration for GST, one should mention correct HSN codes.

HSN Codes are mentioned in the invoices. GST for all type of goods is based on these codes.

Codes are given based on the turnover of a company. Two-digit codes will be used for those having turnover above Rs.1.5 crores and below Rs.5 crores.

And for those having turnover of Rs.5 crores and above, can use four-digit code.

No necessity for whose turnover below Rs.1.5 crores to mention any HSN Code.

Those who deal with the import and export of goods should follow eight-digit HSN code.

SAC

SAC is a short form of Service Accounting Code, meant for services. Based on these code, GST for services are determined.

As GST combines both goods and services, knowing these codes are also needed.

GST Login & Registration

What is GST Registration?

All the businesses with taxable turnover and minimum earning of Rs.9 lakhs should get registered with GST. This is called the Registration of GST. This registration is mandatory to avail the tax benefits of a business transaction.

Why GST Registration is Important?

A person is eligible to collect tax on every supply he made, only after the GST registration. Without it, he cannot claim any type of tax benefits and to receive input credits.

One can reverse tax benefits during the product lost, self-consumption at the time of production, easily after the registration.

Applicability for GST

Business persons having Rs.9 lakhs turnover in North East India should register with GST, but liable for tax pay when his turnover exceeds Rs.10 lakhs.

In the rest of Indian states, persons having turnover of Rs.19 lakhs and below have to register but only to pay tax if it exceeds the limit of Rs.20 lakhs.

And persons who less frequently supply goods in a territory is taken as a casual taxable person.

Agriculturists are not considered as taxable persons.

What are The Documents Required For The GST Registration?

Before starting the registration process, one should have valid details of the documents mentioned below.

1) Pan card

2) Proof of place of business

3) Cancelled Cheque leaf from bank with the IFSC codes and MICR code

4) Business partners’ ID proof and address proof

5) Certificate of incorporation

How to Register for GST?

A person can apply through two modes.

1) GST online registration

2) Facilitation centre notified by the board

Procedures of Registration

At first, the applicant should log into the GST online portal and should fill the PART A of GST FORM 01 which requires PAN card details, mobile number and email address. The mobile number and the email ID is verified with the one time password.

After this verification, the applicant will receive the reference number of his registration via mobile and email ID. An electronic acknowledgement will be sent to the person. Then the applicant has to fill the PART B of GST FORM-01 with his reference number that was sent after the PART A registration. Here, all the business documents are to be submitted. In case of requirement of additional information, GST FORM-03 will be given. After receiving the Form-03, one should go for GST FORM-04 within a week or seven working days.

After all the required information are submitted from Form-01 to form -04, GST FORM-06 will be given for the registration of the main and additional place of business.

In case of unsatisfied information submitted, the registration will be cancelled using the GST FORM-05.

No registration fee is applied for this GST registration.

What are the Taxes GST Replaces

GST replaces various indirect taxes imposed both by state and centre.

Centre based indirect taxes are,

- Excise Duty – levied on manufacture

- Service Tax – levied on services

- CST – levied on interstate purchase or sale

- Customs Duty – levied on imports

State based indirect taxes are,

- VAT- levied on sales within states

- Entertainment Tax- levied on entertainment

- Luxury Tax – levied on luxurious items and services

- Entry Tax – levied on the transfer of goods.

GST replaces all the above said taxes.

What is GSTIN?

GSTIN is the short form of Goods and Services Tax Identification Number.

It is a unique number given to every business body which are registered under GST. In order to have better management and to get rid of various identification numbers, this single GSTIN has been given. It is based on the PAN number of the person. It is a 15-digit alpha numeric code with the representation of state code, PAN number. During every purchase of goods and on services made, to provide this GSTIN is mandatory.

One should obtain this GSTIN through the GST portal, after the enrolment of GST.

GSTN

GSTN is nothing but Goods and Services Tax Network. It is a network which would be maintained by the central government to process all the online practices related to GST. With this network, all the tax transactions will be tracked and maintained.

Merits of GST

- GST will influence the GDP growth of our country, as the experts say. Efficiency in some sectors like logistics, transport will be increased. Thus, the growth of the country on economic terms will rise because of GST.

- The black money issues could be solved by this new tax regime. GST is a digital model. As India is also advancing digitally, every manufacturer, supplier and retailer will be monitored under a roof.

- It becomes a necessity to record all transactions. So, the possible chances of corruption- free India can be seen by GST. As every payment, sales, inputs, credits and debits are recorded periodically on respective stages and those records are made on online, chances of corrupting government will be minimized.

- GST is being said as ‘destination based tax’ and ‘consumption based tax’. It will benefit the developing states rather than the developed states. The growth is maximum where the consumption is maximum.

- GST council organize meetings on Saturday to meet the clarifications regarding GST. So, problems arrived after GST will be noticed and suitable measures will be taken.

- As it is a transparent tax system,transparency in all tax records is a plus.

- Possibility for lesser number of tax issues

- Variation of prices of a product from state to state will be eradicated.

Demerits of GST

Although GST is welcomed by all, it is likely to have some demerits.

- As it is a consumer based tax,there is a doubt for the manufacturing states whether they could have minimum tax returns. There is a possibility for this issue because where the consumption is high, growth is also high. So, the centre will take care of the manufacturing states.

- Trading culture of India is different from the trade of foreign countries. So, adopting this new system will be debatable.

- In case of difficult tax situations arising in a state, formerly state government will look into the issues and solve it. But now,to clear any problem central government is to be approached. Here, obtaining the better solutions will be in doubt.

- Small scale industries with taxable turnover will be burdened by the digitalization procedures of GST. So it is said, such industries should seek the assistance of a nearby commerce service centre.

- Prices of value added products go for a hike. Branded food items will be levied with high tax rate.

- Maintaining strict and proper records is mandatory in GST. So, simple mistakes in the records will lead to excess tax pay to the government.

- Common man’s awareness about the GST policies will be less, because all are well-practised with the year-old taxing system. Sudden change will take much time to be aware about it.

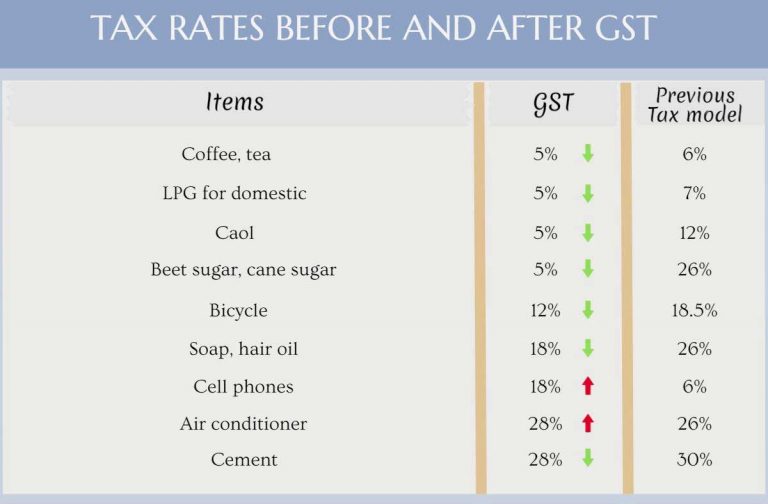

GST Tax Hike and Reduction Comparison with Previous Model

When comparing the previous and present GST model, we can notice that there are rise and fall of taxes in items and services, commercial vehicles, cigarette prices and branded items, as they are costlier. SUV cars, and some electronic items will be in low cost when compared with the previous system.

Let’s compare the GST rates of some items.

Comparison of Previous Tax System and GST on Food and Beverages

There is no change on basic food items like cereals, raw milk, rice, sugar, tea and coffee.They have 5% tax now in GST.

Biscuits and cornflakes are rated 18% of GST. But earlier it is 32%. So comparing both systems, tax rate has been lowered after GST.

Comparison of Previous Tax System and GST on Essentials

After GST, hair oil, soap, tooth paste are rated 18% tax. Earlier it was 28%.

Shampoo, face creams are rated 28% after GST. But earlier it was 26%.

Silk and jute products are tax exempted. Earlier it was 5%.

Rates of silk sarees and jute products are lowered, in order to promote the production of these types of products.

No change in man-made fiber items, that 18% is maintained.

Ayurvedic products hiked a little to 12%.

Products which are all frequently used are imposed with minimum tax.

Comparison of Previous Tax System and GST on Cinema Industry

Based on our choice of theatre, whether it is a multiplex or a single screen, GST tax has been applied.

So, there is a hike in tax rate of cinema tickets in major cities. Multiplex theatres are levied with 28% and single screen theatres are levied with 18%.

Unlike the previous tax model, the tax rate varies depending on our consumption pattern.

Comparison on Durable Items

GST on gold, watches, cement and home appliances are increased. Depending on the kind of the product, TV, fridge, smart phone, AC, furniture arelevied 28%.

Now Gold is levied 3 %. Earlier it was 2%. 1% tax is increased.

Smartphone rates are bit lowered. GST on smartphone is 12%. Earlier it was 17%.

Comparison on Hotel Sector

Depending on the type of hotels, tax is levied.

Hotels with tariff of Rs.7500 and above are taxed the maximum of 28%

And the hotels with tariff of Rs.2500 and above are levied 18%.

Hotels with minimum tariff of Rs.1000 and below are under tax exempted category.

Here the main sufferers are the high profile people. Luxury always costs high in terms of GST.

Comparison on Automobile Sector

For GST, cars are classified into following categories.

1) Small car- Diesel

2) Small car- Petrol

3) Midsized cars

4) Luxury cars

5) SUV

For diesel cars, luxury cars and midsized cars,tax rates are increased. The rates of small petrol cars are lowered to 29%. Earlier it was 31%. SUV cars are levied 43% now. Earlier it was 48%.

Finally..

Implementation of GST will be a boost for Indian economy. Though various issues may arise in its early stage, all will be eliminated sooner. As the council promises to meet the issues and work for the betterment, it will be a perfect and timely move of the Government.

Comments:

hari_2349@yahoo.com - Nov 22, 2017

Very good initiative for better future society. we will grow.

Jawahar - Sep 24, 2017

Clear and useful information about GST. All possible aspects are explained.