Indiabulls home loans are specially crafted to suit your unique needs. It provides home loan at highly competitive interest rates with flexible repayment options. With quick loan disbursement, easy digital processes and thousands of pre-approved projects, Indiabulls housing loans will make your home buying process simpler and easier. You can easily apply for home loan in online anytime and anywhere and get instant loan approval via Indiabulls app or website.

Indiabulls home loan interest rate ranges from 8.65% onwards. The maximum loan repayment tenure is 30 years. Read further to know all about Indiabulls home loan!

What are the features and benefits of Indiabulls Home Loan?

Indiabulls home loan comes with a host of features and benefits given below.

- Online home loans delivered via home loan app and website

- First in India to offer end-to-end online home loan processing

- Attractive interest rates

- Quick loan approval and disbursal

- Simple documentation process

- Zero prepayment charges

- No hidden charges

- Flexible loan tenure options

- Multiple loan repayment options

- Maximum loan amount to property value

- Tax benefits available for both salaried and self-employed individuals.

| Interest Rate | 8.65% p.a onwards |

| Loan Amount | Up to Rs.5 crores |

| Loan Tenure | 30 years |

| Processing Fee | 1% onwards |

| Late payment charges | 24% p.a of outstanding EMI |

| Rate Packages | Fixed/Floating |

What is the interest rate for Indiabulls Home Loan?

The interest rate for Indiabulls home loan starts from 8.65% onwards. The interest rates for various home loan products offered by Indiabulls are given below.

| Indiabulls Home Loan Products | Interest Rate (p.a) |

| Indiabulls Home Loan | 8.65% onwards |

| Indiabulls Home Loan Balance Transfer | 8.80% - 12% |

| Indiabulls Home Loan for NRIs | 8.65% onwards |

| Indiabulls Home Renovation Loan | 8.65% onwards |

| Indiabulls Home Extension Loan | 8.65% onwards |

| Indiabulls Rural Home Loans | 8.96% onwards |

| Indiabulls Loan against Property | 10.50% onwards |

What are the eligibility criteria required to apply for Indiabulls Home Loan?

In order to apply for Indiabulls home loan, you need to meet the following eligibility requirements.

| Eligibility Criteria | Requirements |

| Age of the Applicant | 21-65 years |

| Minimum Income of the Applicant | Rs.15000 and above |

| Residential status | Resident Indian/NRI |

| Employment Type | Salaried/Self-Employed |

What are the home loan products available in Indiabulls?

Indiabulls offers wide range of home loan products to suit the needs of the customers.

Indiabulls Home Loan

Indiabulls home loan is ideal for owning home of your choice.

- Attractive interest rates

- Instant sanction

- Long/short tenure

- EMIs starting at Rs.780 per lakh

- Flexible loan investment plan options

- Speedy processing

- 10,000+ pre-approved projects

- 4 lakh+ properties to choose from IB Home Finder

Indiabulls Home Loan Balance Transfer

Indiabulls home loan balance transfer helps to transfer your outstanding home loan amount from another bank or lending institution for better interest rate.

- Zero prepayment charges

- Multiple loan repayment options

- Flexible loan tenure options

- Maximum loan to property value

Indiabulls Home Loan for NRIs

Indiabulls home loan for NRIs are ideal for those who are residing outside the country.

- Loan repayment up to 15 years

- Speedy loan application process

- 220 nation-wide branches

- Affordable pricing

- Minimum paperwork

- Flexible repayment options

- Available for new and existing customers.

Indiabulls Home Renovation Loan

With Indiabulls home renovation loan, you can renovate your home at incredibly low rate of interest.

- Online home renovation loans delivered via app and web

- Attractive interest rates

- Zero prepayment charges

- Flexible loan tenure options

- Maximum loan to property value

- Quick approval and disbursal

- Available for new and existing customers

- Multiple loan repayment options

Indiabulls Home Extension Loan

Indiabulls home extension loan helps to extend your house for comfortable accommodation of all your needs.

- Online home extension loans delivered via app and web

- Attractive interest rates

- Nil prepayment charges

- Maximum loan to value

- Quick approval and disbursal

- Flexible loan tenure options

- Simple documentation process

- Flexible loan repayment options

Indiabulls Rural Home Loan

Indiabulls rural home loan is designed for rural and semi-urban residents to fulfil the dream of owning home.

- Instant sanction

- Speedy processing

- Attractive interest rates

- No hidden charges

- Transparent fees and charges

- Easy documentation

Indiabulls Loan Against Property

Indiabulls loan against property offers maximum finance against your property value.

- Loan up to 15 years

- Attractive interest rates

- Flexible repayment options

- Door step service

- Loan with continued occupancy on property

Indiabulls Pradhan Mantri Awas Yojana

Indiabulls home loan offers interest subsidy under Pradhan Mantri Awas Yojana scheme. It provides affordable houses to the families of lower and middle income group.

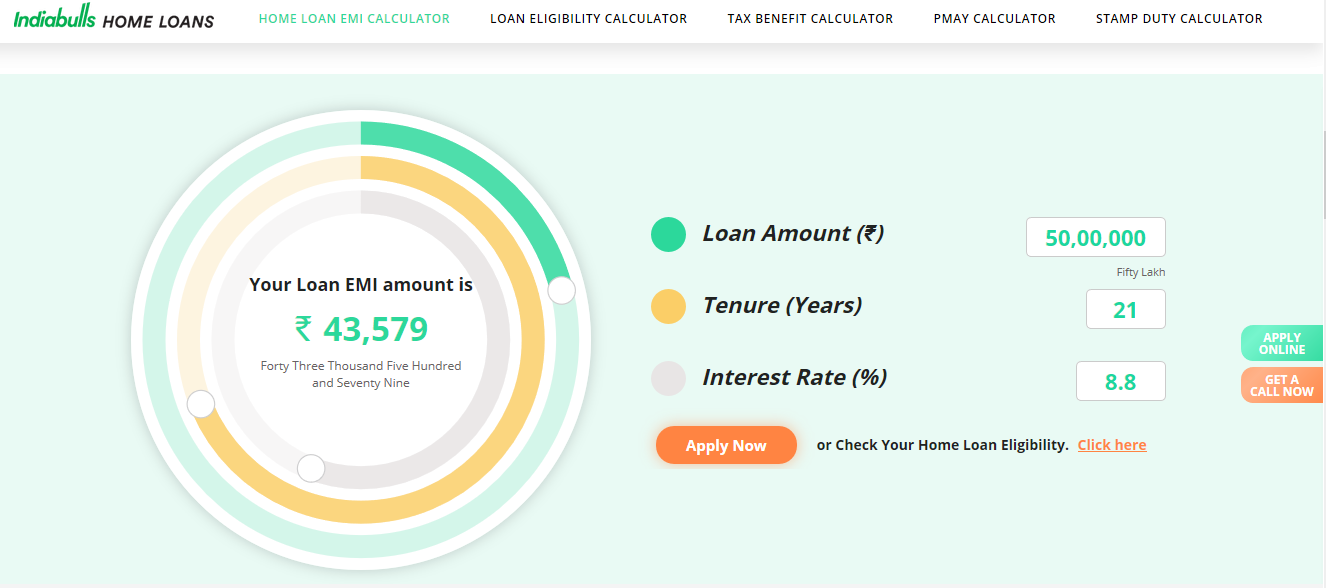

How to calculate EMI for Indiabulls Home Loan?

Indiabulls Home Loan EMI Calculator is an automated system with which you can calculate the EMI for the loan amount taken in Indiabulls home loan. Based on your loan amount, tenure and interest rate, the EMI calculator will calculate the monthly installment which you have to pay for the loan amount. To calculate EMI, just follow the simple steps given below.

Step 1: Click this link Indiabulls Home Loan EMI Calculator

Step 2: Enter the loan amount, loan tenure and interest rate

Step 3: Once you have provided all these details, the monthly EMI you need to pay will appear on the screen.

How to calculate Indiabulls Home Loan Eligibility?

Indiabulls Home Loan Eligibility Calculator helps you to calculate the amount of loan you are eligible for, based on the monthly income, tenure and interest rate. You need to check your eligibility before applying for home loan in Indiabulls. Follow the simple steps given below to calculate your loan eligibility.

Step 1: Click this link Indiabulls Home Loan Eligibility Calculator

Step 2: Enter your net monthly income, tenure and interest rate.

Step 3: Once you have provided all these details, your loan eligibility amount will appear on the screen.

What are the documents required to apply for Indiabulls Home Loan?

You need to submit the following list of documents to apply for Indiabulls home loan.

- Duly signed application form with applicant's passport size photograph.

- Proof of Identity - PAN card/Aadhaar card/Driving License/Passport/Voter ID

- Proof of Address - Passport/Registered Rent Agreement/Electricity Bill

- Processing fee cheque

- Original Copies of Property Documents - No Objection Certificate (NOC) from builder/Housing Society, Possession Certificate, Land Tax Paid Receipt, Sale Deed, Katha, Transfer of Ownership.

For Salaried

- Salary Certificate

- Form 16 of last 2 years

- Offer letter

- Last 6 months Bank Statement

- Income Tax Returns

- Last 3 months Salary Slip

For Self-Employed

- Qualification Certificate

- Last 2 years Balance Sheet

- Last 6 months Bank Statement

- Last 2 years Profit and Loss

- 2 years Income Tax Return with computation

- Gumasta License

Indiabulls Home Loan Customer Care

For any home loan related queries, contact Indiabulls home loan customer care using the contact details given below.

| Call Indiabulls Home Loan Toll-Free Number | 1800 572 7777 |

| homeloans@indiabulls.com nriloans_hl@indiabulls.com | |

| Register in Online | click here |

| Write to Indiabulls Finance Corporate Office Address | Indiabulls Finance Centre, Indiabulls House, Tower 1, 17th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400013, Maharashtra. |

Indiabulls Home Loan - Important Links

- To apply for Indiabulls home loan, click here

- To track Indiabulls home loan application status, click here

- To locate your nearest Indiabulls home loan branch, click here