ICICI bank home loan brings your dream of buying new house come true. As building a new home involves a lot of financial planning, ICICI offers home loan solution and information with which you can purchase/construct new home or renovate the existing house.

ICICI bank offers home loan at lower interest rate starting from 6.90% per annum with longer tenure of up to 30 years. It comes with easy repayment options and low processing fee. As ICICI home loan is linked with PMAY-CLSS scheme, you will get interest subsidy benefit of up to Rs.2.67 lakhs.

What are the features and benefits of ICICI Home Loan?

Some of the features and benefits of ICICI home loan are,

- The home loan tenure is available up to 30 years

- Pre-approved home loans are available for selected customers

- Lower EMIs with tenure up to 30 years

- Simple and quick documentation process for existing customers

- Sanctioning of home loan before the selection of property

- Lower interest rates with both fixed and floating options

- Fixed interest rate for first 10 years and after that option to choose either fixed or floating rate.

- Higher loan amount available under ICICI Bank Set Up Home Loan

- Transferring of your existing loan with other bank to ICICI with balance transfer feature

- Opt for top-up loan up to 100% of your original loan with ICICI bank transfer facility. ICICI offers online tools such as Home Loan Eligibility Calculator and Home Loan EMI Calculator to calculate your loan eligibility and monthly repayment of home loan amount.

| Interest rate | 6.90% p.a onwards |

| Loan Amount | Rs.5 lakhs to Rs.3 crores |

| Maximum Loan Tenure | Up to 30 years |

| Processing Fees | 0.50% of the loan amount plus applicable taxes |

| Rate Packages | Fixed/Floating rate |

| Prepayment Charges | 0 - 4% |

What is the interest rate for ICICI Home Loan?

The interest rate for home loan in ICICI bank starts from 6.90% onwards. According to RBI guidelines, the interest rates are linked to Repo Rate, which is 4% at present (as updated on May 22, 2020). The interest rates may vary on the basis of credit score, scheme, employment type and loan amount.

| Slab | Salaried | Self-Employed |

| Up to Rs.35 lakhs | 6.90% - 7.60% | 7.05% - 7.85% |

| Rs.35 lakhs to Rs.75 lakhs | 7.00% - 7.75% | 7.10% - 7.95% |

| Above Rs.75 lakhs | 7.00% - 7.95% | 7.10% - 8.05% |

What are the eligibility criteria to avail ICICI Home Loan?

The eligibility of a borrower to avail home loan in ICICI bank is based on their income and loan repayment capacity. Besides this, ICICI also considers other factors such as the applicant's age, credit history, credit score, etc. Some of the basic eligibility criteria for ICICI home loan are as follows.

| Age | 21 years to 65 years |

| Profession | Salaried/Self-Employed |

| Minimum Income |

Salaried: Rs.5 lakhs p.a Self-Employed: Rs.7.5 lakhs p.a |

| Maximum Loan Tenure |

30 years |

| Nationality | Resident Indian/Non-Resident Indian |

| Gender | All genders |

What are the interest rates for ICICI Home Loan Schemes?

ICICI home loan offers various schemes to meet the requirements of the customers. Some of the features of the home loan schemes and its interest rates are given below.

ICICI Bank Instant Home Loan:

- For customers who have salary account in the bank, pre-approved home loans are available up to Rs.1 crore.

- Discount in processing fee.

- No documents required for sanctioning of loan.

ICICI Bank 30 Year Home Loan:

- Competitive interest rates on both fixed and floating rate loans.

- Easy repayment with loan tenure up to 30 years.

- The EMI is as low as Rs.808 per lakh.

ICICI Bank Step Up Home Loan:

- This scheme is ideal for young salaried professionals with moderate income.

- The minimum monthly salary limit should be Rs.20,000.

- The loan tenure is up to 20 years.

ICICI Bank NRI Home Loan:

- Nil charges on part-prepayment.

- Affordable interest rates.

- Interest rates are calculated on monthly reducing basis.

| Schemes | Floating Interest Rates (p.a) | Processing Fee | |

| Salaried | Self-Employed | ||

| ICICI Bank Instant Home Loan | 8.65% - 9.25% | 8.80% - 9.40% | Up to 2% of the loan amount + applicable tax |

| ICICI Bank 30 Year Home Loan | 6.90% - 7.95% | 7.05% - 8.05% | Up to 2% of the loan amount or Rs.1500, whichever is higher |

| ICICI Bank Step Up Home Loan | 6.90% - 8.05% | 6.90% - 8.05% | Up to 2% of the loan amount or Rs.1500, whichever is higher |

| ICICI NRI Home Loan | 6.90% - 8.05% | 6.90% - 8.05% | Up to 2% of the loan amount + applicable tax |

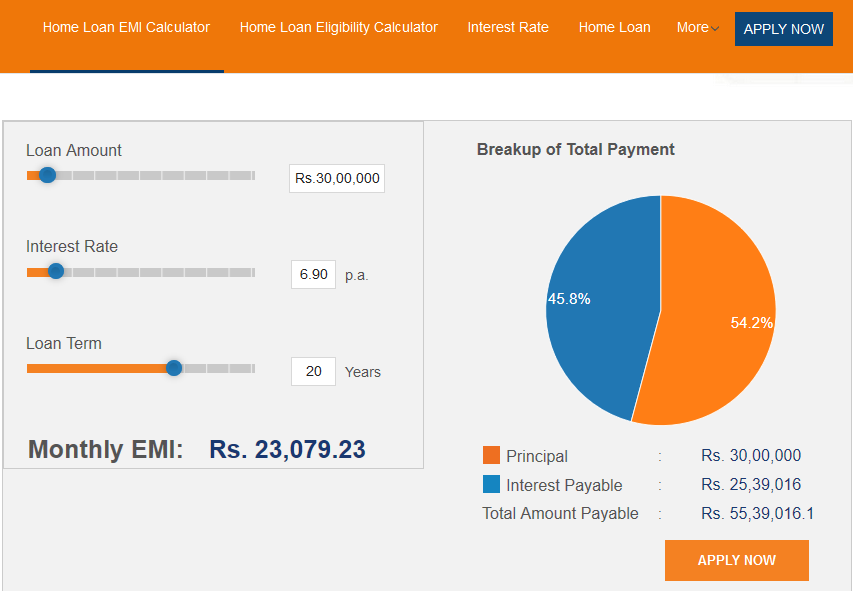

How to calculate EMI for ICICI Home Loan?

With ICICI Home Loan EMI Calculator, you can estimate the EMI for your home loan taken in ICICI bank. ICICI bank offers home loan at lower EMIs with the repayment tenure of up to 30 years.

Step 1: Click here to calculate EMI for ICICI home loan.

Step 2: Select the loan amount, interest rate and loan tenure.

Step 3: Once you have provided the details, the EMI for the loan amount will appear on the screen.

How to calculate ICICI Home Loan Eligibility?

The eligibility for home loan is calculated based on various factors such as current age, monthly income, other EMIs if any, retirement age, etc. ICICI Home Loan Eligibility Calculator gives accurate estimate of home loan taken in ICICI bank.

Step 1: Click here to calculate your eligibility for home loan

Step 2: Select your monthly income, loan tenure, interest rate and other EMIs if any.

Step 3: Once you have provided all these details, the maximum loan amount you are eligible for will appear on the screen.

What are the documents required to apply for ICICI Home Loan?

To apply for home loan in ICICI bank, you need to submit the following list of documents.

For Salaried:

- Duly filled application form with signed photograph

- Identity proof, address proof and residence proof

- Last 6 months bank statement

- Last 3 months salary slips if the applicant is salaried

- Processing fee cheque

- Form 16 or IT Returns

For Self-Employed:

- Duly filled application form with signed photograph

- Identity proof, address proof and residence proof

- Business profile

- Business existence proof

- Education qualification certificate

- Last 3 years IT Returns with computation of income

- Last 3 years CA certified/ audited balance sheet and profit and loss account

ICICI Home Loan - Important Links:

- To apply for ICICI home loan, click here

- To track your ICICI home loan status, click here

- To locate your nearest ICICI bank branch, click here

ICICI Home Loan Customer Care:

If you need any help regarding home loan, you can contact ICICI home loan customer care.

| Call ICICI Toll-Free Number |

18601207777 04071403333 |

| Give a Missed Call | 8100881008 |

| Send SMS | HOME to 5676766 |

| Register in online | Click here |

| Write to ICICI Corporate Office Address | ICICI Bank Towers, Bandra-Kurla Complex, Mumbai - 400 051. |